通用型逐笔成交统计

逐笔成交统计想用通用化,难点在于去限定一次完整开平交易的开始点和结束点,抽象来说就是寻找特殊的断点对所有成交记录进行划分。

断点的选择

而在算法状态机控制中,我们可以知道数字0是一个非常有用的评判标准,即我们构建一列数据,让它数值在完全平仓后变成0,就知道真正的平仓时间。

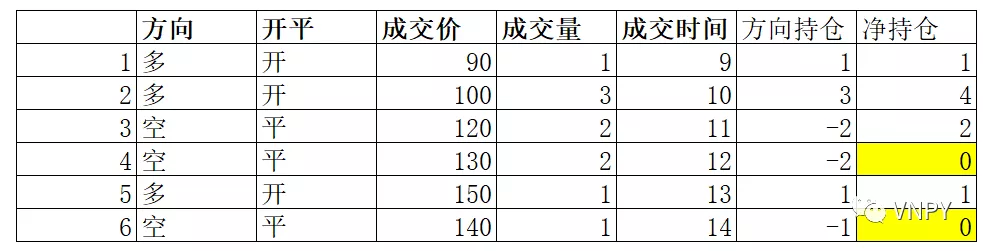

在实践中,累计净持仓恰恰好符合这个标准,我们把多头仓位设为”+”,空头仓位设为“-”,得到如下表的【方向持仓】,对【方向持仓】进行累计得到【净持仓】。

这样,我们基于【净持仓】为0可以得到每次开平交易的结束点。而该结束点为成交记录的断点。

使用断点划分成交记录

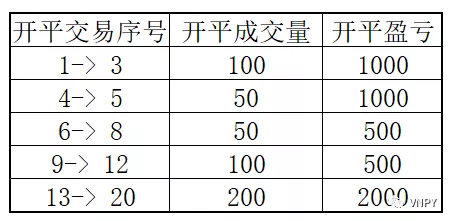

为了简单演示,下面我们只显示【净持仓】(列)为0的成交信息(行),如下表所示,一共发生了5开完整的开平仓交易。每笔交易的结束点对应的交易序号分别为3、5、8、12、20。这5个结束点即为对所有成交信息的断点。

之后,我们要引入2个新的概念:

- 存量:某一时间点的累计统计量

- 增量:某一时间段内,累计统计量的增加量

存量是静态的,可以理解为对累计统计量的信息进行时间切片;而增量是动态的,代表时间切片信息的变化量,所以他们二者的关系如下:

