@康矣

1)\vnpy\trader\rqdata.py 这个文件已经移到\vnpy\trader\mddata文件夹下了,所以\vnpy\trader\rqdata.py 这个文件需要删除

2)查找所有用到rqdata_client的地方(script_trader\engine.py,cta_backtester\engine.py,cta_strategy\engine.py)进行mddata_client的替换,参考上文中第三步。

这个问题挺好的,一张表或集合数据量过大之后确实有瓶颈,有时间的话我准备来挑战一下分表。

用Python的交易员 wrote:

目前数据质量如何?之前我们测试的时候发现对比RQData质量差距还是挺明显的,有缺失和错误的地方

老大提醒的对,这东西是自己业余搞的,JQData数据的质量确实没有做过全面的考察,用到的朋友注意一下。

@pilotao 大概知道你的问题了,setting.py是用VNPY自带的文件在vnpy/trader文件夹下,不要在mddata文件夹下自己搞一个。

pilotao wrote:

Traceback (most recent call last):

File "C:\vnstudio\lib\site-packages\vnstation\cli.py", line 78, in run_trader

module = importlib.import_module(d["module"])

File "C:\vnstudio\lib\importlib__init.py", line 127, in import_module

return _bootstrap._gcd_import(name[level:], package, level)

File "<frozen importlib._bootstrap>", line 1006, in _gcd_import

File "<frozen importlib._bootstrap>", line 983, in _find_and_load

File "<frozen importlib._bootstrap>", line 967, in _find_and_load_unlocked

File "<frozen importlib._bootstrap>", line 677, in _load_unlocked

File "<frozen importlib._bootstrap_external>", line 728, in exec_module

File "<frozen importlib._bootstrap>", line 219, in _call_with_frames_removed

File "C:\vnstudio\lib\site-packages\vnpy\app\cta_strategy\init.py", line 9, in <module>

from .engine import CtaEngine

File "C:\vnstudio\lib\site-packages\vnpy\app\cta_strategy\engine.py", line 54, in <module>

from vnpy.trader.mddata import mddata_client

File "C:\vnstudio\lib\site-packages\vnpy\trader\mddata\init__.py", line 3, in <module>

from vnpy.trader.mddata.rqdata import rqdata_client

File "C:\vnstudio\lib\site-packages\vnpy\trader\mddata\rqdata.py", line 9, in <module>

from .setting import SETTINGS

File "C:\vnstudio\lib\site-packages\vnpy\trader\mddata\setting.py", line 7, in <module>

from .utility import load_json

ModuleNotFoundError: No module named 'vnpy.trader.mddata.utility'前辈你好,我按照步骤操作,最后提示报错如上,请问这个 'vnpy.trader.mddata.utility' 文件是在哪里?代码中没有涉及,谢谢

我的代码里没有 'vnpy.trader.mddata.utility' 这个东西,你看看是不是那里搞错了!

我的米筐账号试用期到了,看到张国平一篇聚宽的接入文章《利用聚宽(Joinquant)数据源为vnpy添加期货行情数据》深受启发,整了一个聚宽数据(JDDataSDK)集成方案,可以和米筐数据并存,自由配置切换,具体特性如下:

1)抽象了行情数据接口

2)实现了vn_symobl到jq_symbol的转换

3)避免了jqdata在交易日自动填充交易量为0的脏数据BUG,原理参考国平的文章《如果使用Joinquant做实盘行情数据,有一个比较大bug的要注意》

4)实现了和VNPY的深度集成,可以采用VNPY的配置界面实现傻瓜式配置。

聚宽数据的具体介绍,包括如何申请账号在国平的文章里已经写得很清楚了,需要了解的兄弟可以参考上文链接,本文主要介绍如何与VNPY集成在一起。

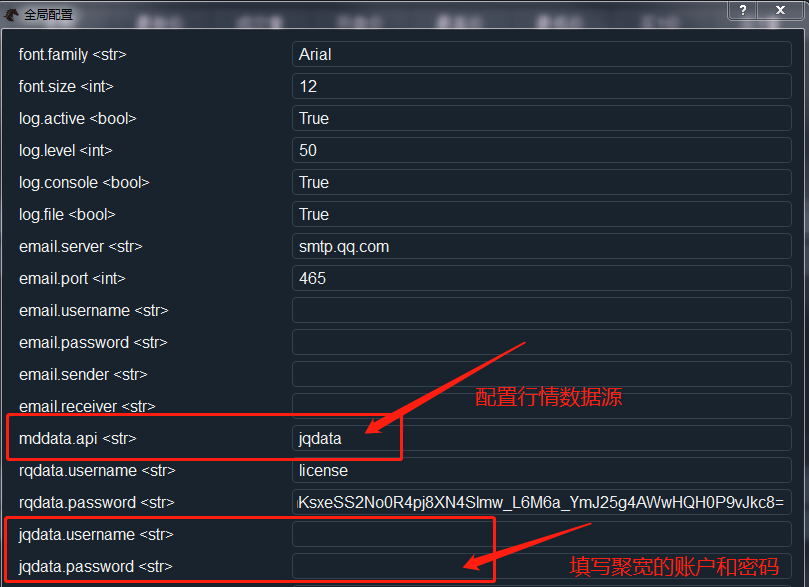

第一步:配置行情数据源,具体如下图所示:

行情配置的代码很简单,在setting.py文件里加上三行代码即可,具体如下:

"mddata.api": "rqdata",

"jqdata.username": "",

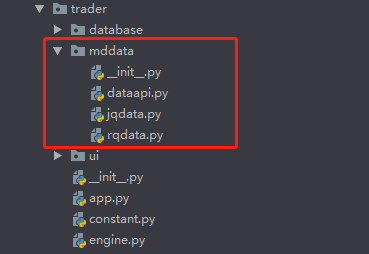

"jqdata.password": "",第二步:抽象了行情数据接口,所有文件集中在 trader/mddata 文件夹中:

dataapi.py文件是抽象类:

from abc import ABC, abstractmethod

from vnpy.trader.object import HistoryRequest

class MdDataApi(ABC):

"""

抽象数据接口

"""

@abstractmethod

def init(self, username="", password=""):

"""

初始化行情数据接口

:param username: 用户名

:param password: 密码

:return:

"""

pass

@abstractmethod

def query_history(self, req: HistoryRequest):

"""

查询历史数据接口

:param req:

:return:

"""

passjqdata.py是聚宽数据接口的具体实现

import jqdatasdk as jq

from datetime import timedelta, datetime

from typing import List

from vnpy.trader.constant import Exchange, Interval

from vnpy.trader.mddata.dataapi import MdDataApi

from vnpy.trader.object import BarData, HistoryRequest

from vnpy.trader.setting import SETTINGS

INTERVAL_VT2JQ = {

Interval.MINUTE: "1m",

Interval.HOUR: "60m",

Interval.DAILY: "1d",

}

INTERVAL_ADJUSTMENT_MAP_JQ = {

Interval.MINUTE: timedelta(minutes=1),

Interval.HOUR: timedelta(hours=1),

Interval.DAILY: timedelta() # no need to adjust for daily bar

}

class JqdataClient(MdDataApi):

"""聚宽JQData客户端封装类"""

def __init__(self):

""""""

self.username = SETTINGS["jqdata.username"]

self.password = SETTINGS["jqdata.password"]

self.inited = False

def init(self, username="", password=""):

""""""

if self.inited:

return True

if username and password:

self.username = username

self.password = password

if not self.username or not self.password:

return False

try:

jq.auth(self.username, self.password)

except Exception as ex:

print("jq auth fail:" + repr(ex))

return False

self.inited = True

return True

def to_jq_symbol(self, symbol: str, exchange: Exchange):

"""

CZCE product of RQData has symbol like "TA1905" while

vt symbol is "TA905.CZCE" so need to add "1" in symbol.

"""

if exchange in [Exchange.SSE, Exchange.SZSE]:

if exchange == Exchange.SSE:

jq_symbol = f"{symbol}.XSHG" # 上海证券交易所

else:

jq_symbol = f"{symbol}.XSHE" # 深圳证券交易所

elif exchange == Exchange.SHFE:

jq_symbol = f"{symbol}.XSGE" # 上期所

elif exchange == Exchange.CFFEX:

jq_symbol = f"{symbol}.CCFX" # 中金所

elif exchange == Exchange.DCE:

jq_symbol = f"{symbol}.XDCE" # 大商所

elif exchange == Exchange.INE:

jq_symbol = f"{symbol}.XINE" # 上海国际能源期货交易所

elif exchange == Exchange.CZCE:

# 郑商所 的合约代码年份只有三位 需要特殊处理

for count, word in enumerate(symbol):

if word.isdigit():

break

# Check for index symbol

time_str = symbol[count:]

if time_str in ["88", "888", "99", "8888"]:

return symbol

# noinspection PyUnboundLocalVariable

product = symbol[:count]

year = symbol[count]

month = symbol[count + 1:]

if year == "9":

year = "1" + year

else:

year = "2" + year

jq_symbol = f"{product}{year}{month}.XZCE"

return jq_symbol.upper()

def query_history(self, req: HistoryRequest):

"""

Query history bar data from JQData.

