港股如何获取价格跳动(price tick)呢?

看futu_gateway中query_contract返回的pricetick是固定的0.001,显然是不对的?

请问大侠,特别是futu里哪个api可以返回正确的pricetick呢?

` def add_parameter_list(

self,

name: str,

value_list: List[float]

) -> Tuple[bool, str]:

self.params[name] = value_list

return True, f"列表参数添加成功,数量{len(value_list)}"

def add_constrait(self, constraint: Callable[[dict], bool]):

self.constraint = constraint

def generate_settings(self) -> List[dict]:

""""""

keys: dict_keys = self.params.keys()

values: dict_values = self.params.values()

products: list = list(product(*values))

settings: list = []

for p in products:

setting: dict = dict(zip(keys, p))

if self.constraint is None or self.constraint(setting) is True:

settings.append(setting)

print(f"generate_settings: {len(settings)}/{len(products)}")

return settings

`

使用例子

opt_setting.add_parameter_list("signal_window", [15, 30, 60, 120])

opt_setting.add_parameter("short_entry_window", 10, 40, 2)

opt_setting.add_parameter("short_exit_window", 6, 30, 2)

# opt_setting.add_parameter("keltner_dev", 0, 3, 0.5)

# opt_setting.add_parameter("long_entry_window", 20, 60, 2)

# opt_setting.add_parameter("long_exit_window", 10, 40, 2)

opt_setting.add_parameter("cci_window", 8, 30, 2)

opt_setting.add_parameter("cci_signal", 8, 40, 4)

opt_setting.add_parameter("n_window", 10, 30, 2)

opt_setting.add_parameter("unit_limit", 1, 6, 1)

# opt_setting.add_parameter("trading_size", 1, 4, 1)

# opt_setting.add_parameter("pnl_filter", True,

# opt_setting.add_parameter("price_add", 0.2, 2, 0.2)

opt_setting.add_constrait(lambda params: params["short_exit_window"] < params["short_entry_window"])

# %%

engine.run_ga_optimization(opt_setting, max_workers=max_workers)在atr_rsi_strategy策略中,只有止损出场?

怎么处理止盈呢?

只有止损没有处理止盈,怎么会有盈利呢?

` def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.cancel_all()

am = self.am

am.update_bar(bar)

if not am.inited:

return

atr_array = am.atr(self.atr_length, array=True)

self.atr_value = atr_array[-1]

self.atr_ma = atr_array[-self.atr_ma_length:].mean()

self.rsi_value = am.rsi(self.rsi_length)

if self.pos == 0:

self.intra_trade_high = bar.high_price

self.intra_trade_low = bar.low_price

if self.atr_value > self.atr_ma:

if self.rsi_value > self.rsi_buy:

self.buy(bar.close_price + 5, self.fixed_size)

elif self.rsi_value < self.rsi_sell:

self.short(bar.close_price - 5, self.fixed_size)

elif self.pos > 0:

self.intra_trade_high = max(self.intra_trade_high, bar.high_price)

self.intra_trade_low = bar.low_price

long_stop = self.intra_trade_high * \

(1 - self.trailing_percent / 100)

self.sell(long_stop, abs(self.pos), stop=True)

elif self.pos < 0:

self.intra_trade_low = min(self.intra_trade_low, bar.low_price)

self.intra_trade_high = bar.high_price

short_stop = self.intra_trade_low * \

(1 + self.trailing_percent / 100)

self.cover(short_stop, abs(self.pos), stop=True)

`

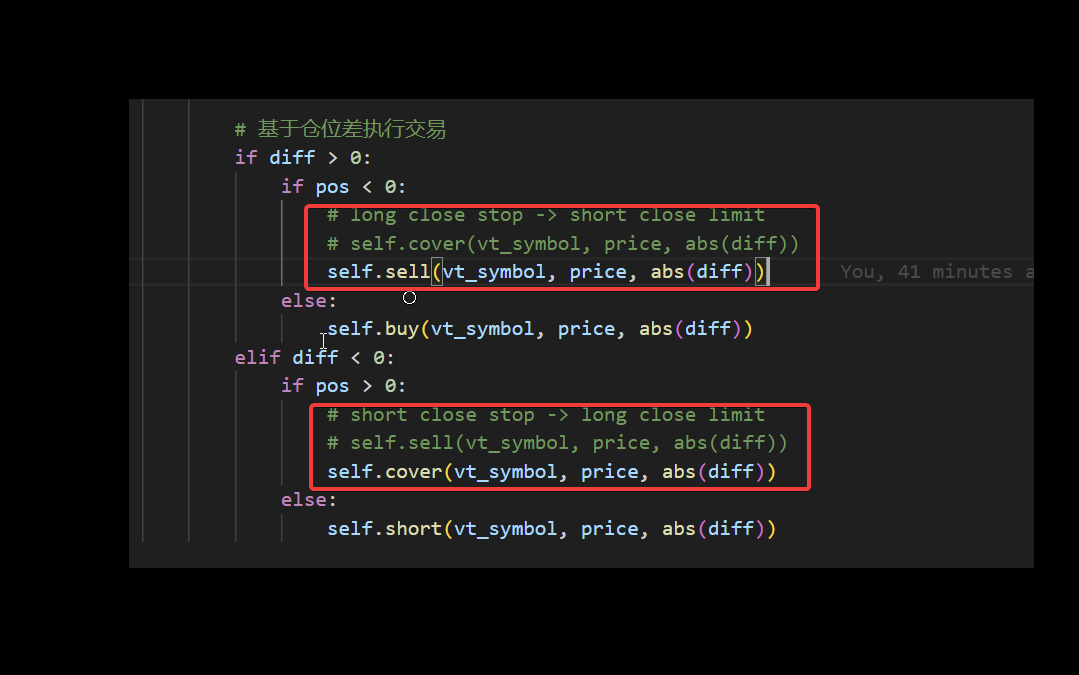

在尝试吧atr_rsi_strategy转成portfoliostrategy的过程中。发现ctastrategy使用停止单来平仓。但是portfoliostrategy只有限价单,所以需要使用限价单来模拟停止单。

通过log对比,发现portfoliostrategy的rebalance_portfolio应该有bug,是错误的!不知道是我理解有误,还是确实有bug呢?

核心修改如下,也就是说需要使用sell来代替cover来卖平对应的short买开,使用cover来代替sell来买平对应的buy买开