T0时刻存量 + T0->T1增量 = T1时刻存量

换句话说,

T0->T1增量 = T1时刻存量 - T0时刻存量

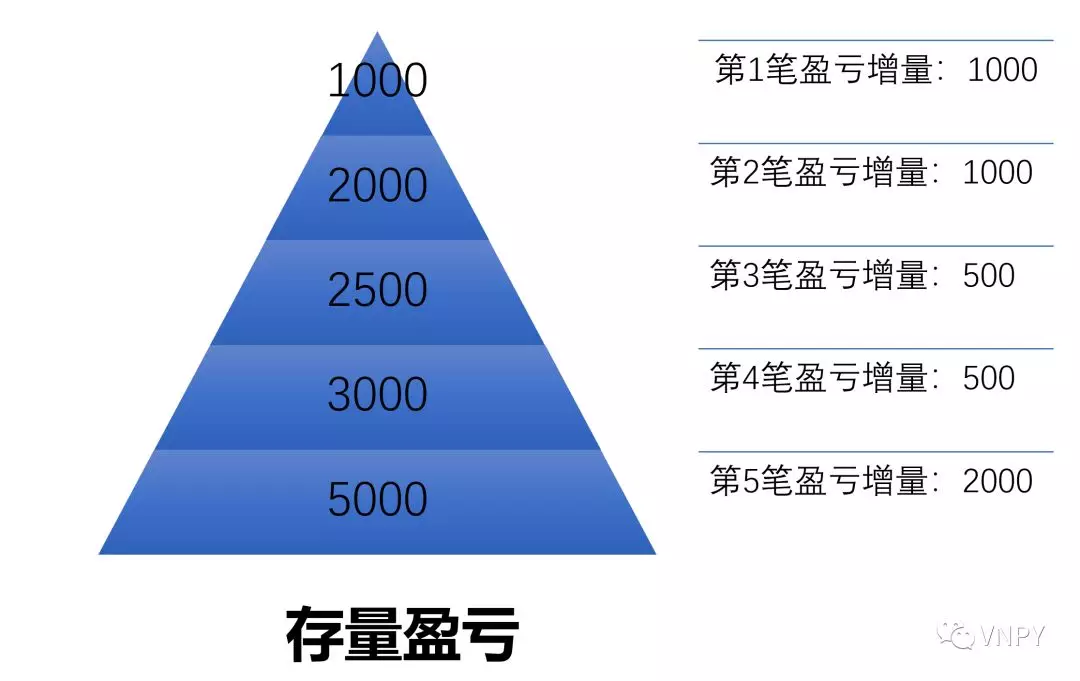

回到逐笔回测统计主题上,增量这个概念,就能代表最新的完整开平仓交易,例如其每笔盈亏,对累计盈亏的影响。

如下图所示,在完成第一笔开平仓交易后,累计盈亏是1000;完成了第二笔完整的开平仓交易,累计盈亏是2000,那么二者的差别,即2000-1000=1000。这增加1000的盈利,就是属于第二笔开平仓交易的。

所以,通过对每个断点存量信息的对比,我们就可以得到每笔开平仓成交后的统计量:

这些开平仓的统计量可以如下表所示的开平成交量、开平盈亏,也可以是开平仓交易的持仓时间、手续费、滑点以及净盈亏:

从算法的原理到代码

计算开平交易结果

- 生成基础DataFrame信息,包括每笔交易的方向,开平,价格,时间;

- 计算方向持仓,以及有方向持仓累加的净持仓,计算累计持仓存量(成交量的简单相加);

- 计算盈亏存量,当净持仓为0时候,显示每笔开平交易对于存量盈亏的增量;

- 当净持仓为0时候,显示每笔开平交易的持仓时间,成交量,成交额的增量;

- 对DataFrame的行进行处理,剔除出那些净持仓不为0的行数,即剩下的行数都是每笔开平交易的最后一次平仓交易,通过平仓的方向可以判断该完整开平流程,如方向为空,开平为平,那么完整开平交易为多开->空平。

- 计算手续费,滑点以及净盈亏

- 返回新的DataFrame。

import pandas as pd

from datetime import datetime

import matplotlib.pyplot as plt

import numpy as np

pd.set_option('mode.chained_assignment', None)

def calculate_trades_result(trades):

"""

Deal with trade data

"""

dt, direction, offset, price, volume = [], [], [], [], []

for i in trades.values():

dt.append(i.datetime)

direction.append(i.direction.value)

offset.append(i.offset.value)

price.append(i.price)

volume.append(i.volume)

# Generate DataFrame with datetime, direction, offset, price, volume

df = pd.DataFrame()

df["direction"] = direction

df["offset"] = offset

df["price"] = price

df["volume"] = volume

df["current_time"] = dt

df["last_time"] = df["current_time"].shift(1)

# Calculate trade amount

df["amount"] = df["price"] * df["volume"]

df["acum_amount"] = df["amount"].cumsum()

# Calculate pos, net pos(with direction), acumluation pos(with direction)

def calculate_pos(df):

if df["direction"] == "多":

result = df["volume"]

else:

result = - df["volume"]

return result

df["pos"] = df.apply(calculate_pos, axis=1)

df["net_pos"] = df["pos"].cumsum()

df["acum_pos"] = df["volume"].cumsum()

# Calculate trade result, acumulation result

# ej: trade result(buy->sell) means (new price - old price) * volume

df["result"] = -1 * df["pos"] * df["price"]

df["acum_result"] = df["result"].cumsum()

# Filter column data when net pos comes to zero

def get_acum_trade_result(df):

if df["net_pos"] == 0:

return df["acum_result"]

df["acum_trade_result"] = df.apply(get_acum_trade_result, axis=1)

def get_acum_trade_volume(df):

if df["net_pos"] == 0:

return df["acum_pos"]

df["acum_trade_volume"] = df.apply(get_acum_trade_volume, axis=1)

def get_acum_trade_duration(df):

if df["net_pos"] == 0:

return df["current_time"] - df["last_time"]

df["acum_trade_duration"] = df.apply(get_acum_trade_duration, axis=1)

def get_acum_trade_amount(df):

if df["net_pos"] == 0:

return df["acum_amount"]

df["acum_trade_amount"] = df.apply(get_acum_trade_amount, axis=1)

