作者:张国平 ;来源:韦恩的派论坛

在尝试写tick级别的策略,由于交易反馈时间要求高,感觉需要对单个order的事有个全面了解,就花了些时间尝试性去分析了VNPY中 从发送交易指令(sendOrder())到交易所,和接收成交返回信息(onOrder()/onTrade())的代码。如果有错误或者遗漏,请指正。这里先将发送

一·在策略中,一般不直接调用sendOrder(), 而且用四个二次封装函数函数,这些都是在class CtaTemplate中定义的,这里面主要区别就是sendorder()函数的中ordertype制定不一样,用来区分是买开卖开等交易类型。

返回一个vtOrderIDList, 这个list里面包含vtOrderID,这个是个内部给号,可以用做追踪同一个order的状态。

二·接下来我们看看那sendOrder()源码,还在class CtaTemplate中定义;如果stop为True是本地停止单,这个停止单并没有发送给交易所,而是存储在内部,使用ctaEngine.sendStopOrder()函数;否则这直接发送到交易所,使用ctaEngine.sendStopOrder函数。这里会返回一个vtOrderIDList, 这个list里面包含vtOrderID,和上面说的一样。这里补充一下,对于StopOrder真是交易通常是涨停价或者跌停价发出的市价单(Market price),参数price只是触发条件;而普通sendOrder是真正按照参数price的限价单(Limit price)

三·这里我们首先看看ctaEngine.sendStopOrder()函数,在class CtaEngine中定义的,首先实例初始化时候定义了两个字典,用来存放stoporder,区别一个是停止单撤销后删除,一个不会删除;还定义了一个字典,策略对应的所有orderID。

然后在函数sendStopOrder中,首先记录给本地停止单一个专门编号,就是前缀加上顺序编号,其中STOPORDERPREFIX是 'CtaStopOrder.',那么第一条本地编码就是'CtaStopOrder.1',后面是这个单据信息;这里可以发现orderType其实是一个direction和offset的组合。交易方向direction有Long、short两个情况,交易对offset有open和close两个情况。组合就是上面买开,卖平等等。然后把这个stoporder放入字典,等待符合价格情况到达触发真正的发单。这里返回本地编码作为vtOrderIDList。

四· 下面是processStopOrder()函数,也在classCtaEngine中定义的,主要是当行情符合时候如何发送真正交易指令,因为stopOrderID不是tick交易重点,这里简单讲讲,具体请看源码。

当接收到tick时候,会查看tick.vtSymbol,是不是存在workingStopOrderDict的so.vtSymbol有一样的,如果有,再看tick.lastPrice价格是否可以满足触发阈值,如果满足,根据原来so的交易Direction,Long按照涨停价,Short按照跌停价发出委托。然后从workingStopOrderDic和strategyOrderDict移除该so,并更新so状态,并触发事件onStopOrder(so).

这里发现,so只是只是按照涨停价发单给交易所,并没有确保成绩,而且市价委托的实际交易vtOrderID也没有返回;从tick交易角度,再收到tick后再发送交易,本事也是有了延迟一tick。所以一般tick级别交易不建议使用stoporder。

五·前面说了这么多,终于到了正主sendOrder(),也在class CtaEngine中定义的。代码较长,下面做了写缩减。

1)通过mainEngine.getContract获得这个品种的合约的信息,包括这个合约的名称,接口名gateway(国内期货就是ctp),交易所,最小价格变动等信息;

2)创建一个class VtOrderReq的对象req,在vtObject.py中,这个py包括很多事务类的定义;然后赋值,包括contract获得信息,交易手数,和price,和priceType,这里只有限价单。

3)根据orderType赋值direction和offset,之前sendStopOrder中已经说了,就不重复。

4)然后跳到mainEngine.convertOrderReq(req),这里代码比较跳,分析下来,如果之前没有持仓,或者是直接返回[req];如果有持仓就调用PositionDetail.convertOrderReq(req),这个时候如果是平仓操作,就分析持仓量,和平今和平昨等不同操作返回拆分的出来[reqTd,reqYd],这里不展开。

5) 如果上一部没有返回[req],则委托有问题,直接返回控制。如果有[req],因为存在多个req情况,就遍历每个req,使用mainEngine.sendOrder发单,并保存返回的vtOrderID到orderStrategyDict[],strategyOrderDict[]两个字典;然后把vtOrderIDList返回。

六·在mainEngine.sendOrder中,这里不列举代码了,首先进行风控,如果到阈值就不发单,然后看gateway是否存在,如果存在,就调用gateway.sendOrder(orderReq)方法;下面用ctpgateway说明。class CtpGateway(VtGateway)是VtGateway是继承,把主要发单,返回上面都实现,同时对于不同的接口,比如外汇,只要用一套接口标准就可以,典型继承使用。

CtpGateway.sendOrder实际是调用class CtpTdApi(TdApi)的,这个就是一套ctp交易交口,代码很简单,最后是调用封装好C++的ctp接口reqOrderInsert()。最关键返回的vtOrderID是接口名+顺序数。

整个流程下来,不考虑stoporder,是ctaTemplate -> CtaEngine->mainEngine ->ctpgateway ->CtpTdApi, 传到C++封装的接口。返回的就是vtOrderID; 因为存在平昨,平今还有锁仓,反手等拆分情况,返回的可能是一组。

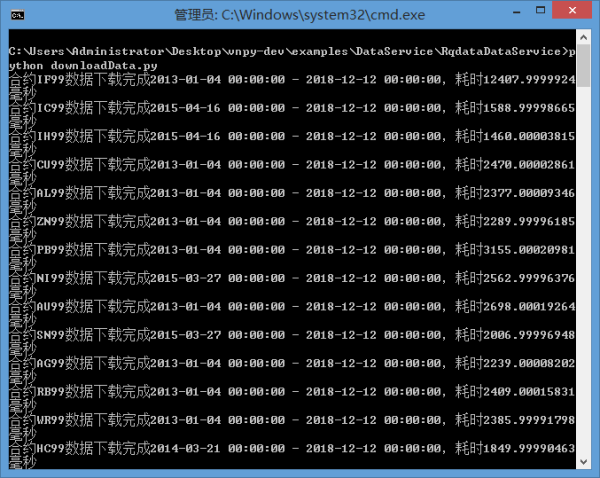

我在云服务器上配置RQData同样出现这样的问题,但是在本机(老版本)上可以正常下载。。。

估计是RQData那边版本升级出现了bug,已经联系那边的人员尝试修复问题

(继续上一章节未完成的测试)