"""

symbol = req.symbol

exchange = req.exchange

interval = req.interval

start = req.start

end = req.end

jq_symbol = self.to_jq_symbol(symbol, exchange)

# if jq_symbol not in self.symbols:

# return None

jq_interval = INTERVAL_VT2JQ.get(interval)

if not jq_interval:

return None

# For adjust timestamp from bar close point (RQData) to open point (VN Trader)

adjustment = INTERVAL_ADJUSTMENT_MAP_JQ.get(interval)

# For querying night trading period data

# end += timedelta(1)

now = datetime.now()

if end >= now:

end = now

elif end.year == now.year and end.month == now.month and end.day == now.day:

end = now

df = jq.get_price(

jq_symbol,

frequency=jq_interval,

fields=["open", "high", "low", "close", "volume"],

start_date=start,

end_date=end,

skip_paused=True

)

data: List[BarData] = []

if df is not None:

for ix, row in df.iterrows():

bar = BarData(

symbol=symbol,

exchange=exchange,

interval=interval,

datetime=row.name.to_pydatetime() - adjustment,

open_price=row["open"],

high_price=row["high"],

low_price=row["low"],

close_price=row["close"],

volume=row["volume"],

gateway_name="JQ"

)

data.append(bar)

return data

jqdata_client = JqdataClient()rqdata.py文件是VNPY已经提供的米筐数据接口实现,这里就改了一句,增加对标准接口MdDataApi的继承

class RqdataClient(MdDataApi):init.py文件会根据setting.py的配置文件加载具体的行情数据接口

from vnpy.trader.mddata.dataapi import MdDataApi

from vnpy.trader.mddata.jqdata import jqdata_client

from vnpy.trader.mddata.rqdata import rqdata_client

from vnpy.trader.setting import SETTINGS

if SETTINGS["mddata.api"] == "jqdata":

mddata_client: MdDataApi = jqdata_client

else:

mddata_client: MdDataApi = rqdata_client第三步:使用mddata_client替换rqdata_client即可,例如cta_strategy/engine.py文件的改造如下:

注意:script_trader/engine.py,cta_backtester/engine.py,cta_strategy/engine.py 这三个文件都要改造

from vnpy.trader.mddata import mddata_client

def init_rqdata(self):

"""

Init RQData client.

"""

result = mddata_client.init()

md_data_api = SETTINGS["mddata.api"]

if result:

self.write_log(f"{md_data_api}数据接口初始化成功")

def query_bar_from_rq(

self, symbol: str, exchange: Exchange, interval: Interval, start: datetime, end: datetime

):

"""

Query bar data from RQData.

"""

req = HistoryRequest(

symbol=symbol,

exchange=exchange,

interval=interval,

start=start,

end=end

)

try:

data = mddata_client.query_history(req)

except Exception as ex:

self.write_log(f"{symbol}.{exchange.value}合约下载失败:{ex.args}")

return None

return dataCTP接口本身是不收费的,你做交易的话期货公司会收手续费,VNPY本身具备了CTP接口能力,你到期货公司开户认证后就可以用VNPY的CTP模块了。

搞定了,所有引用枚举的地方导入模块名都要写全,例如:from vnpy.trader.constant import Exchange

我之前是这样写的:from trader.constant import Exchange,少了vnpy所以枚举就不一致了,python这个特点也真是奇葩!

如下图所示:同一个Enum值比较却不相同,没查到资料,有没有大神指点一下

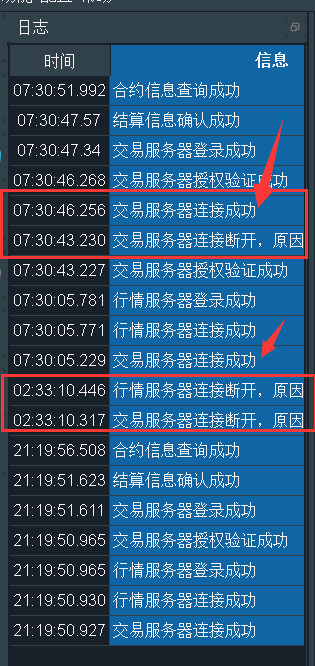

从日志来看应该是具备自动重连的功能

目前有当CTP柜台服务器启动时自动重连的机制吗,比如说按照固定时间间隔自动重连 ?