# Select row data with net pos equil to zero

df = df.dropna()

return df

def generate_trade_df(trades, size, rate, slippage, capital):

"""

Calculate trade result from increment

"""

df = calculate_trades_result(trades)

trade_df = pd.DataFrame()

trade_df["close_direction"] = df["direction"]

trade_df["close_time"] = df["current_time"]

trade_df["close_price"] = df["price"]

trade_df["pnl"] = df["acum_trade_result"] - \

df["acum_trade_result"].shift(1).fillna(0)

trade_df["volume"] = df["acum_trade_volume"] - \

df["acum_trade_volume"].shift(1).fillna(0)

trade_df["duration"] = df["current_time"] - \

df["last_time"]

trade_df["turnover"] = df["acum_trade_amount"] - \

df["acum_trade_amount"].shift(1).fillna(0)

trade_df["commission"] = trade_df["turnover"] * rate

trade_df["slipping"] = trade_df["volume"] * size * slippage

trade_df["net_pnl"] = trade_df["pnl"] - \

trade_df["commission"] - trade_df["slipping"]

result = calculate_base_net_pnl(trade_df, capital)

return result

汇总生成资金曲线

- 基于每笔开平交易的净盈亏,计算累计盈亏;

- 累计盈亏加上用户输入的起始资金即为资金曲线;

- 基于资金曲线计算每笔的每笔开平交易的盈利率,回撤和百分比回撤。

def calculate_base_net_pnl(df, capital):

"""

Calculate statistic base on net pnl

"""

df["acum_pnl"] = df["net_pnl"].cumsum()

df["balance"] = df["acum_pnl"] + capital

df["return"] = np.log(

df["balance"] / df["balance"].shift(1)

).fillna(0)

df["highlevel"] = (

df["balance"].rolling(

min_periods=1, window=len(df), center=False).max()

)

df["drawdown"] = df["balance"] - df["highlevel"]

df["ddpercent"] = df["drawdown"] / df["highlevel"] * 100

df.reset_index(drop=True, inplace=True)

return df

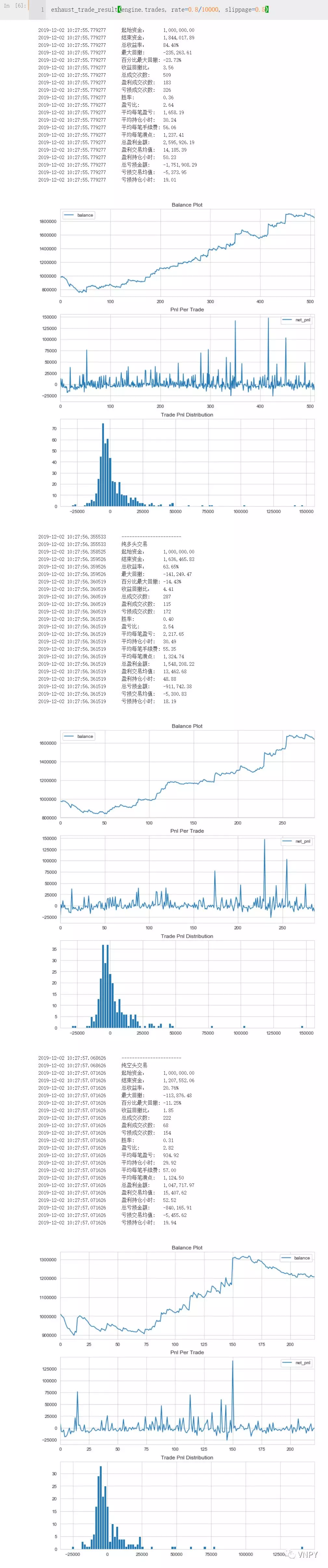

统计整体策略效果

- 主要是一些统计指标的计算,如平均滑点,平均手续费,总成交次数,胜率,盈亏比,收益回撤比等等。

- 然后是画图,画出资金曲线图,每笔净盈亏图和净盈亏分布图

def statistics_trade_result(df, capital, show_chart=True):