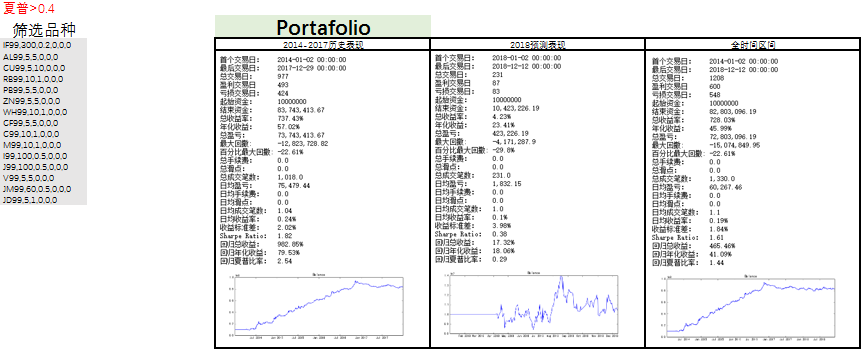

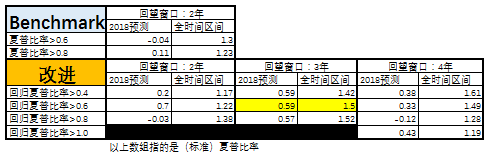

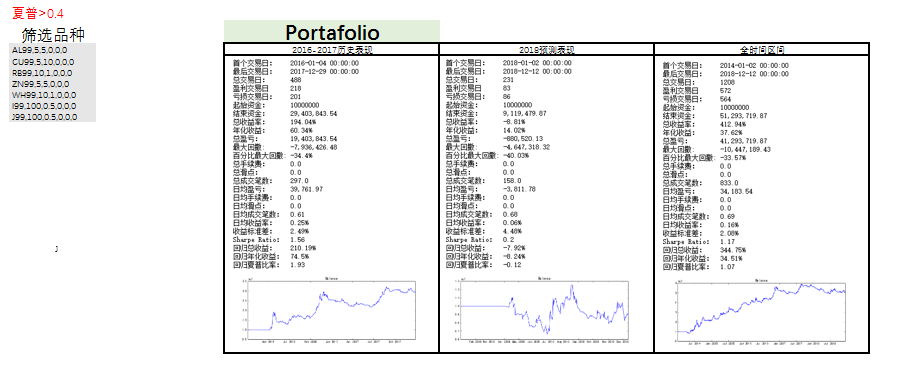

选择标准:回归夏普比率>0.4

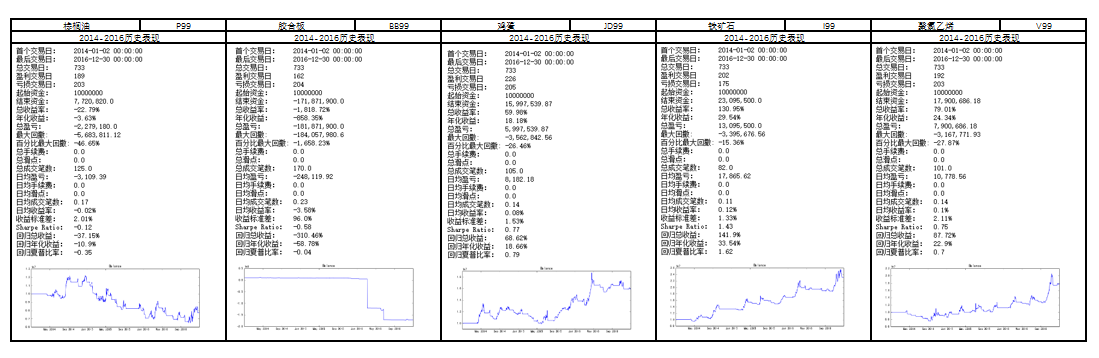

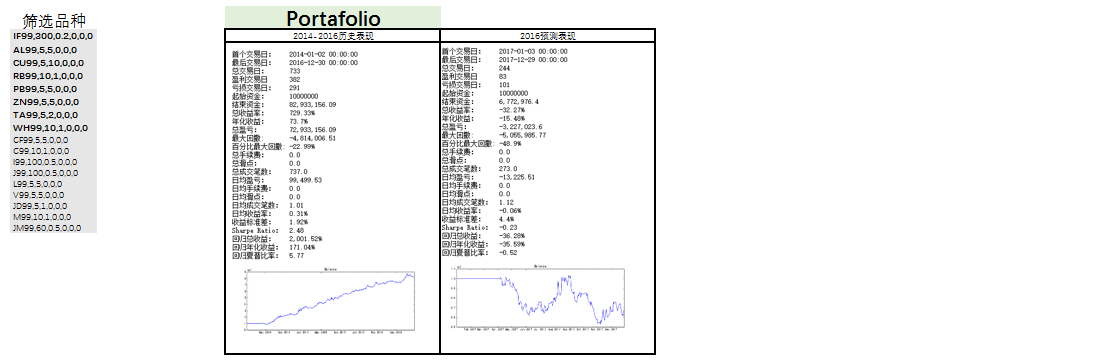

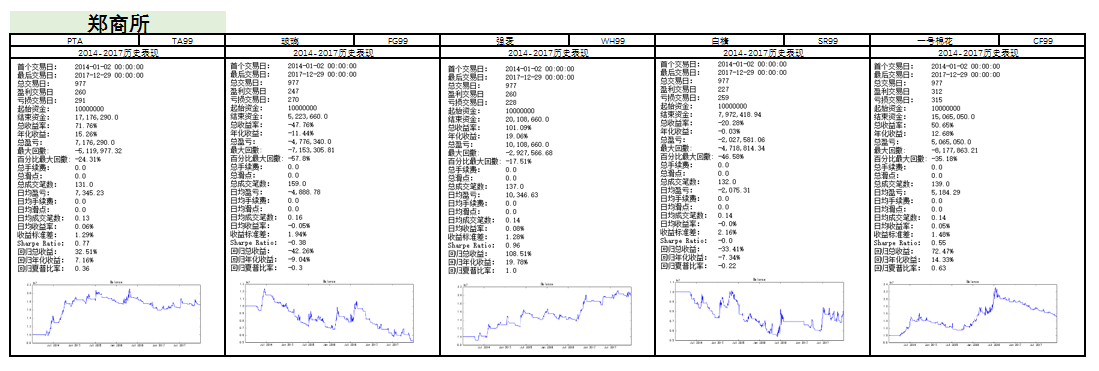

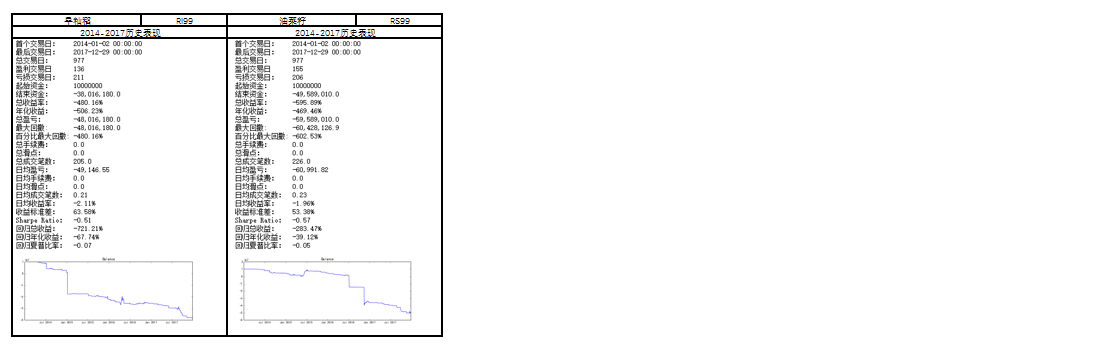

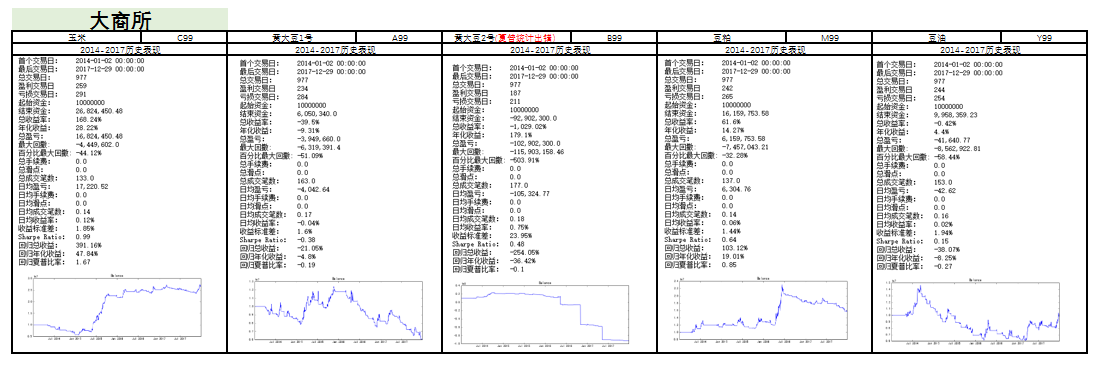

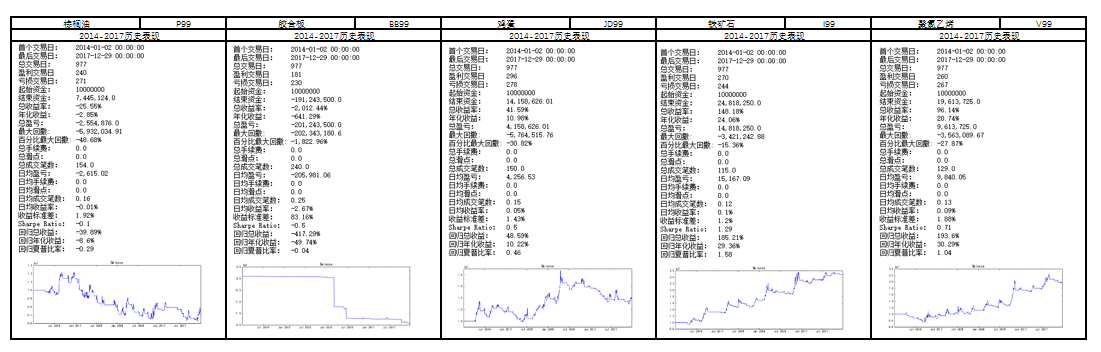

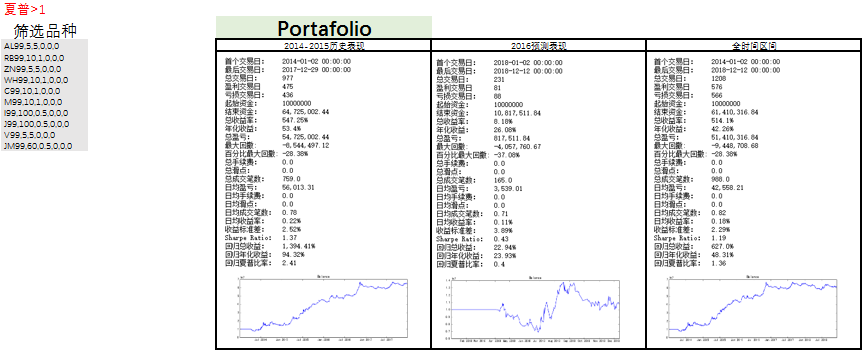

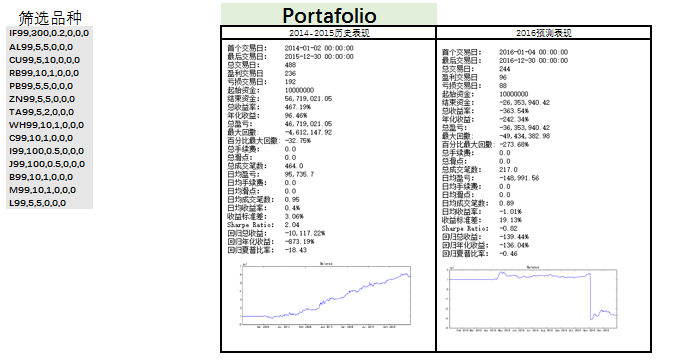

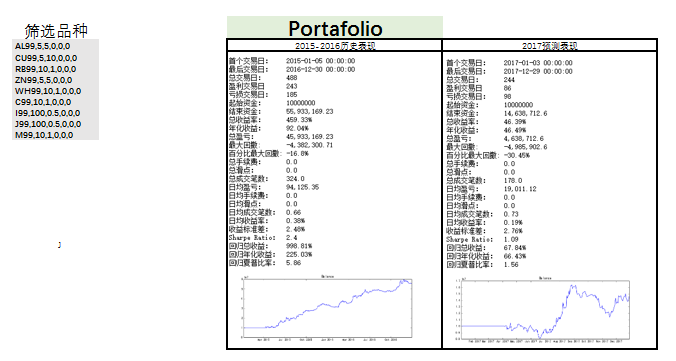

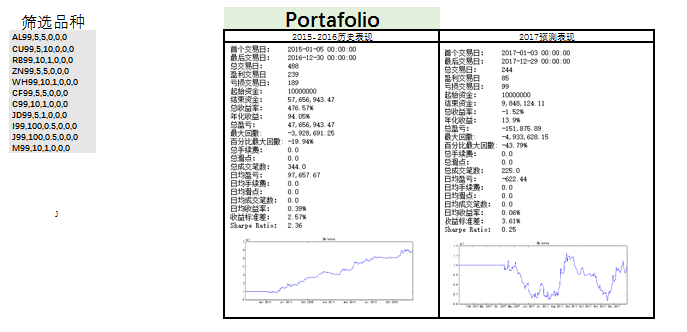

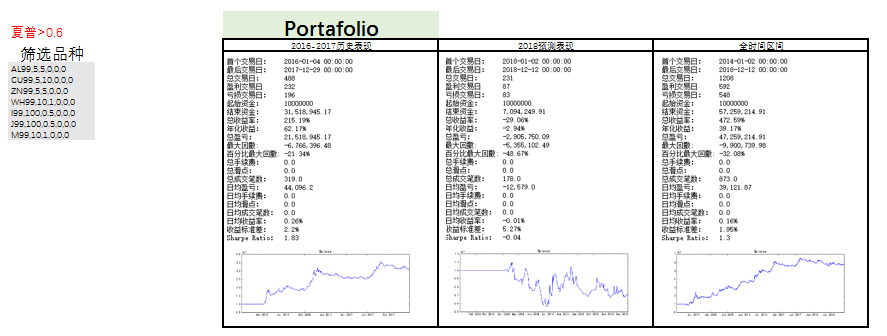

对初步筛选出来的样本进行2014-2016年回测,选择回归夏普比率>0.4的品种,然后构成组合,如图所示。

根据回归夏普比率>0.4的准则,筛选出了17个品种,其历史表现和2017年预测表现如图6-31所示。投资组合在2014-2016年年化收益73.7%,百分比最大回撤-22.99%,夏普比率达2.48,资金曲线平滑且整体向上,但是2017年预测表现不佳,资金曲线不断上下震荡,夏普比率仅仅是-0.23。

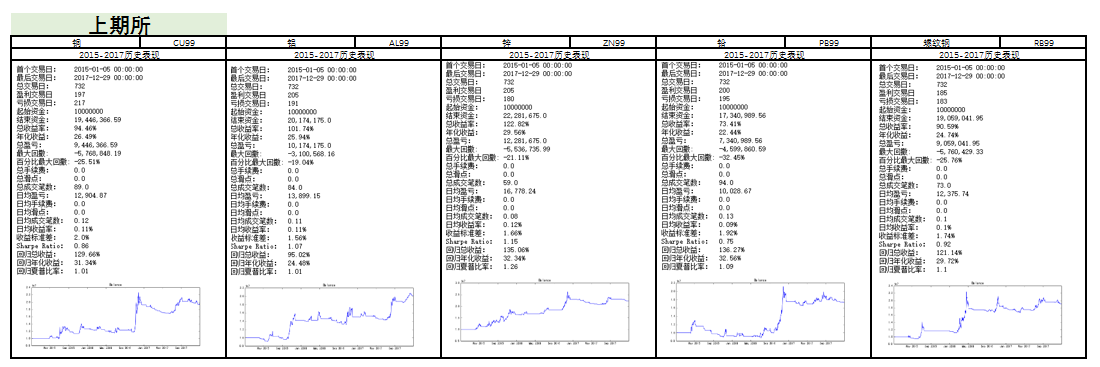

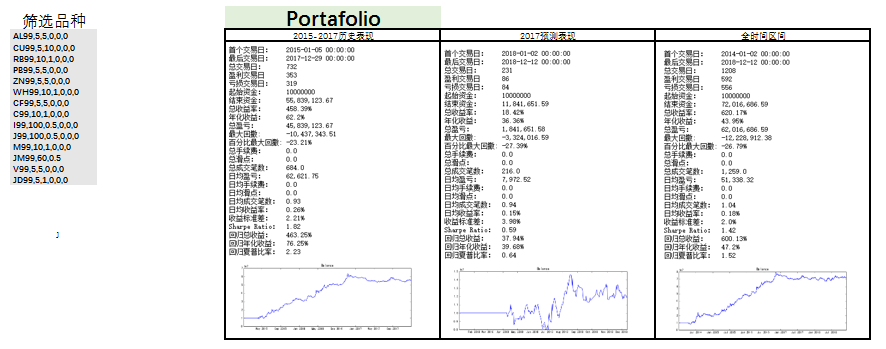

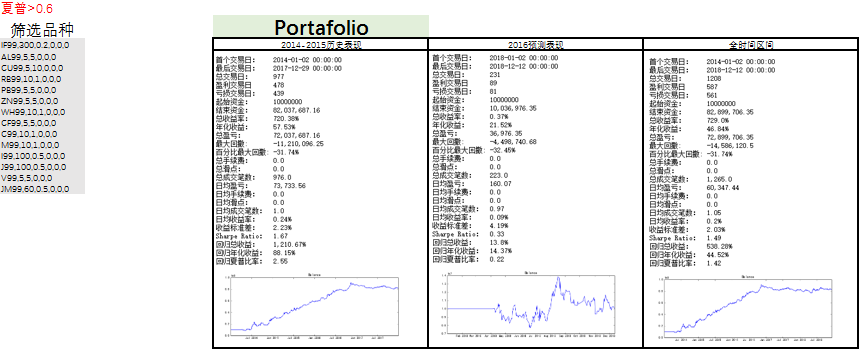

2015-2017年回测是最后一轮策略,选择回归夏普比率>0.4的品种,然后构成最终的海龟组合,如图所示。

根据回归夏普比率>0.4的准则,筛选出了14个品种,其历史表现和2018年预测表现如图6-33所示。投资组合在2015-2017年年化收益62.2%,百分比最大回撤-23.21%,夏普比率达1.82;但是2017年震荡向上,夏普比率达0.59,故2018年是盈利的;全时间区间的夏普比率为1.42。

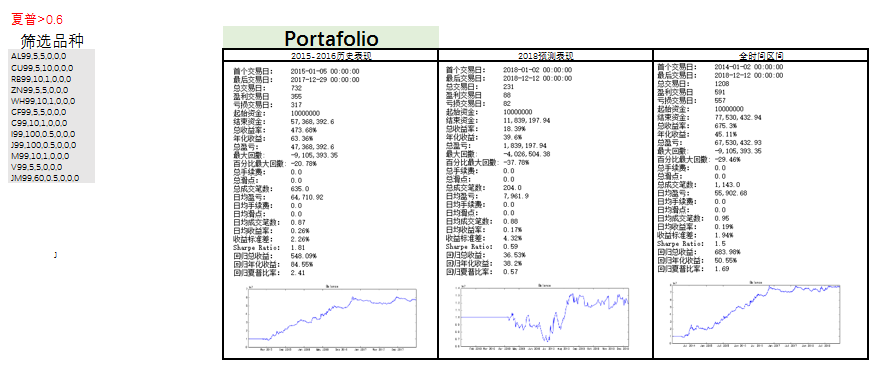

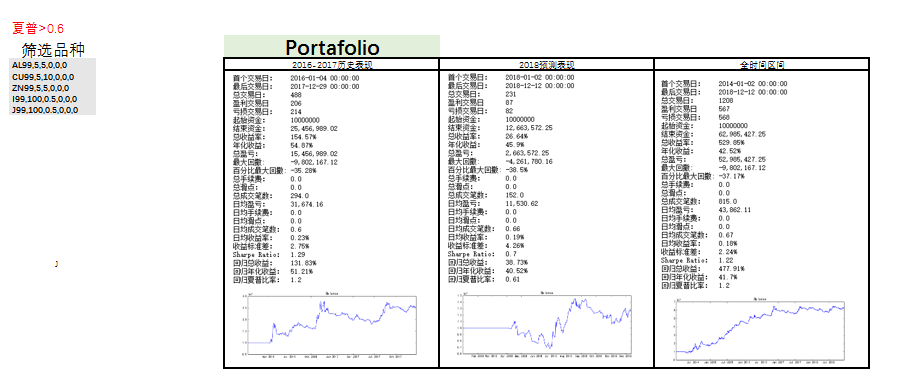

若把筛选标准改成回归夏普比率>0.6后,投资组合的品种数量降低到12个,其其历史表现和2018年预测表现如图6-34所示。投资组合在2015-2017年年化收益63.36%,百分比最大回撤-20.78%,夏普比率达1.81; 2018年预测表现是先发生回撤然后行情走好,夏普比率达0.59;全时间区间的夏普比率为1.5。