from datetime import datetime

from vnpy.app.cta_strategy.backtesting import BacktestingEngine

from vnpy.app.cta_strategy.strategies.atr_rsi_strategy import (

AtrRsiStrategy,

)

engine = BacktestingEngine()

engine.set_parameters(

vt_symbol="rb1910.SHFE",

interval="1m",

start=datetime(2010, 1, 1),

end=datetime(2019, 7, 17),

rate=0.3 / 10000,

slippage=0.2,

size=300,

pricetick=0.2,

capital=1_000_000,

)

engine.add_strategy(AtrRsiStrategy, {})

engine.load_data()

engine.run_backtesting()

df = engine.calculate_result()

engine.calculate_statistics()

engine.show_chart()

这个很明显构造函数 init 里需要传入 main_engine 和 event_engine

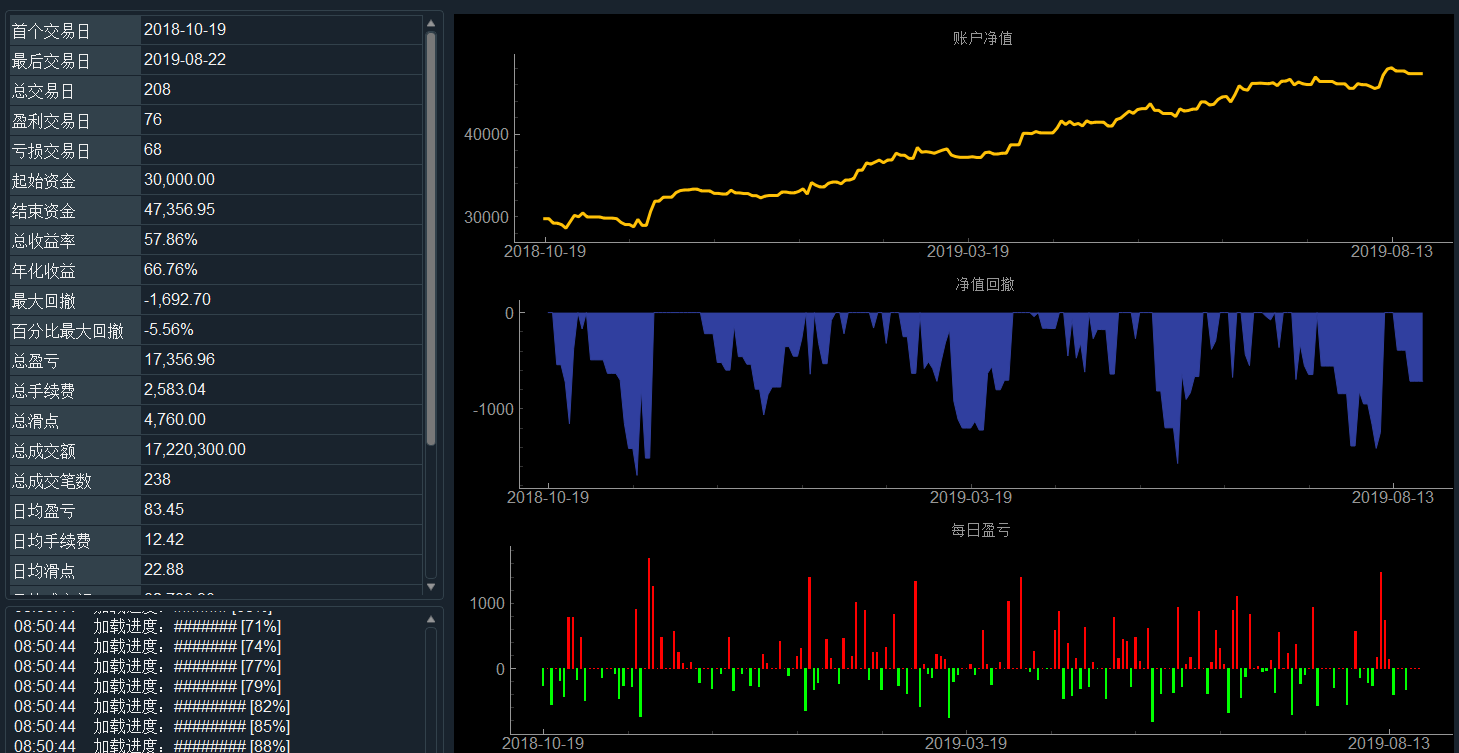

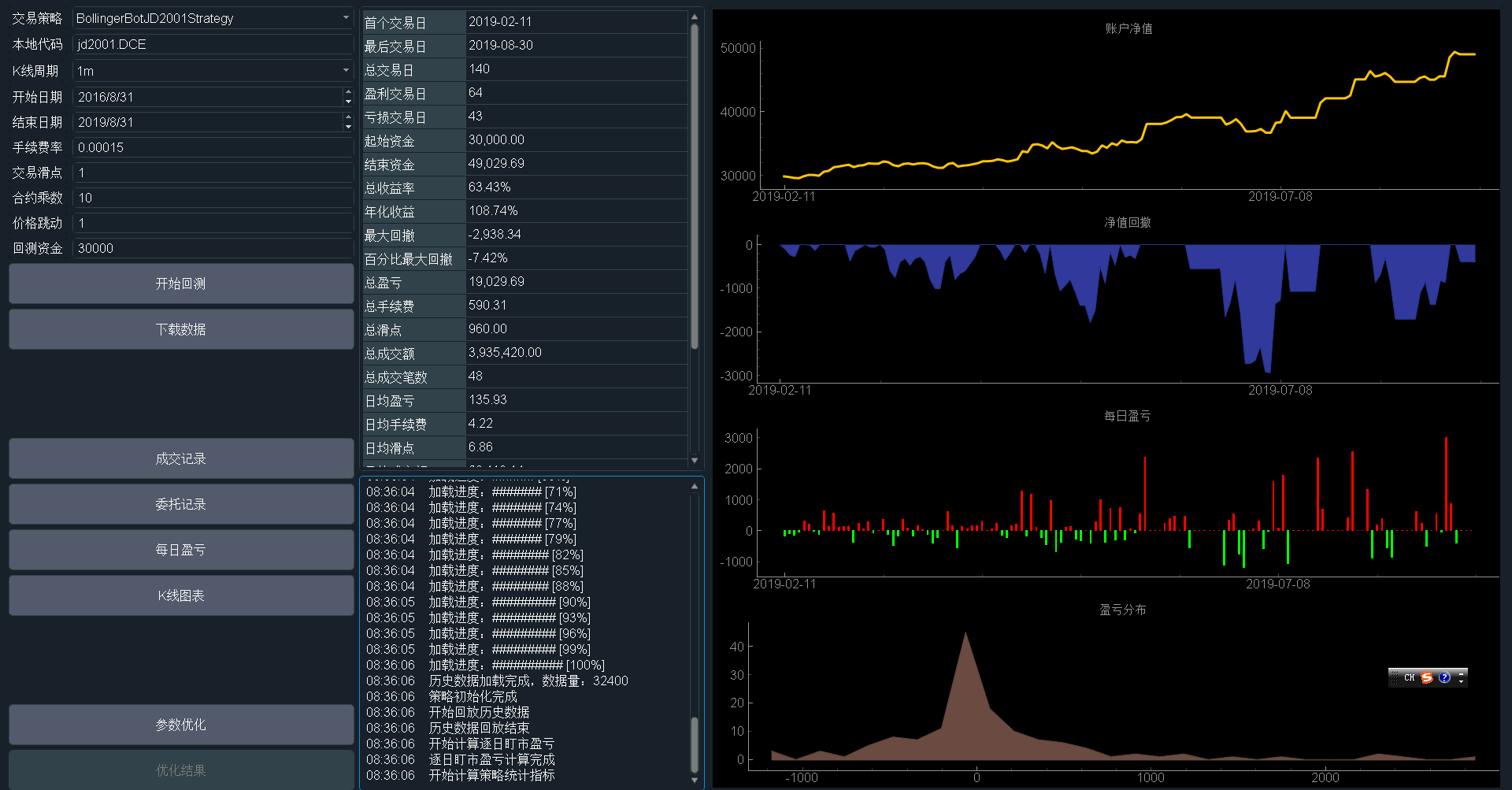

做了一个JD2001的图 @用Python的交易员 看看要向哪个方向改进

大体上好的资金曲线,x 0轴右侧应该越大越好(代表单笔最大盈利越高),左侧最大刻度代表了单笔最大亏损,y 轴代表了对应的金额的成交笔数

账户净值下方加个K线图就好了,一眼就能看出策略在哪个形态的K线下表现较好

@用Python的交易员 老大有没有适应性好的策略推荐一下,给个思路也行,谢谢~

现在哪里可以上传图片啊,本来想贴张图的,找不到上传的地方了

我用BollingerBotStrategy策略稍微改造了一下,用在RB1901上感觉还可以,但是换到其它品种就一塌糊涂了