""""""

end_balance = df["balance"].iloc[-1]

max_drawdown = df["drawdown"].min()

max_ddpercent = df["ddpercent"].min()

pnl_medio = df["net_pnl"].mean()

trade_count = len(df)

duration_medio = df["duration"].mean().total_seconds()/3600

commission_medio = df["commission"].mean()

slipping_medio = df["slipping"].mean()

win = df[df["net_pnl"] > 0]

win_amount = win["net_pnl"].sum()

win_pnl_medio = win["net_pnl"].mean()

win_duration_medio = win["duration"].mean().total_seconds()/3600

win_count = len(win)

loss = df[df["net_pnl"] < 0]

loss_amount = loss["net_pnl"].sum()

loss_pnl_medio = loss["net_pnl"].mean()

loss_duration_medio = loss["duration"].mean().total_seconds()/3600

loss_count = len(loss)

winning_rate = win_count / trade_count

win_loss_pnl_ratio = - win_pnl_medio / loss_pnl_medio

total_return = (end_balance / capital - 1) * 100

return_drawdown_ratio = -total_return / max_ddpercent

output(f"起始资金:\t{capital:,.2f}")

output(f"结束资金:\t{end_balance:,.2f}")

output(f"总收益率:\t{total_return:,.2f}%")

output(f"最大回撤: \t{max_drawdown:,.2f}")

output(f"百分比最大回撤: {max_ddpercent:,.2f}%")

output(f"收益回撤比:\t{return_drawdown_ratio:,.2f}")

output(f"总成交次数:\t{trade_count}")

output(f"盈利成交次数:\t{win_count}")

output(f"亏损成交次数:\t{loss_count}")

output(f"胜率:\t\t{winning_rate:,.2f}")

output(f"盈亏比:\t\t{win_loss_pnl_ratio:,.2f}")

output(f"平均每笔盈亏:\t{pnl_medio:,.2f}")

output(f"平均持仓小时:\t{duration_medio:,.2f}")

output(f"平均每笔手续费:\t{commission_medio:,.2f}")

output(f"平均每笔滑点:\t{slipping_medio:,.2f}")

output(f"总盈利金额:\t{win_amount:,.2f}")

output(f"盈利交易均值:\t{win_pnl_medio:,.2f}")

output(f"盈利持仓小时:\t{win_duration_medio:,.2f}")

output(f"总亏损金额:\t{loss_amount:,.2f}")

output(f"亏损交易均值:\t{loss_pnl_medio:,.2f}")

output(f"亏损持仓小时:\t{loss_duration_medio:,.2f}")

if not show_chart:

return

plt.figure(figsize=(10, 12))

acum_pnl_plot = plt.subplot(3, 1, 1)

acum_pnl_plot.set_title("Balance Plot")

df["balance"].plot(legend=True)

pnl_plot = plt.subplot(3, 1, 2)

pnl_plot.set_title("Pnl Per Trade")

df["net_pnl"].plot(legend=True)

distribution_plot = plt.subplot(3, 1, 3)

distribution_plot.set_title("Trade Pnl Distribution")

df["net_pnl"].hist(bins=100)

plt.show()

def output(msg):

"""

Output message with datetime.

"""

print(f"{datetime.now()}\t{msg}")

统计纯多头和纯空头交易

纯多头交易就是只有多开->空平的交易,而纯空头交易就是反过来。

为了筛选出纯多开交易,只要在DataFrame中判断其平仓方向的空的即可;纯空头交易则反过来,平仓方向为多。

def buy2sell(df, capital):

"""

Generate DataFrame with only trade from buy to sell

"""

buy2sell = df[df["close_direction"] == "空"]

result = calculate_base_net_pnl(buy2sell, capital)

return result

def short2cover(df, capital):

"""

Generate DataFrame with only trade from short to cover

"""

short2cover = df[df["close_direction"] == "多"]

result = calculate_base_net_pnl(short2cover, capital)

return result

整合所有计算步骤

最后,我们将上文中所有的函数进行整合,封装到单个函数中,用于实现策略回测效果的一键生成:

def exhaust_trade_result(

trades,

size: int = 10,

rate: float = 0.0,

slippage: float = 0.0,

capital: int = 1000000,

show_long_short_condition=True

):

"""

Exhaust all trade result.