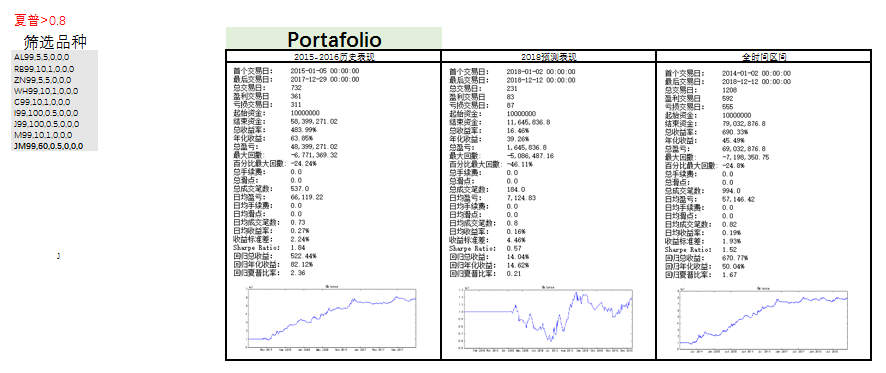

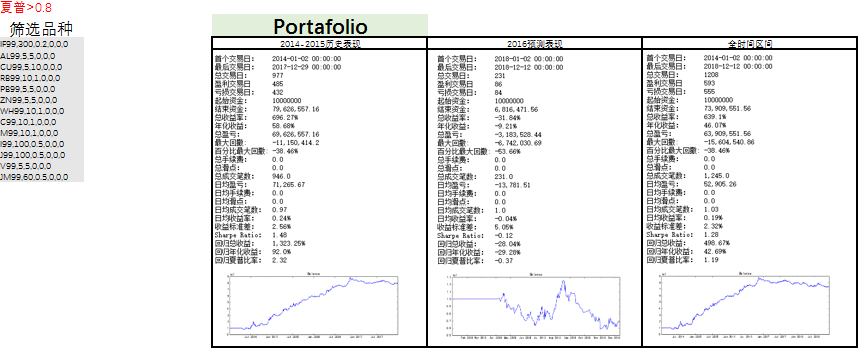

若把筛选标准改成回归夏普比率>0.8后,投资组合的品种数量降低到9个,其其历史表现和2018年预测表现如图6-35所示。投资组合在2015-2017年年化收益63.85%,百分比最大回撤-24.24%,夏普比率达1.84; 2018年预测表现是先发生回撤然后行情走好,夏普比率达0.57;全时间区间的夏普比率为1.52。

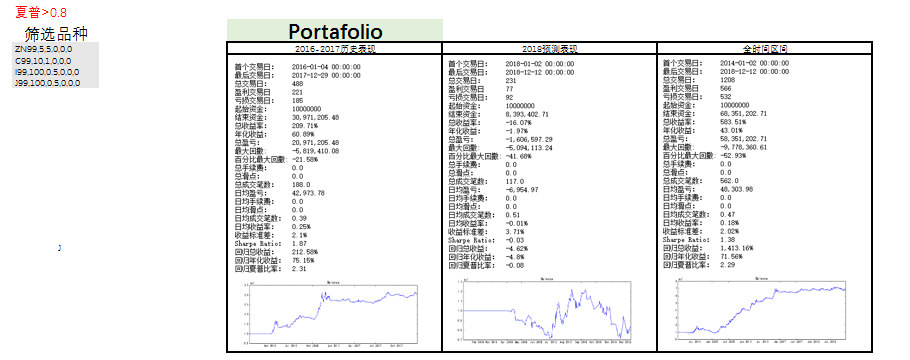

选择标准是回归夏普比率>0.4,对初步筛选出来的样本进行2014-2017年回测,然后一步到位构成组合,如图所示。

根据回归夏普比率>0.4的准则,筛选出了15个品种,其历史表现和2017年预测表现如图6-37所示。投资组合在2015-2017年年化收益57.2%,百分比最大回撤-22.61%,夏普比率达1.82;但是2018年资金曲线上下震荡,夏普比率仅仅是0.38;全时间区间的夏普比率为1.61。

根据回归夏普比率>0.6的准则,剔除了鸡蛋这个品种,其历史表现和2017年预测表现如图6-38所示。投资组合在2015-2017年年化收益57.2%,百分比最大回撤-22.61%,夏普比率达1.67;但是2018年夏普比率是0.33;全时间区间的夏普比率为1.49。

根据回归夏普比率>0.8的准则,剔除了一号棉花这个品种,其历史表现和2017年预测表现如图6-39所示。投资组合在2015-2017年年化收益58.68%,百分比最大回撤-38.46%,夏普比率达1.48;但是2018年夏普比率是-0.12;全时间区间的夏普比率为1.28。

根据回归夏普比率>1.0的准则,剔除的品种包括:沪深300股指、铜、铅,其历史表现和2018年预测表现如图6-40所示。投资组合在2015-2017年年化收益53.4%,百分比最大回撤-28.38%,夏普比率达1.37; 2018年夏普比率是0.43;全时间区间的夏普比率为1.19。

在上面的测试中,尝试了通过不同的回望周期(如2年、3年、4年)和不同的筛选标准得到了10个备选的海龟组合,下面仅仅以2018年预测效果和全时间区间的夏普比率构建备选表格,如图所示。从该表格可以看出,整体表现最好的是回望周期为3年,筛选标准是回归夏普比率>0.6的组合,故以该投资组合成为最终的海龟组合,用于其他关键要素的验证,比如单位头寸限制,长短周期出入场信号,上一笔盈利过滤等等。

上面测试国内期货品种,用的是日线数据 (RQData上的期货指数数据,“88”结尾的)。

作者:viponedream ;来源:维恩的派论坛

# ----------------------------------------------------------------------

def convert_datetime(dt=None, oldtz=None, newtz=None, fmt=None, returnStr=False, withFlag=False):

"""输入一个日期,时间,返回一个新时区的datetime对象

DateTime 可以是字符串,数字,日期,时间或者日期对象

可能的值 (可以带时区,默认为UTC)

20160530 10:59:59 字符 日期 时间

20160530 字符 日期

10:59:59 字符 时间

1536249467.2627187 timestamp(可字符或数字)

传入的日期或字符串日期, 如20160530 10:59:59

或者传入一个时间戳 时间戳没有时区概念,是GMT以来的秒数

newtz 想要的新时区,有新时区则返回新时区,否则返回UTC时间

oldtz 传入日期的原来时区 可选参数 CST EST GMT UTC

withFlag

"""

"""

now(), datetime(), time()都是可以指定tzinfo信息的,而date是不行的

"""

# 定义输出格式 '%Y%m%d %H:%M:%S' '%Y%m%d %H:%M:%S.%f'

if not fmt:

fmt = '%Y%m%d %H:%M:%S.%f'

# 定义常用时区

utcZone = pytz.timezone('utc') # 标准时间 UTC, GMT

estZone = pytz.timezone('US/Eastern') # 北美 EST 时区 US/Eastern

cstZone = pytz.timezone('Asia/Shanghai') # 中国时区 CST

# 判断传入时间的时区 UTC, GMT, CST, EST

if oldtz is not None:

oldtz = oldtz.upper()

if not oldtz or oldtz in ['UTC', 'GMT']: # 没有传入默认为 UTC(GMT)

oldtz = utcZone

elif oldtz == 'CST': # 传入的是中国时区

oldtz = cstZone

elif oldtz == 'EST': # 传入的是北美时区

oldtz = estZone

else:

print(u'传入的时区没法识别')

return

# 判断要转换出去的时区 UTC, GMT, CST, EST

if newtz is not None:

newtz = newtz.upper()

if not newtz or newtz in ['UTC', 'GMT']: # 没有传入默认为 UTC(GMT)

newtz = utcZone

dtEndStr = 'GMT'

elif newtz == 'CST': # 传入的是中国时区

newtz = cstZone

dtEndStr = 'CST'

elif newtz == 'EST': # 传入的是北美时区

newtz = estZone

dtEndStr = 'EST'

else:

print(u'传入的时区没法识别')

return

newdt = None

# 先判断是否日期对象

if isinstance(dt, str):

# 2016-01-05 21:55:20

# 如果只是导入的 21:55:20,则先在前面加上日期,

dt = dt.replace('-', '')

if dt is None or not dt: # 如果dt为空或者没有传进来

now = time.time()

newdt = datetime.datetime.fromtimestamp( now, datetime.timezone.utc)

elif isinstance(dt, datetime.datetime): # 日期格式,

newdt = dt

elif isinstance(dt,datetime.date): # 只有日期

tt = datetime.time(23, 59, 59, tzinfo=oldtz)

newdt = datetime.datetime.combine(dt, tt)

elif isinstance(dt, datetime.time): #只有时间

newdt = datetime.utcnow()

newdt = newdt.replace(hour=dt.hour, minute=dt.minute, second=dt.second, tzinfo=oldtz)

elif isinstance(dt, (int, float)): # 数字,就是 timestamp

newdt = datetime.datetime.fromtimestamp(float(dt), datetime.timezone.utc)

elif isinstance(dt, str) and len(dt) == 8:

if ':' in dt: # 21:55:20

t = datetime.strptime(dt, '%H:%M:%S')

newdt = datetime.utcnow()

newdt = newdt.replace(hour=t.hour, minute=t.minute, second=t.second, tzinfo=utcZone)

else: # YYYYmmdd 20160815

y = int(dt[0:4])

m = int(dt[4:6])

d = int(dt[6:8])

tt = datetime.time(23, 59, 59, tzinfo=oldtz)

dd = datetime.date(y, m, d) # date没有时区信息

newdt = datetime.datetime.combine(dd, tt)

elif "." in dt and ':' in dt: # 20180906 16:46:20.157940

newdt = datetime.datetime.strptime(dt, '%Y%m%d %H:%M:%S.%f')

elif ':' in dt and not "." in dt: # 20180906 16:46:20

newdt = datetime.datetime.strptime(dt, '%Y%m%d %H:%M:%S')

elif dt.replace(".", '').isdigit(): # timestamp 1536249467.2627187 1536249467

newdt = datetime.datetime.fromtimestamp(float(dt), datetime.timezone.utc)

if not isinstance(newdt, datetime.datetime): # 日期格式,

print( f" MY_vtFunction 日期转化不对{dt}")

return

try:

newdt = oldtz.localize(newdt) # 设置时区

except:

pass

utcDateTime = newdt.astimezone(utcZone) # 再转为UTC标准时间

newDateTime = newtz.normalize(utcDateTime) # 转出为 newtz

# 返回时再把时区信息去掉。

newDateTime = newDateTime.replace(tzinfo=None)

if returnStr: # 返回字符串

newDateTime = newDateTime.strftime(fmt)

if withFlag:

newDateTime = ' '.join([newDateTime, dtEndStr]) # 加上时区标识

return newDateTime

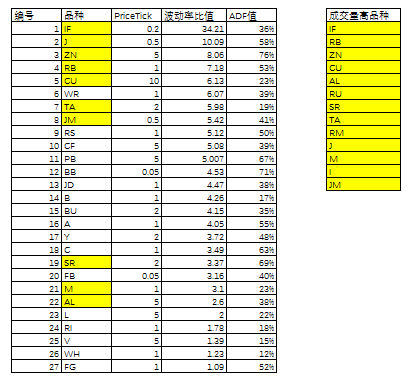

初步筛选从仅仅基于历史行情外,还加多了品种波动率和自相关性的要求,故总的来说其初步筛选条件为三点:

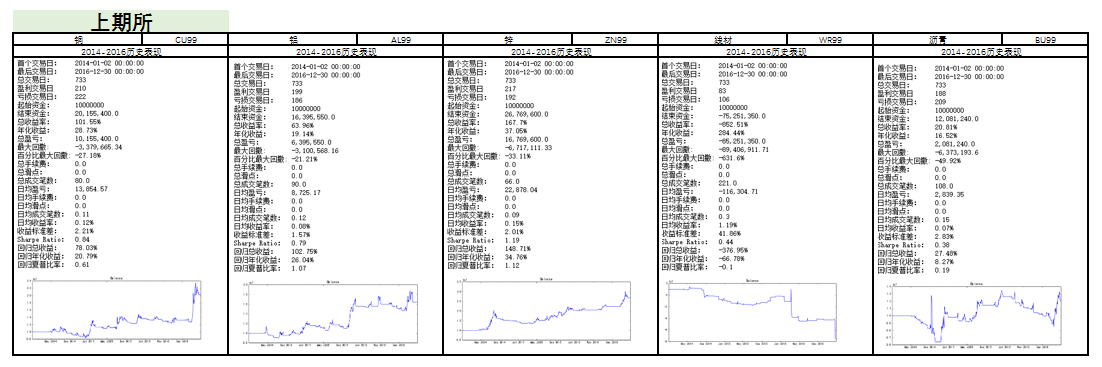

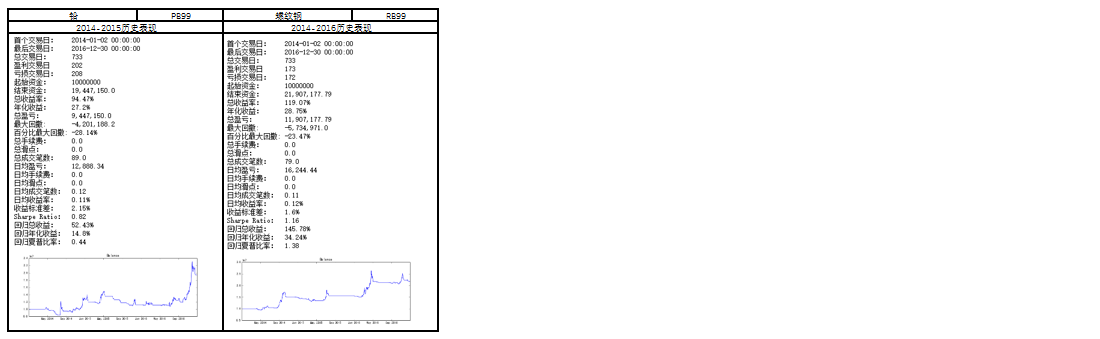

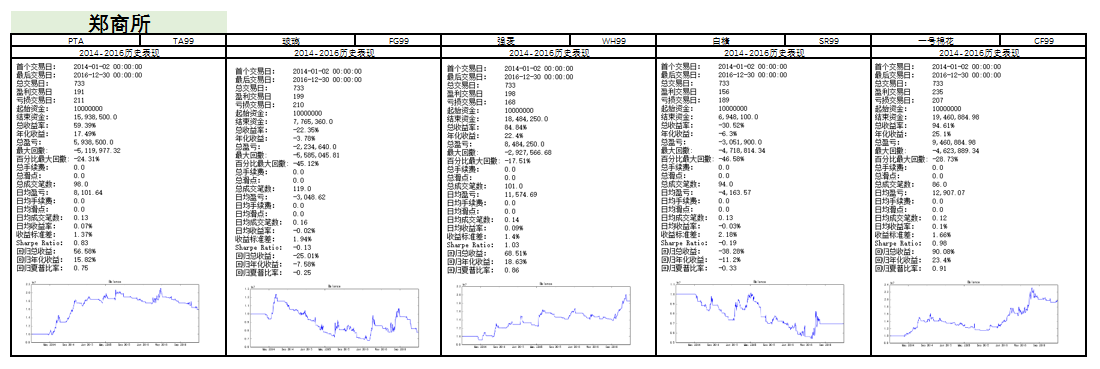

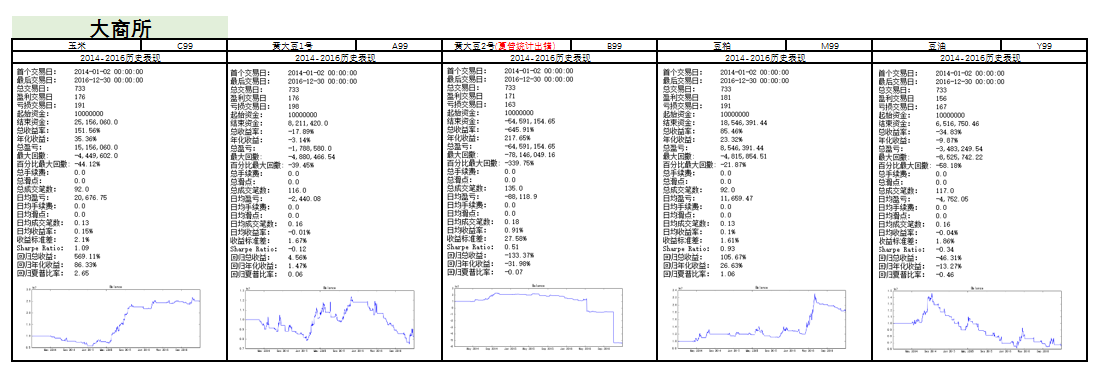

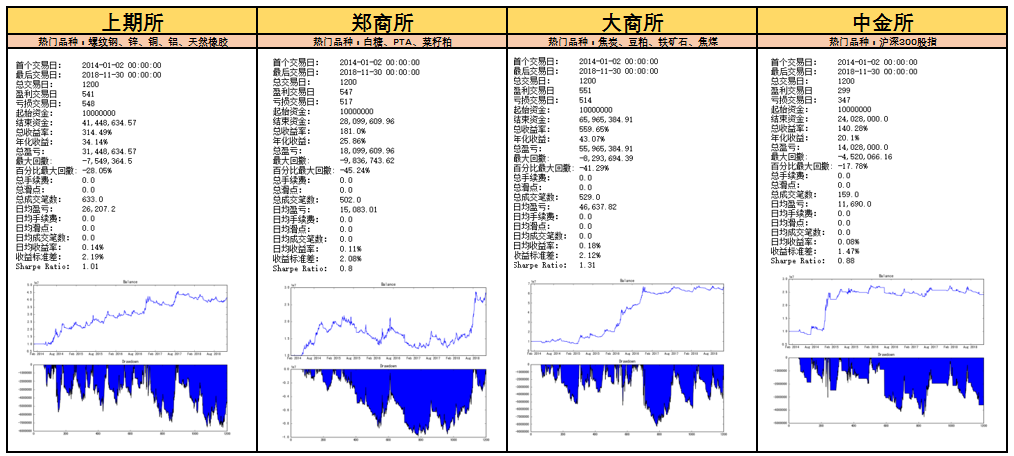

根据初步筛选标准,剔除了不符合要求品种后,测试样本从调整前的35个缩小至27个,根据其调整后波动率比值的大小按从大到小排序,如图所示。

结合高成交量特征,一般来说,成交量高的品种,其波动率高,自相关性强,故具有正相关性。

根据交易所分类,这27个品种划分成4部分:

初步筛选之后,我们会通过不同的回望周期(如2年、3年、4年)以及基于回归夏普比率不同的筛选标准来得到若干个海龟组合备选方案,最后通过相互比较得到最终的组合。

(以下测试基于米筐RQData的小时级别期货指数数据,有兴趣的朋友可以自行验证或者使用别的数据源测试一下!)