"""

total_trades = generate_trade_df(trades, size, rate, slippage, capital)

statistics_trade_result(total_trades, capital)

if not show_long_short_condition:

return

long_trades = buy2sell(total_trades, capital)

short_trades = short2cover(total_trades, capital)

output("-----------------------")

output("纯多头交易")

statistics_trade_result(long_trades, capital)

output("-----------------------")

output("纯空头交易")

statistics_trade_result(short_trades, capital)

最后附上完整的源代码

import pandas as pd

from datetime import datetime

import matplotlib.pyplot as plt

import numpy as np

pd.set_option('mode.chained_assignment', None)

def calculate_trades_result(trades):

"""

Deal with trade data

"""

dt, direction, offset, price, volume = [], [], [], [], []

for i in trades.values():

dt.append(i.datetime)

direction.append(i.direction.value)

offset.append(i.offset.value)

price.append(i.price)

volume.append(i.volume)

# Generate DataFrame with datetime, direction, offset, price, volume

df = pd.DataFrame()

df["direction"] = direction

df["offset"] = offset

df["price"] = price

df["volume"] = volume

df["current_time"] = dt

df["last_time"] = df["current_time"].shift(1)

# Calculate trade amount

df["amount"] = df["price"] * df["volume"]

df["acum_amount"] = df["amount"].cumsum()

# Calculate pos, net pos(with direction), acumluation pos(with direction)

def calculate_pos(df):

if df["direction"] == "多":

result = df["volume"]

else:

result = - df["volume"]

return result

df["pos"] = df.apply(calculate_pos, axis=1)

df["net_pos"] = df["pos"].cumsum()

df["acum_pos"] = df["volume"].cumsum()

# Calculate trade result, acumulation result

# ej: trade result(buy->sell) means (new price - old price) * volume

df["result"] = -1 * df["pos"] * df["price"]

df["acum_result"] = df["result"].cumsum()

# Filter column data when net pos comes to zero

def get_acum_trade_result(df):

if df["net_pos"] == 0:

return df["acum_result"]

df["acum_trade_result"] = df.apply(get_acum_trade_result, axis=1)

def get_acum_trade_volume(df):

if df["net_pos"] == 0:

return df["acum_pos"]

df["acum_trade_volume"] = df.apply(get_acum_trade_volume, axis=1)

def get_acum_trade_duration(df):

if df["net_pos"] == 0:

return df["current_time"] - df["last_time"]

df["acum_trade_duration"] = df.apply(get_acum_trade_duration, axis=1)

def get_acum_trade_amount(df):

if df["net_pos"] == 0:

return df["acum_amount"]

df["acum_trade_amount"] = df.apply(get_acum_trade_amount, axis=1)

# Select row data with net pos equil to zero

df = df.dropna()

return df

def generate_trade_df(trades, size, rate, slippage, capital):

"""

Calculate trade result from increment

"""

df = calculate_trades_result(trades)

trade_df = pd.DataFrame()

trade_df["close_direction"] = df["direction"]

trade_df["close_time"] = df["current_time"]

trade_df["close_price"] = df["price"]

trade_df["pnl"] = df["acum_trade_result"] - \

df["acum_trade_result"].shift(1).fillna(0)

trade_df["volume"] = df["acum_trade_volume"] - \

df["acum_trade_volume"].shift(1).fillna(0)

trade_df["duration"] = df["current_time"] - \

df["last_time"]

trade_df["turnover"] = df["acum_trade_amount"] - \

df["acum_trade_amount"].shift(1).fillna(0)

trade_df["commission"] = trade_df["turnover"] * rate

trade_df["slipping"] = trade_df["volume"] * size * slippage

trade_df["net_pnl"] = trade_df["pnl"] - \

trade_df["commission"] - trade_df["slipping"]

result = calculate_base_net_pnl(trade_df, capital)

return result

def calculate_base_net_pnl(df, capital):

"""

Calculate statistic base on net pnl

"""

df["acum_pnl"] = df["net_pnl"].cumsum()

df["balance"] = df["acum_pnl"] + capital

df["return"] = np.log(

df["balance"] / df["balance"].shift(1)

).fillna(0)

df["highlevel"] = (

df["balance"].rolling(

min_periods=1, window=len(df), center=False).max()

)

df["drawdown"] = df["balance"] - df["highlevel"]

df["ddpercent"] = df["drawdown"] / df["highlevel"] * 100

df.reset_index(drop=True, inplace=True)

return df

def buy2sell(df, capital):

"""

Generate DataFrame with only trade from buy to sell

"""

buy2sell = df[df["close_direction"] == "空"]

result = calculate_base_net_pnl(buy2sell, capital)

return result

def short2cover(df, capital):

"""

Generate DataFrame with only trade from short to cover

"""

short2cover = df[df["close_direction"] == "多"]

result = calculate_base_net_pnl(short2cover, capital)

return result

def statistics_trade_result(df, capital, show_chart=True):

""""""

end_balance = df["balance"].iloc[-1]

max_drawdown = df["drawdown"].min()

max_ddpercent = df["ddpercent"].min()

pnl_medio = df["net_pnl"].mean()

trade_count = len(df)

duration_medio = df["duration"].mean().total_seconds()/3600

commission_medio = df["commission"].mean()

slipping_medio = df["slipping"].mean()

win = df[df["net_pnl"] > 0]

win_amount = win["net_pnl"].sum()

win_pnl_medio = win["net_pnl"].mean()

win_duration_medio = win["duration"].mean().total_seconds()/3600

win_count = len(win)

loss = df[df["net_pnl"] < 0]

loss_amount = loss["net_pnl"].sum()

loss_pnl_medio = loss["net_pnl"].mean()

loss_duration_medio = loss["duration"].mean().total_seconds()/3600

loss_count = len(loss)

winning_rate = win_count / trade_count

win_loss_pnl_ratio = - win_pnl_medio / loss_pnl_medio

total_return = (end_balance / capital - 1) * 100

return_drawdown_ratio = -total_return / max_ddpercent

output(f"起始资金:\t{capital:,.2f}")

output(f"结束资金:\t{end_balance:,.2f}")

output(f"总收益率:\t{total_return:,.2f}%")

output(f"最大回撤: \t{max_drawdown:,.2f}")

output(f"百分比最大回撤: {max_ddpercent:,.2f}%")

output(f"收益回撤比:\t{return_drawdown_ratio:,.2f}")

output(f"总成交次数:\t{trade_count}")

output(f"盈利成交次数:\t{win_count}")

output(f"亏损成交次数:\t{loss_count}")

output(f"胜率:\t\t{winning_rate:,.2f}")

output(f"盈亏比:\t\t{win_loss_pnl_ratio:,.2f}")

output(f"平均每笔盈亏:\t{pnl_medio:,.2f}")

output(f"平均持仓小时:\t{duration_medio:,.2f}")

output(f"平均每笔手续费:\t{commission_medio:,.2f}")

output(f"平均每笔滑点:\t{slipping_medio:,.2f}")

output(f"总盈利金额:\t{win_amount:,.2f}")

output(f"盈利交易均值:\t{win_pnl_medio:,.2f}")

output(f"盈利持仓小时:\t{win_duration_medio:,.2f}")

output(f"总亏损金额:\t{loss_amount:,.2f}")

output(f"亏损交易均值:\t{loss_pnl_medio:,.2f}")

output(f"亏损持仓小时:\t{loss_duration_medio:,.2f}")

if not show_chart:

return

plt.figure(figsize=(10, 12))

acum_pnl_plot = plt.subplot(3, 1, 1)

acum_pnl_plot.set_title("Balance Plot")

df["balance"].plot(legend=True)

pnl_plot = plt.subplot(3, 1, 2)

pnl_plot.set_title("Pnl Per Trade")

df["net_pnl"].plot(legend=True)

distribution_plot = plt.subplot(3, 1, 3)

distribution_plot.set_title("Trade Pnl Distribution")

df["net_pnl"].hist(bins=100)

plt.show()

def output(msg):

"""

Output message with datetime.

"""

print(f"{datetime.now()}\t{msg}")

def exhaust_trade_result(

trades,

size: int = 10,

rate: float = 0.0,

slippage: float = 0.0,

capital: int = 1000000,

show_long_short_condition=True

):

"""

Exhaust all trade result.

"""

total_trades = generate_trade_df(trades, size, rate, slippage, capital)

statistics_trade_result(total_trades, capital)

if not show_long_short_condition:

return

long_trades = buy2sell(total_trades, capital)

short_trades = short2cover(total_trades, capital)

output("-----------------------")

output("纯多头交易")

statistics_trade_result(long_trades, capital)

output("-----------------------")

output("纯空头交易")

statistics_trade_result(short_trades, capital)

了解更多知识,请关注vn.py社区公众号。