选择标准:回归夏普比率>0.4

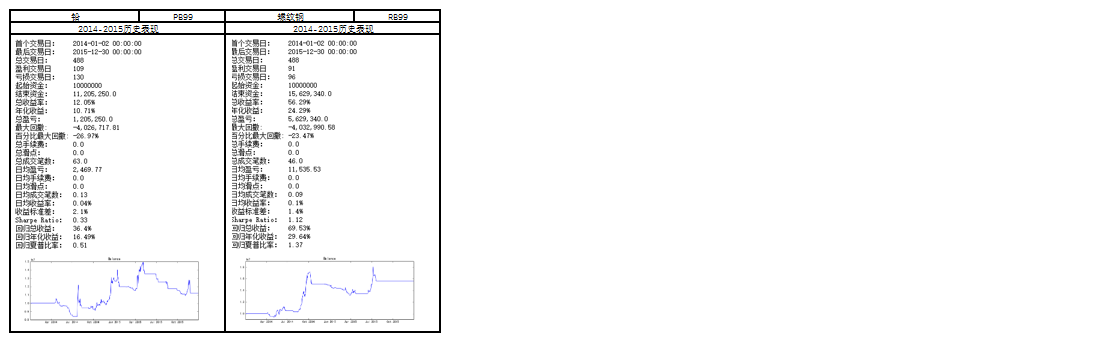

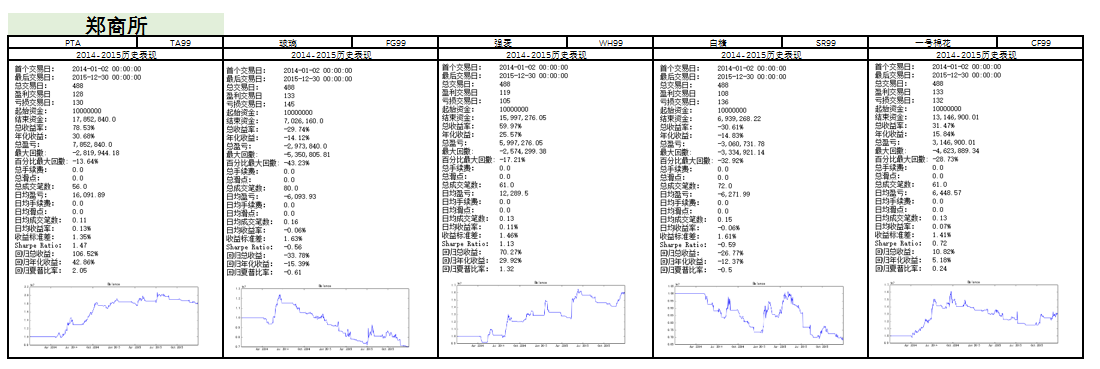

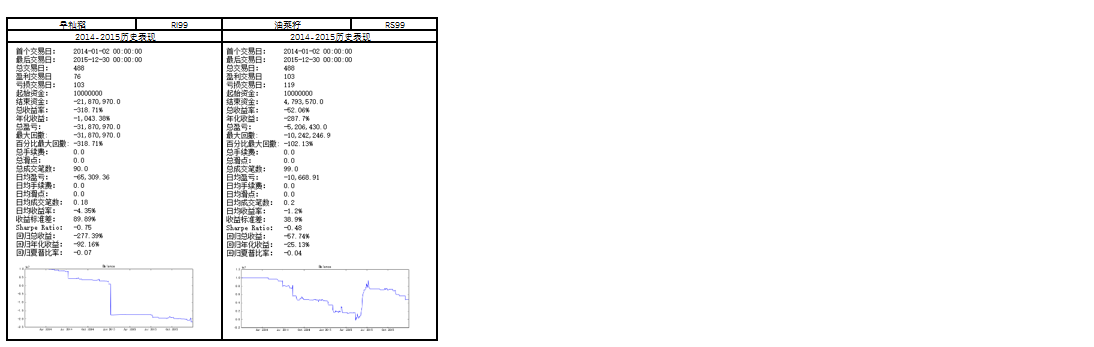

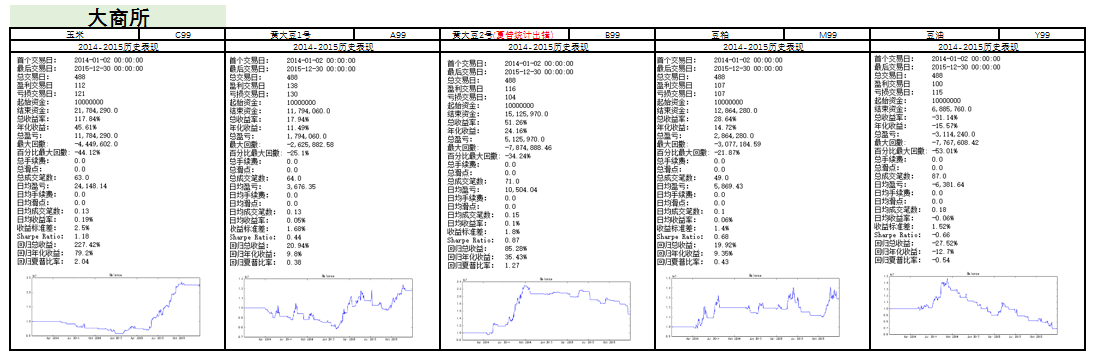

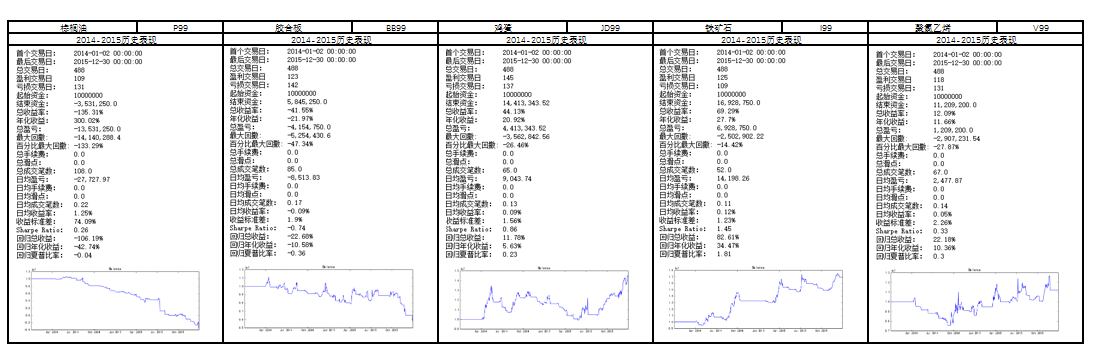

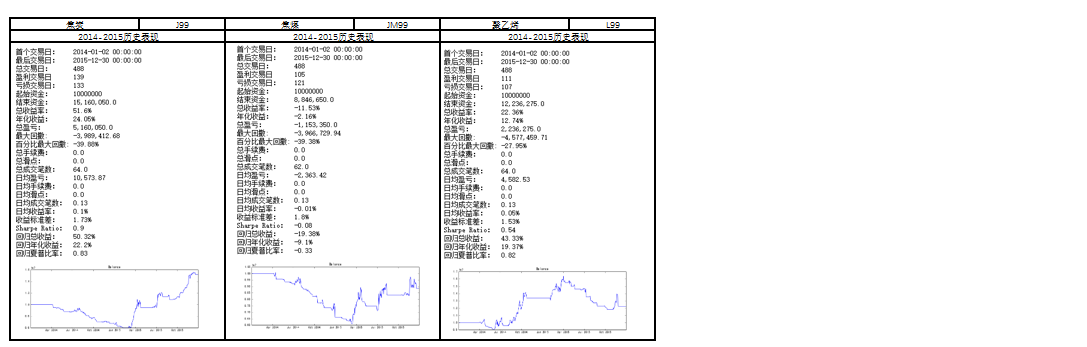

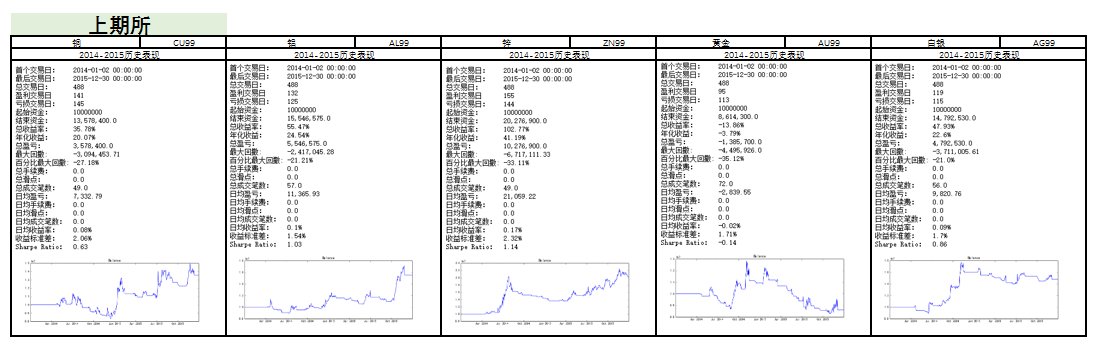

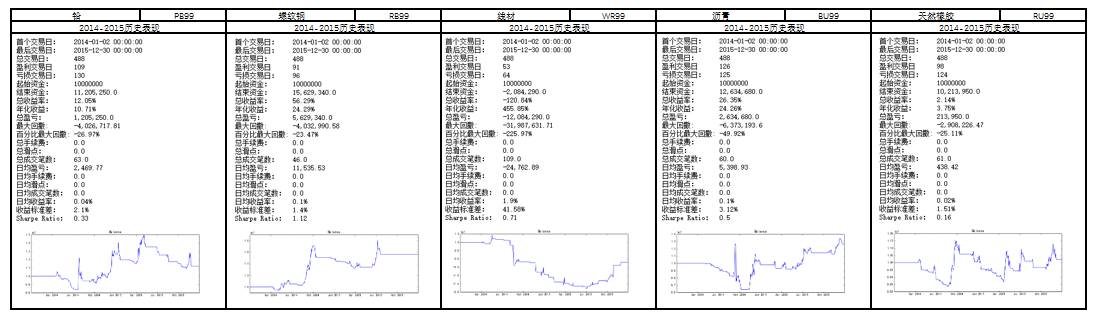

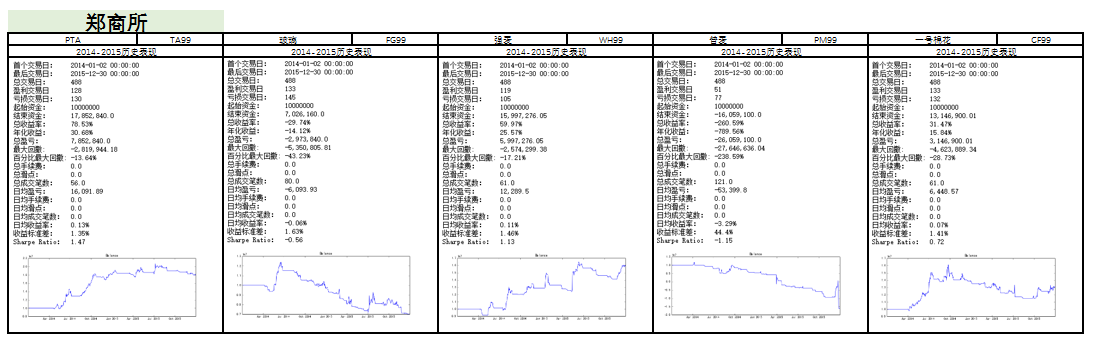

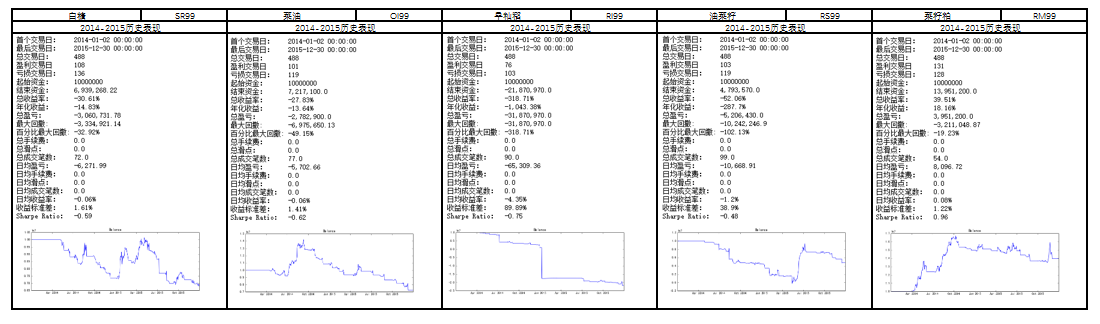

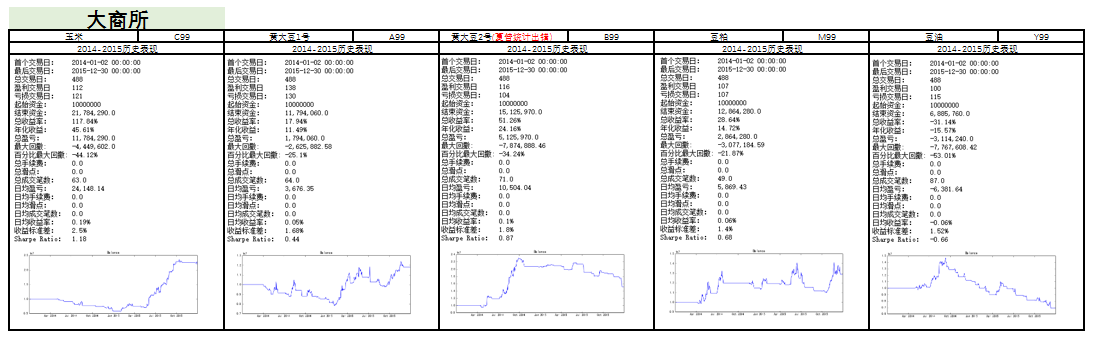

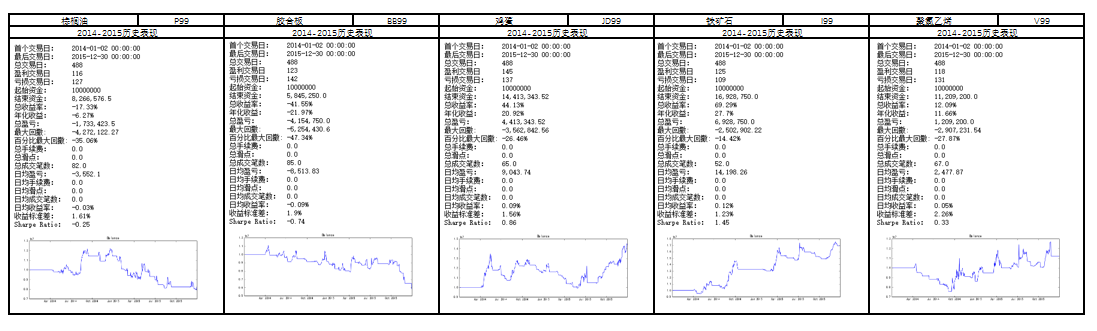

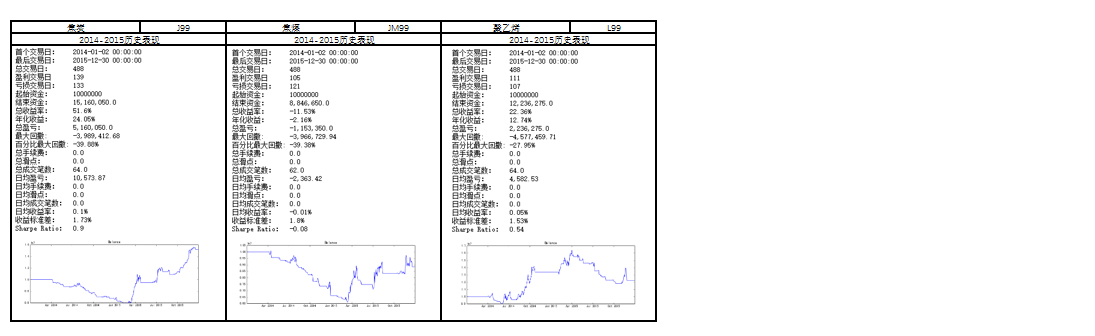

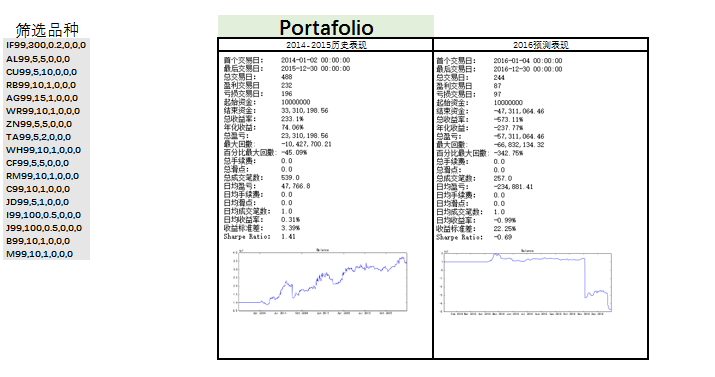

对初步筛选出来的样本进行2014-2015年回测,选择回归夏普比率>0.4的品种,然后构成组合,如图所示。

根据回归夏普比率>0.4的准则,筛选出了14个品种,其历史表现和2016年预测表现如图6-23所示。投资组合在2014-2015年年化收益96.46%,百分比最大回撤-32.75%,夏普比率达2.04,资金曲线平滑且整体向上,但是2016年预测表现不佳,需要剔除更多噪声因子。

下面分析一下挑选出来的品种成分,按交易所分类如下:

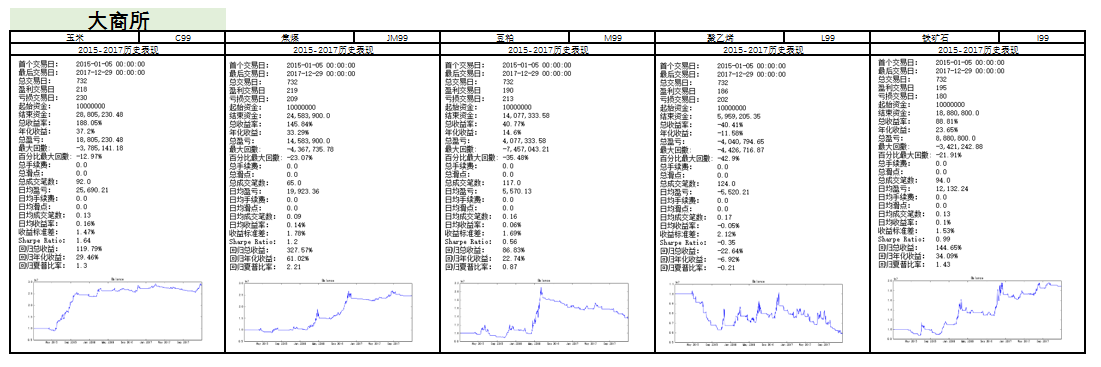

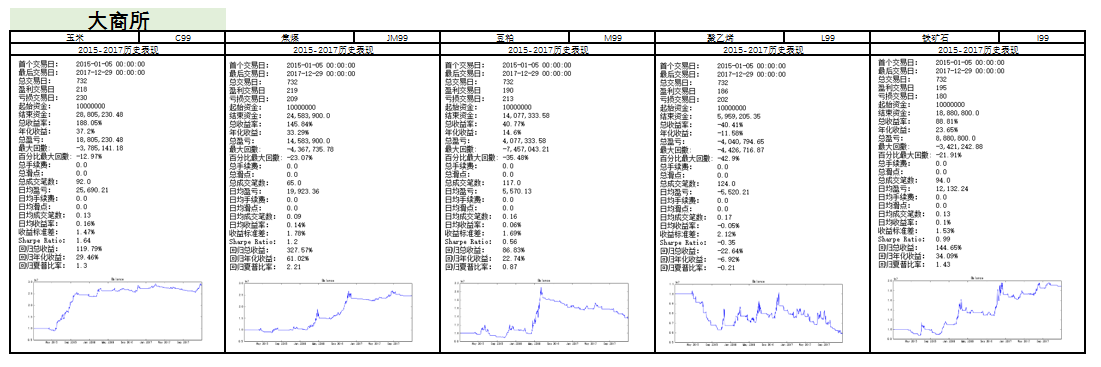

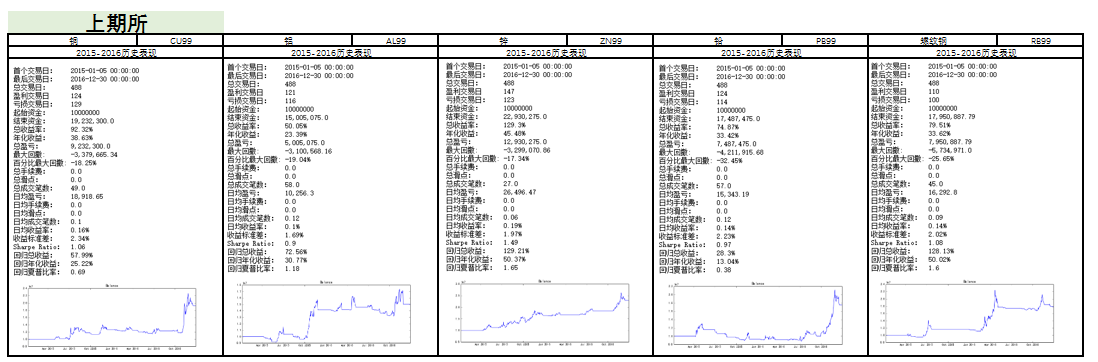

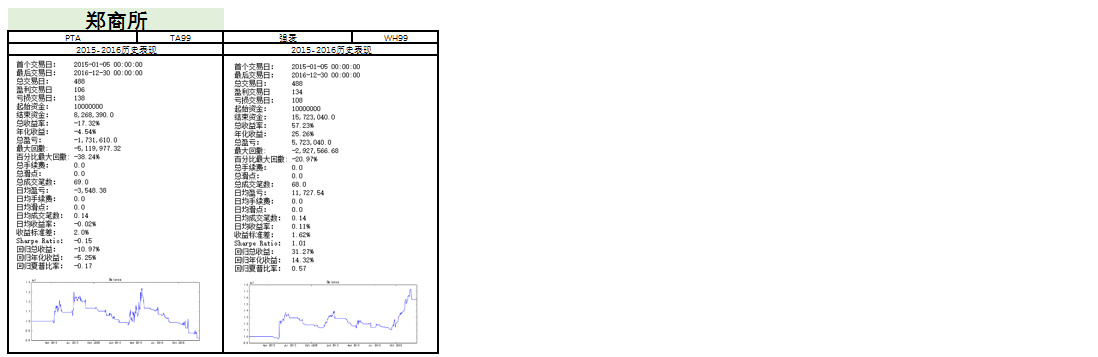

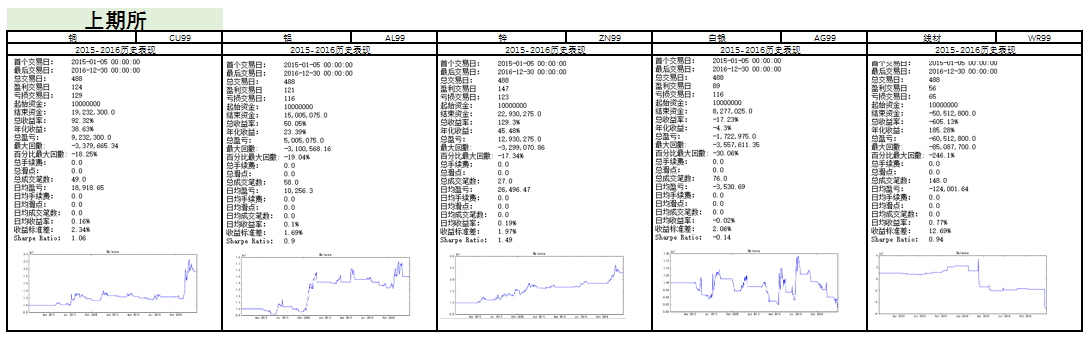

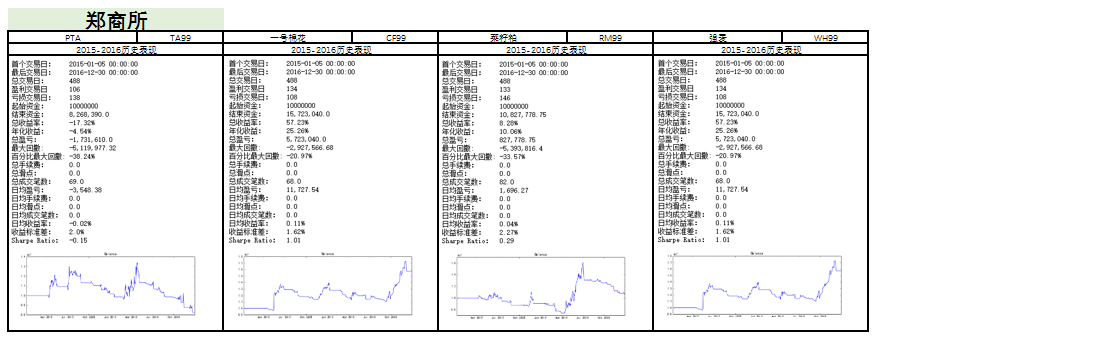

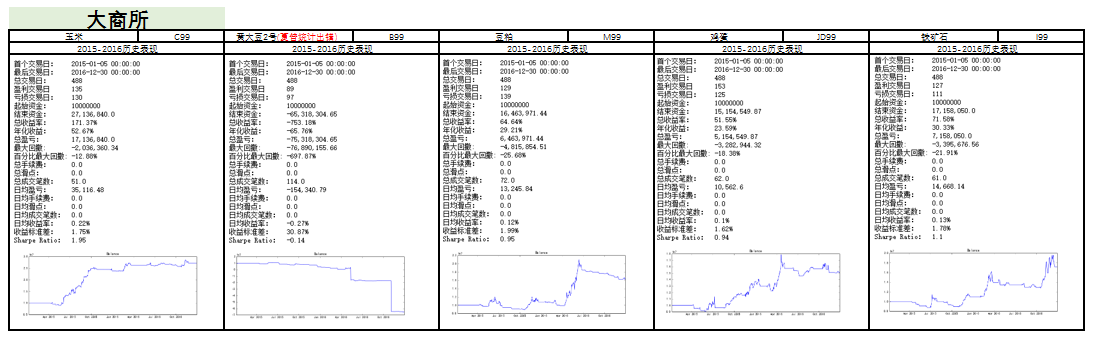

同样对剩下的样本进行2015-2016年回测,选择回归夏普比率>0.4的品种,然后构成组合。

经过第二轮筛选后,剩下9个品种,同样按照交易所分类,如下:

在新的投资组合中,年化收益达92.04%,百分比最大回撤是-16.8%,夏普比率达2.4,整体资金曲线比较平滑。在2017年预测表现理想,年化收益46.49%,百分比最大回撤-30.45%,夏普比率达1.09,如图所示。

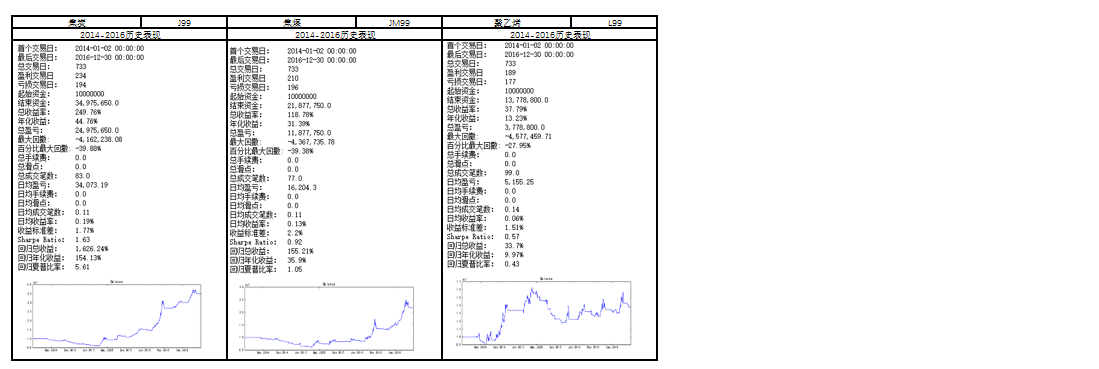

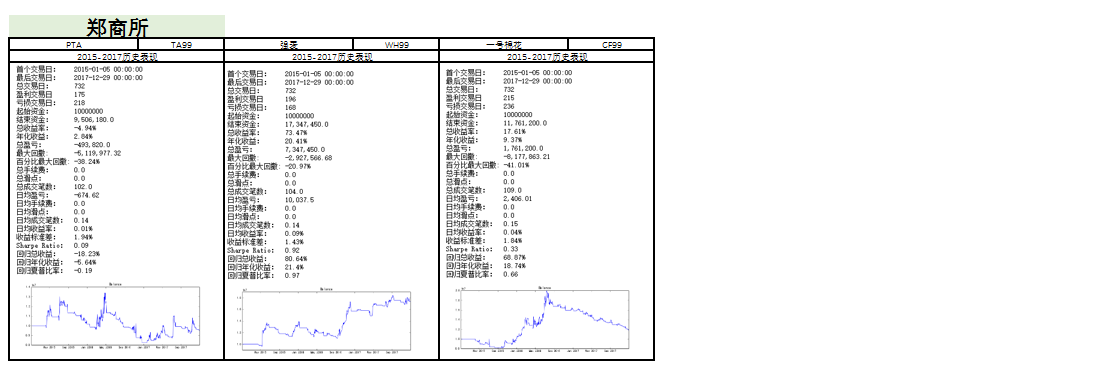

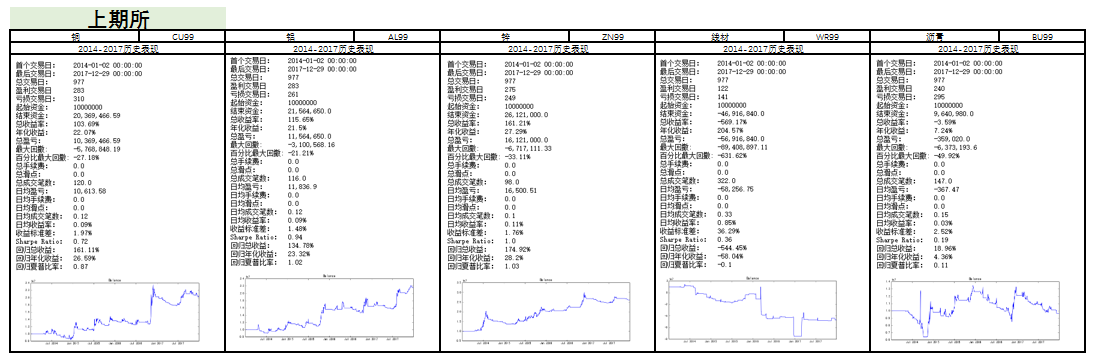

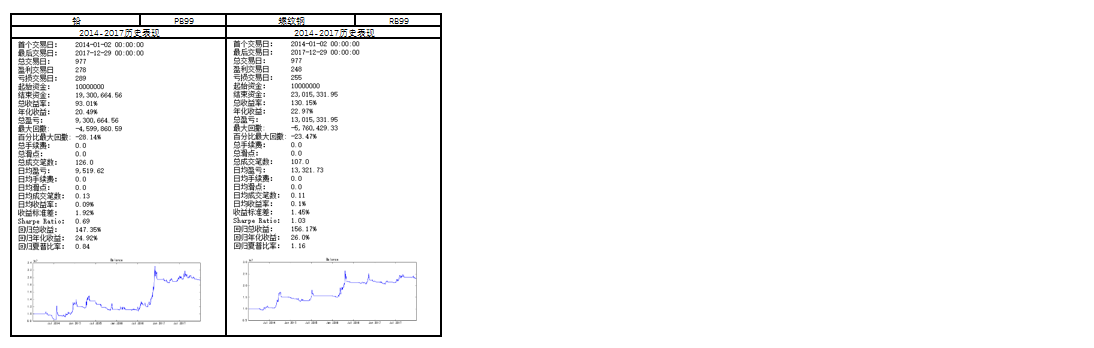

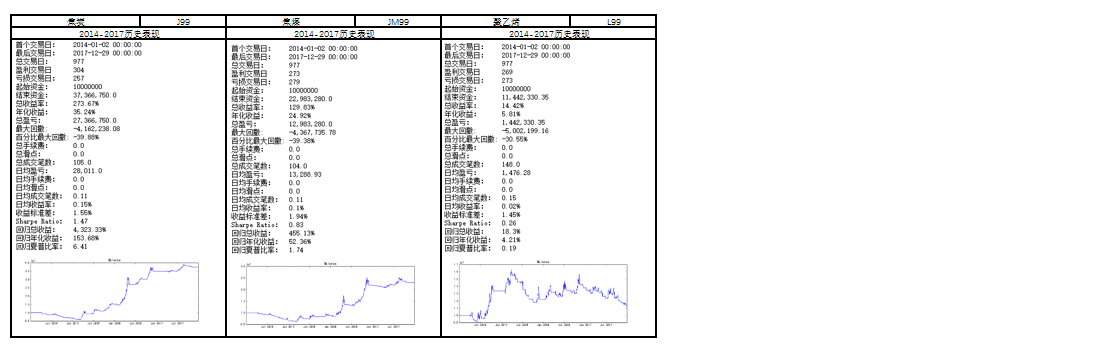

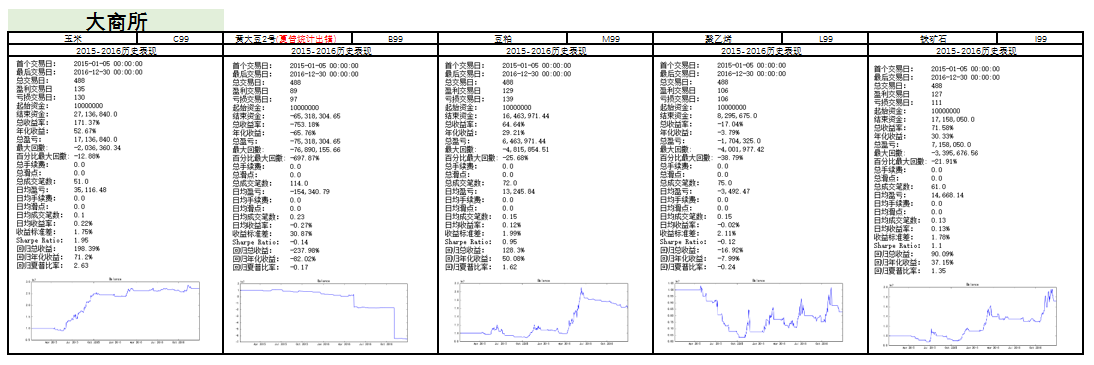

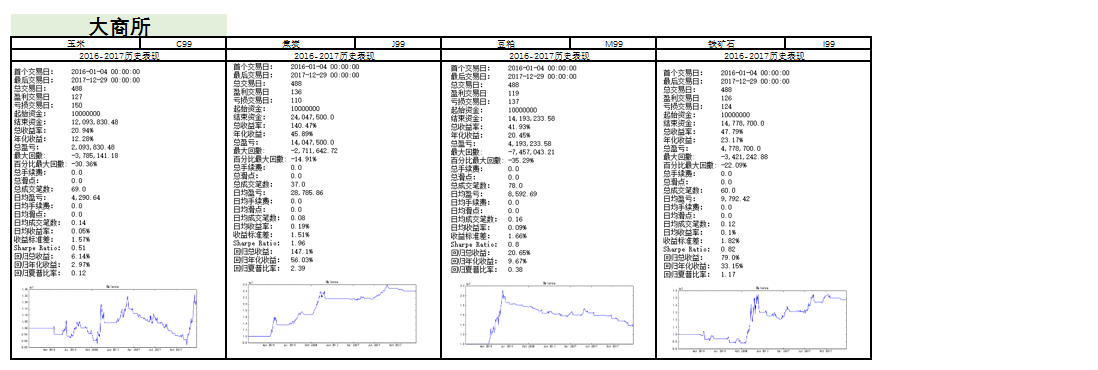

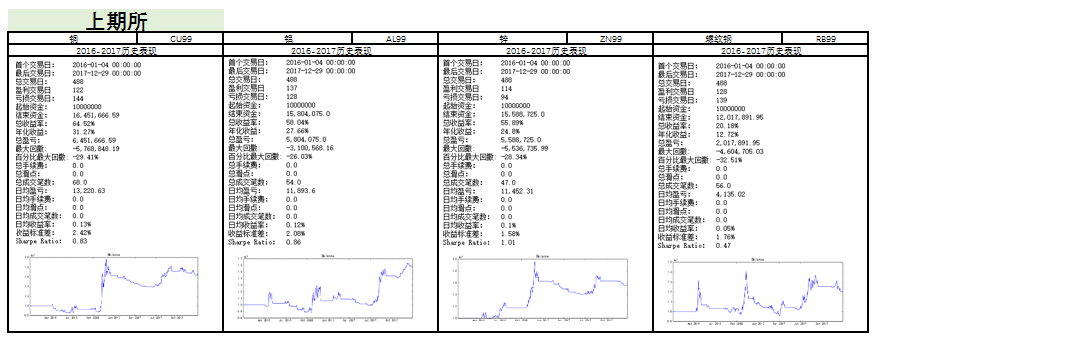

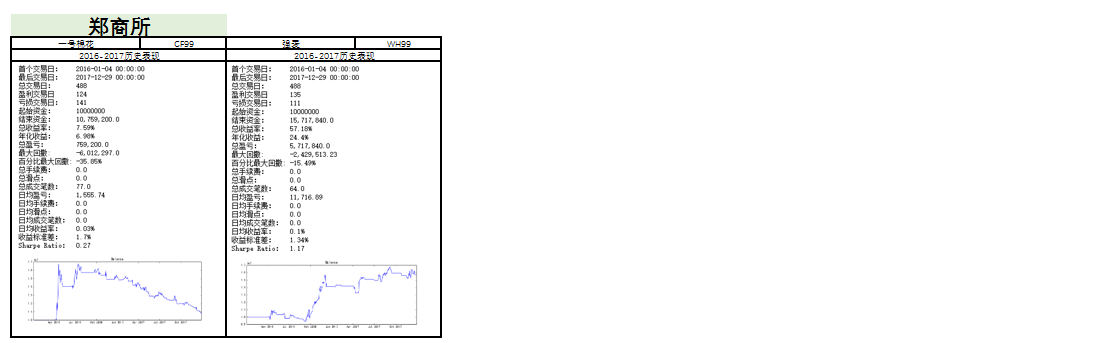

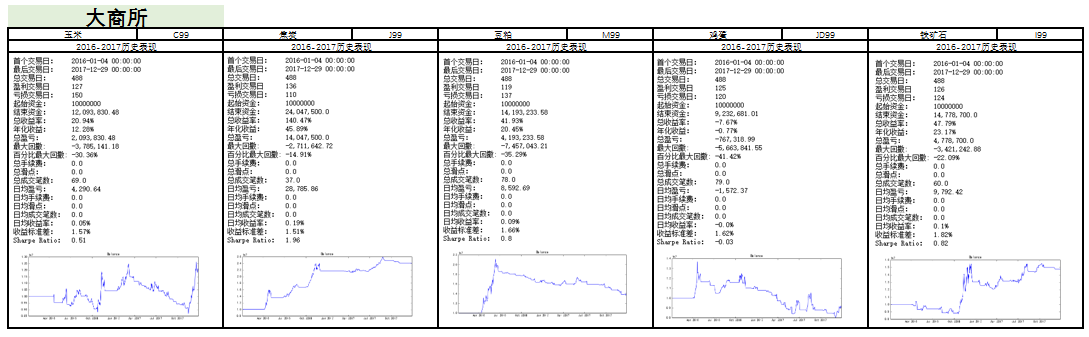

最后一轮策略,将挑选出最终的品种组成海龟组合,单品种品种如图所示。

第三轮筛选后,基于回归夏普比率>0.4得到由铝、铜、锌、普麦、铁矿石、焦炭、螺纹钢组成的海龟组合,2016-2017年标准夏普达1.56,2018年预测的夏普比率是-0.12,全时间区间的夏普比率表现是1.17。投资组合效果差强人意。

基于上面2年回望周期所做展示的回测图,可以更加便捷的更改筛选标准而不用从新进行测试就得到结果,故下面把筛选标准改成回归夏普比率>0.6,其测试情况如图所示。

把筛选标准提高0.2后,得到的样本数量降低到5个,分别是铝、铜、锌、铁矿石、焦炭,2016-2017年标准夏普达1.29,2018年预测的夏普比率是0.7,全时间区间的夏普比率表现是1.22。

若把筛选标准提升至回归夏普比率>0.8,则得到4个样本品种:铜、锌、铁矿石、焦炭,2016-2017年标准夏普达1.87,2018年预测的夏普比率是-0.03,全时间区间的夏普比率表现是1.38,如图所示。

作者:爱茶语 ;来源:维恩的派论坛

结果显示尽管参数不多,但是模型还是过拟合了。但是在策略内实现Tick数据聚合成X分钟K线还是值得学习一下

# 设置回测使用的数据

engine.setBacktestingMode(engine.BAR_MODE) # 设置引擎的回测模式为K线

engine.setDatabase(MINUTE_DB_NAME, 'RB99') # RQDATA一分钟期货指数数据

engine.setStartDate('20130101') # 设置回测用的数据起始日期

# 配置回测引擎参数

engine.setSlippage(1) # 设置滑点为1跳

engine.setRate(1/1000) # 设置手续费

engine.setSize(10) # 设置合约大小

engine.setPriceTick(1) # 设置最小价格变动

engine.setCapital(200000) # 设置回测本金

策略代码如下

# encoding: UTF-8

import talib

import numpy as np

from vnpy.trader.vtObject import VtBarData

from vnpy.trader.vtConstant import EMPTY_INT,EMPTY_STRING

from vnpy.trader.app.ctaStrategy.ctaTemplate import CtaTemplate

########################################################################

class RBMAStrategy(CtaTemplate):

"""结合MA的一个30分钟线交易策略"""

className = 'RBMAStrategy'

author = 'xldistance'

#策略参数

initDays = 33 # 初始化数据所用的天数默认35

open_pos = 10 #每次交易的手数

OCM = 30 #操作分钟周期(1,60)默认30

# 策略变量

bar = None # K线对象

barMinute = EMPTY_STRING # K线当前的分钟

minutebar = None # minuteK线对象

ma_windows1 = 20 #默认20

ma_windows2 = 200 #默认200

# 参数列表,保存了参数的名称

paramList = ['name',

'className',

'author',

'vtSymbol',

'open_pos']

# 变量列表,保存了变量的名称

varList = ['inited',

'trading',

'pos',

'OCM',

'ma20_value',

'ma200_value']

#----------------------------------------------------------------------

def __init__(self, ctaEngine, setting):

"""Constructor"""

super(RBMAStrategy, self).__init__(ctaEngine, setting)

"""

如果是多合约实例的话,变量需要放在__init__里面

"""

#self.orderList = []

self.barList = []

self.bufferSize = 201 # 需要缓存的数据的大小

self.bufferCount = 0 # 目前已经缓存了的数据的计数

self.highArray = np.zeros(self.bufferSize) # K线最高价的数组

self.lowArray = np.zeros(self.bufferSize) # K线最低价的数组

self.closeArray = np.zeros(self.bufferSize) # K线收盘价的数组

self.openArray = np.zeros(self.bufferSize) # K线开盘价的数组

self.LongEnterable = False

self.ShortEnterable = False

self.ma20_value = 0

self.ma200_value = 0

def onInit(self):

self.writeCtaLog('%s策略初始化' %self.name)

# 载入历史数据,并采用回放计算的方式初始化策略数值

initData = self.loadBar(self.initDays)

for bar in initData:

self.onBar(bar)

self.putEvent()

#----------------------------------------------------------------------

def onStart(self):

"""启动策略(必须由用户继承实现)"""

self.writeCtaLog('%s策略启动' %self.name)

self.putEvent()

#----------------------------------------------------------------------

def onStop(self):

"""停止策略(必须由用户继承实现)"""

self.writeCtaLog('%s策略停止' %self.name)

self.putEvent()

#----------------------------------------------------------------------

def onTick(self, tick):

"""收到行情TICK推送(必须由用户继承实现)"""

tickMinute = tick.datetime.minute

if tickMinute != self.barMinute:

if self.bar:

self.onBar(self.bar)

bar = VtBarData()

bar.vtSymbol = tick.vtSymbol

bar.symbol = tick.symbol

bar.exchange = tick.exchange

bar.open = tick.lastPrice

bar.high = tick.lastPrice

bar.low = tick.lastPrice

bar.close = tick.lastPrice

bar.date = tick.date

bar.time = tick.time

bar.datetime = tick.datetime # K线的时间设为第一个Tick的时间

self.bar = bar # 这种写法为了减少一层访问,加快速度

self.barMinute = tickMinute # 更新当前的分钟

else: # 否则继续累加新的K线

bar = self.bar # 写法同样为了加快速度

bar.high = max(bar.high, tick.lastPrice)

bar.low = min(bar.low, tick.lastPrice)

bar.close = tick.lastPrice

#----------------------------------------------------------------------

def onBar(self, bar):

"""收到Bar推送(必须由用户继承实现)"""

if self.LongEnterable:

if self.pos == 0:# and bar.close > self.dayOpen

self.buy(bar.close,self.open_pos,True)

elif self.pos < 0 :

self.cover(bar.close,abs(self.pos),True)

if self.ShortEnterable:

if self.pos ==0:#and bar.close < self.dayOpen

self.short(bar.close,self.open_pos,True)

elif self.pos > 0:

self.sell(bar.close,abs(self.pos),True)

if bar.datetime.minute % self.OCM == 0:

# 如果已经有聚合minuteK线

if self.minutebar:

# 将最新分钟的数据更新到目前minute线中

minutebar = self.minutebar

minutebar.high = max(minutebar.high, bar.high)

minutebar.low = min(minutebar.low, bar.low)

minutebar.close = bar.close

# 推送minute线数据

self.onminutebar(minutebar)

# 清空minute线数据缓存

self.minutebar = None

else:

# 如果没有缓存则新建

if not self.minutebar:

minutebar = VtBarData()

minutebar.vtSymbol = bar.vtSymbol

minutebar.symbol = bar.symbol

minutebar.exchange = bar.exchange

minutebar.open = bar.open

minutebar.high = bar.high

minutebar.low = bar.low

minutebar.close = bar.close

minutebar.date = bar.date

minutebar.time = bar.time

minutebar.datetime = bar.datetime

self.minutebar = minutebar

else:

minutebar = self.minutebar

minutebar.high = max(minutebar.high, bar.high)

minutebar.low = min(minutebar.low, bar.low)

minutebar.close = bar.close

# 发出状态更新事件

self.putEvent()

#----------------------------------------------------------------------

def onminutebar(self,bar):

"""收到Bar推送(必须由用户继承实现)"""

# 撤销之前发出的尚未成交的委托(包括限价单和停止单)

#for orderID in self.orderList:

#self.cancelOrder(orderID)

#self.orderList = []

# 保存K线数据

self.closeArray[0:self.bufferSize-1] = self.closeArray[1:self.bufferSize]

self.highArray[0:self.bufferSize-1] = self.highArray[1:self.bufferSize]

self.lowArray[0:self.bufferSize-1] = self.lowArray[1:self.bufferSize]

self.openArray[0:self.bufferSize-1] = self.openArray[1:self.bufferSize]

self.closeArray[-1] = bar.close

self.highArray[-1] = bar.high

self.lowArray[-1] = bar.low

self.openArray[-1] = bar.open

self.bufferCount += 1

if self.bufferCount < self.bufferSize:

return

# 计算指标数值

ma_20 = talib.EMA(self.closeArray,timeperiod = self.ma_windows1)

ma_200 = talib.EMA(self.closeArray,timeperiod = self.ma_windows2)

self.ma20_value = ma_20[-1]

self.ma200_value = ma_200[-1]

self.LongEnterable = ma_20[-1] > ma_200[-1] and ma_20[-2] < ma_200[-2]

self.ShortEnterable = ma_20[-1] < ma_200[-1] and ma_20[-2] > ma_200[-2]

# 发出状态更新事件

self.putEvent()

#----------------------------------------------------------------------

def onOrder(self, order):

"""收到委托变化推送(必须由用户继承实现)"""

pass

#----------------------------------------------------------------------

def onTrade(self, trade):

# 发出状态更新事件

self.putEvent()

def onStopOrder(self, so):

"""停止单推送"""

pass本章主要讲述构建海龟组合的痛点和解决方案

在追求策略稳健性前提下,通过传统的滚动测试的方法不能筛选出盈利组合,即这种适用于日内CTA策略的检验方法针对海龟组合是无效的。

构建海龟组合困难表现为以下几点:

a. 历史数据过于少

从2014年到2018年这5年间,其日线数据仅仅是1,200根。其数据过少导致调整回望周期的灵活性降低,即最多回望周期只能设置为2年、3年、4年;同时数据少很难检验出策略的稳健性和有效性。(原版海龟策略历史回测周期是10年)

反观传统日内CTA策略,该策略是基于分钟级别的,1年的分钟K线就接近6,000根。用传统的筛选品种的方法,2年回望周期K线达到12,000根,在数据足够大的情况下更易于体现出策略的稳健性。

b. 回撤过大

海龟策略属于高风险高收益的中低频策略,夸张的比喻就是“3年不开张,开张吃3年”,在设定回测区间可能表现出持续的亏损,但也有可能在之后出现一波大行情,短期的盈利能够快速覆盖长期的亏损。但是滚动回测筛选品种时因为夏普过低而剔除该品种,导致错过隐含策略收益。

c. 筛选指标不稳健

本次滚动回测筛选标准是夏普比率,但是夏普比率对于策略回测时间区间起始点和终点非常敏感,对于趋势的把握不足。举例说明:在2年时间区间夏普比率是1.3,若整体回测区间向后移动3个月,得到的夏普比率可能是0.9。

故夏普比率不适应于海龟策略这种波动性大的类型,必须找到一种指标可以预测其趋势,比如“新式夏普比率”,在2年间比值是1.3,整体向前或者向后滚动3个月,其比值也接近1.3。

d. 样品数量噪音过大

尽管通过历史行情,其2014年前上市品种,已经把检测样本从51个降低到35个。但是对巨大的样品数量检验也造成很大的操作负担。例如一些低流动性或者持续走震荡行数的品种,没有必要来进行海龟策略的测试。

从新对“流动性强”进行定义,在统计意义上,可以指行情波动巨大和具有大趋势,故通过2个指标来专门对35个品种重新进行筛选,这2个指标分别是:

a. 调整后波动率比值:

计算公式是收盘价的标准差/(合约最小价格变动 *100),调整后波动率比值越大,代表其品种的相对波动幅度越大,趋势跟踪策略的盈利能力越强。

举个例子说明,假设趋势跟踪策略正确预测行情的概率是x%,其固定交易成本为c,那么收益率r = (x% * 波动幅度) - 固定成本。所以当波动幅度足够大时,交易才有利可图,否则交易盈利覆盖不了交易成本,导致单子做得越多,亏的也越多。

b. ADF值

这是推论统计学概念,通过ADF检验来得出其ADF值,然后与10%进行比较,若ADF值要大于10%,证明完全不能拒绝原假设,即原假设成立。

原假设为存在单位根,有单位根代表着品种自相关性强,具有趋势行情。

总结一下,增加了两个初步筛选的标准,分别是

代码实现步骤

在jupter notebook上运行下面脚本代码,逐个测试样本

import numpy as np

import pandas as pd

import statsmodels.tsa.stattools as ts

#################################################

def volPriceTick (SYM, PT):

c=pymongo.MongoClient()

symbol = SYM #合约代号

col = c['VnTrader_Daily_Db'][symbol]

cx = col.find()

l = list(cx)

d = {}

for key in l[0].keys():

d[key] = []

for data in l:

for k, v in data.items():

d[k].append(v)

df = pd.DataFrame.from_dict(d)

PriceTick = PT #最小价格变动

close = df['close']

var = np.std(close) #收盘价的标准差

ratio = var/(PriceTick*100) # 定义调整后波动率比值

adfresult = ts.adfuller(close) # 得到ADF值

return ratio,adfresult

调用定义好的函数进行测试,如图所示,品种是沪深300股指期货(IF99),其最小价格变动是0.02。

得到的调整后波动率比值为342.19,比值远大于1说明品种价格变化挺活跃的;然后ADF值是0.36,同样大于10%说明其自相关性强,适用于趋势跟踪类型策略。

在上面已经提到,夏普比率不稳健的特点,导致其很难去识别一些行情趋势,而且对于回撤承受度不高,难于应用于像海龟策略这种高风险高收益的策略。所以产生了新筛选指标的需求。

新的指标应该具有3方面特点:

故开发“回归夏普比率”用于品种筛选,其步骤如下:

在海龟策略回测引擎的calculateResult中加入上面逻辑即可,其代码如下:

#计算回归总收益

daysList = range(1,totalDays+1)

#slope , intercept = np.polyfit (changduList , balanceList , 1) #numpy方法

slope, intercept, r_value, p_value, slope_std_error = stats.linregress(daysList , balanceList) #scipy方法

RegendBalance = intercept + totalDays * slope

RegtotalReturn = (RegendBalance / intercept - 1) * 100

计算回归年化收益

if RegtotalReturn > 0:

RegannualizedReturn = (((1+RegtotalReturn/100) **(annualDays/totalDays) )-1)*100

else:

RegannualizedReturn = -(((1-RegtotalReturn/100) **(annualDays/totalDays) )-1)*100

#计算回归日收益

RegdailyReturn = RegannualizedReturn/annualDays

#计算回归夏普比率

if returnStd:

sharpeRatio = dailyReturn / returnStd * np.sqrt(annualDays)

RegsharpeRatio = RegdailyReturn / returnStd * np.sqrt(annualDays)

else:

sharpeRatio = 0

RegsharpeRatio = 0

新指标的缺点:

综合回归夏普比率的优势和缺点,我们得知其对回撤的容忍度高,可以摒弃噪声从而捕捉到趋势,故适用于作为一个筛选标准;另一方面有时候会出现高估或者低估行情表现,故不能作为判断业绩表现的指标(如标准的夏普比率)。

把回望周期分别设置为2年,3年和4年。

理论上较短回测周期使用较为宽松的筛选标准(如回归夏普比率大于0.4),较长回测周期使用较为苛刻的筛选标准(如回归夏普比率大于0.8)。

当然为了测试的全面新,通过3个不同的回望周期(如:2年、3年、4年),通过不同的回归夏普比率(如:0.4、0.6、0.8)进行筛选,力求新的海龟组合能够较好地预测2018年行情。(即表现出较高的稳健性)

作者:赵信的派 ;来源:维恩的派论坛

ctaHistoryData可以导入历史数据,但不支持wind。这里增加wind的分钟数据导入函数,并在主程序中调用即可。

#----------------------------------------------------------------------

def loadWind(code,dbName, symbol):

"""将wind的历史数据插入到Mongo数据库中"""

from WindPy import *

import pandas as pd

from pandas import DataFrame

w.start()

start = time()

print u'开始读取wind文件%s中的数据插入到%s的%s中' %(code, dbName, symbol)

# 锁定集合,并创建索引

host, port, logging = loadMongoSetting()

client = pymongo.MongoClient(host, port)

collection = client[dbName][symbol]

collection.ensure_index([('datetime', pymongo.ASCENDING)], unique=True)

# 读取数据和插入到数据库

wsd_data = w.wsi(code, "open,high,low,close,volume,amt,oi", "2017-02-19 09:00:00", "2017-05-21 00:06:20", "")

print(wsd_data)

df1=DataFrame(wsd_data.Data,index=wsd_data.Fields,columns=wsd_data.Times)

print '1'

df1=df1.T

df_wind=df1.dropna(subset=['open'])

index=0

print df_wind

for d in df_wind.index:

bar = CtaBarData()

bar.vtSymbol = symbol

bar.symbol = symbol

bar.open = float(df_wind['open'].iloc[index])

bar.high = float(df_wind['high'].iloc[index])

bar.low = float(df_wind['low'].iloc[index])

bar.close = float(df_wind['close'].iloc[index])

print(type(d))

bar.datetime=datetime.strftime(d.to_pydatetime(),'%Y-%m-%d %H:%M:%S')

bar.date = datetime.strftime(d.to_pydatetime(),'%Y%m%d')

bar.time = datetime.strftime(d.to_pydatetime(),'%H:%M:%S')

bar.volume = df_wind['volume'].iloc[index]

flt = {'datetime': bar.datetime}

collection.update_one(flt, {'$set':bar.__dict__}, upsert=True)

print bar.datetime

#主函数

if __name__ == '__main__':

## 简单的测试脚本可以写在这里

#from time import sleep

#e = HistoryDataEngine()

#sleep(1)

#e.downloadEquityDailyBar('000001')

#e.downloadEquityDailyBarts('000001')

# 这里将项目中包含的股指日内分钟线csv导入MongoDB,作者电脑耗时大约3分钟

#loadMcCsv('IF0000_1min.csv', MINUTE_DB_NAME, 'IF0000')

start = time()

#导入wind数据

loadWind("MA709.CZC",MINUTE_DB_NAME, 'MA709')

#测时

print u'插入完毕,耗时:%s' % (time()-start)

#导入通达信历史分钟数据

#loadTdxCsv('CL8.csv', MINUTE_DB_NAME, 'c0000)传统意义上,为保证策略的稳健性,应该进行样本内外检验,其具体步骤如下:

初步的筛选仅仅基于历史行情。

因为本次测试规定历史回测时间从2014年1月1日开始,故首先剔除在该时间点后才上市的品种,所以进行历史回测的品种从51个降低至35个。

所以一些例如苹果之类非常热门的新品种,不在本次测试范围之内。

滚动回测标准如下

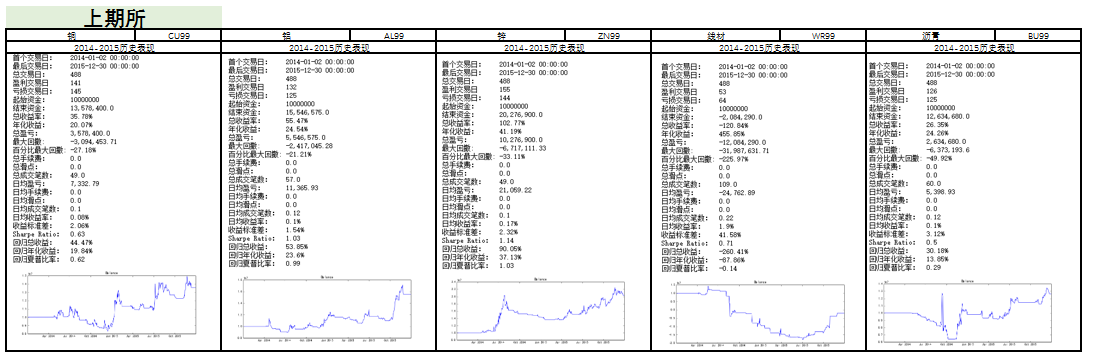

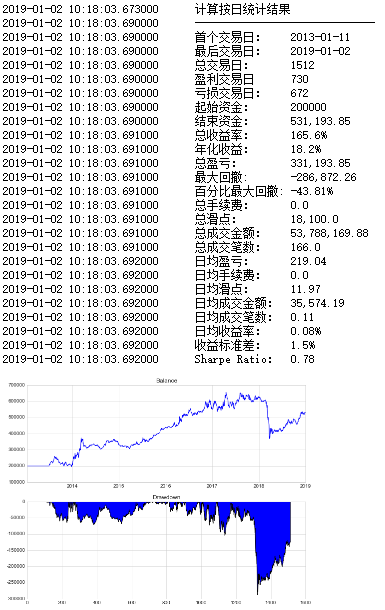

对35个品种进行海龟策略的历史回测,如图所示。(下图小字“夏普统计出错”,其意思是总收益为负数,有时候转换成年化收益变成正数,导致负的夏普比率变成正数。)

根据夏普比率>0.6的准则,筛选出了17个品种,其历史表现和2016年预测表现如图所示。

投资组合在2014-2015年年化收益74.06%,百分比最大回撤-45.09%,夏普比率,1.41,整体上还可以,但是去2016年预测表现非常糟糕。这说明投资组合里噪声过多,稳健性弱。

下面分析一下挑选出来的品种成分,按交易所分类如下:

可以发现占绝大部分的是成交量巨大的品种,推测可能是流动性差的品种,如黄大豆2号等,导致其投资组合在2016年亏损,故非常有必要进行滚动回测来剔除表现不好的品种。

第一次从35个样本中筛选出17个,本次同样将继续剔除噪声因子,试图提高海龟组合的预测效果,测试如图所示。

经过第二轮筛选后,剩下11个品种,同样按照交易所分类,如下:

在新的投资组合中,年化收益达94.05%,百分比最大回撤是-19.94%,夏普比率达2.36,整体资金曲线比较平滑,但是其组合的稳健性仍未提高,在2017年仍然亏损,百分比最大回撤达43.79%,还需要在剔除无效的样本。

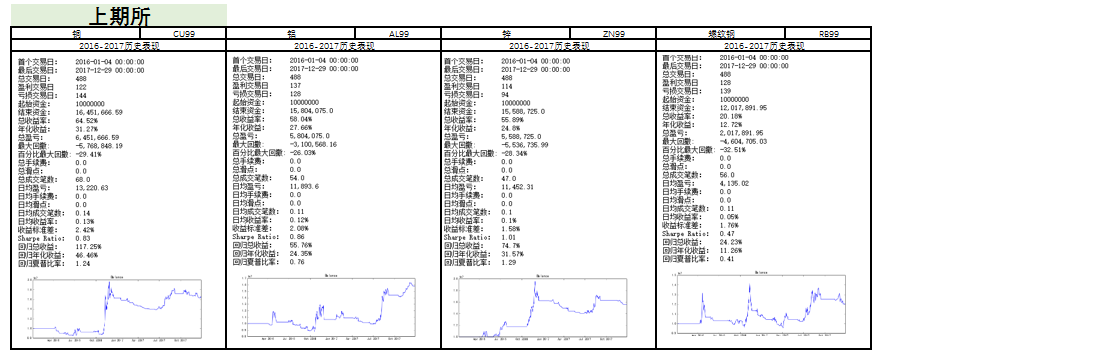

第三轮测试也是最后一轮测试,将决定最终海龟组合内品种的构成,其单品种测试效果如图所示。

第三轮筛选后,得到由铝、铜、锌、普麦、铁矿石、焦炭、豆粕组成的海龟组合,都符合了流动性强的特征,该组合的历史回测和2018年预测效果如图所示。

结果同样是不理想,在样本内表现出色,样本外却亏损。

作者:量化学习菜鸟 ;来源:维恩的派论坛

def onBar(self, bar):

"""收到Bar推送(必须由用户继承实现)"""

if self.zhouqi == 'm':

dt = bar.datetime.minute

kaiguan = dt % self.zhouqi_val == 0

elif self.zhouqi == 'h':

dt = bar.datetime.hour

kaiguan = dt % self.zhouqi_val == 0 and bar.datetime.minute == 0

if kaiguan:

if self.fiveBar:

fiveBar = self.fiveBar

fiveBar.high = max(fiveBar.high, bar.high)

fiveBar.low = min(fiveBar.low, bar.low)

fiveBar.close = bar.close

# 推送

self.onFiveBar(fiveBar)

# 清空缓存

self.fiveBar = None

else:

fiveBar = VtBarData()

fiveBar.vtSymbol = bar.vtSymbol

fiveBar.symbol = bar.symbol

fiveBar.exchange = bar.exchange

fiveBar.open = bar.open

fiveBar.high = bar.high

fiveBar.low = bar.low

fiveBar.close = bar.close

fiveBar.date = bar.date

fiveBar.time = bar.time

fiveBar.datetime = bar.datetime

#发出去

self.onFiveBar(fiveBar)

#清空

self.fiveBar = None

else:

# 如果没有缓存则新建

#print 'dt zhengchu//0'

if not self.fiveBar:

fiveBar = VtBarData()

fiveBar.vtSymbol = bar.vtSymbol

fiveBar.symbol = bar.symbol

fiveBar.exchange = bar.exchange

fiveBar.open = bar.open

fiveBar.high = bar.high

fiveBar.low = bar.low

fiveBar.close = bar.close

fiveBar.date = bar.date

fiveBar.time = bar.time

fiveBar.datetime = bar.datetime

self.fiveBar = fiveBar

else:

fiveBar = self.fiveBar

fiveBar.high = max(fiveBar.high, bar.high)

fiveBar.low = min(fiveBar.low, bar.low)

fiveBar.close = bar.close作者:moonnejs ;来源:维恩的派论坛

为了研究高频策略,我优化了下vnpy的回测引擎,有错误的地方希望大家指点。

大概优化了下面这些内容:

# encoding: UTF-8

'''

本文件包含了CTA引擎中的策略开发用模板,开发策略时需要继承CtaTemplate类。

'''

import datetime

import copy

from ctaBase import *

from vtConstant import *

from vtGateway import *

########################################################################

class CtaTemplate1(object):

"""CTA策略模板"""

# 策略类的名称和作者

className = 'CtaTemplate'

author = EMPTY_UNICODE

# MongoDB数据库的名称,K线数据库默认为1分钟

tickDbName = TICK_DB_NAME

barDbName = MINUTE_DB_NAME

productClass = EMPTY_STRING # 产品类型(只有IB接口需要)

currency = EMPTY_STRING # 货币(只有IB接口需

# 策略的基本参数

name = EMPTY_UNICODE # 策略实例名称

vtSymbol = EMPTY_STRING # 交易的合约vt系统代码

vtSymbol1 = EMPTY_STRING # 交易的合约2vt系统代码

# 策略的基本变量,由引擎管理

inited = False # 是否进行了初始化

trading = False # 是否启动交易,由引擎管理

backtesting = False # 回测模式

pos = 0 # 总投机方向

pos1 = 0 # 总投机方向

tpos0L = 0 # 今持多仓

tpos0S = 0 # 今持空仓

ypos0L = 0 # 昨持多仓

ypos0S = 0 # 昨持空仓

tpos1L = 0 # 今持多仓

tpos1S = 0 # 今持空仓

ypos1L = 0 # 昨持多仓

ypos1S = 0 # 昨持空仓

# 参数列表,保存了参数的名称

paramList = ['name',

'className',

'author',

'vtSymbol']

# 变量列表,保存了变量的名称

varList = ['inited',

'trading',

'pos']

#----------------------------------------------------------------------

def __init__(self, ctaEngine, setting):

"""Constructor"""

self.ctaEngine = ctaEngine

self.productClass = EMPTY_STRING # 产品类型(只有IB接口需要)

self.currency = EMPTY_STRING # 货币(只有IB接口需

# 策略的基本变量,由引擎管理

self.inited = False # 是否进行了初始化

self.trading = False # 是否启动交易,由引擎管理

self.backtesting = False # 回测模式

self.pos = 0 # 总投机方向

self.pos1 = 0 # 总投机方向

self.tpos0L = 0 # 今持多仓

self.tpos0S = 0 # 今持空仓

self.ypos0L = 0 # 昨持多仓

self.ypos0S = 0 # 昨持空仓

self.tpos1L = 0 # 今持多仓

self.tpos1S = 0 # 今持空仓

self.ypos1L = 0 # 昨持多仓

self.ypos1S = 0 # 昨持空仓

# 设置策略的参数

if setting:

d = self.__dict__

for key in self.paramList:

if key in setting:

d[key] = setting[key]

#----------------------------------------------------------------------

def onInit(self):

"""初始化策略(必须由用户继承实现)"""

raise NotImplementedError

#----------------------------------------------------------------------

def onUpdate(self,setting):

"""刷新策略"""

if setting:

d = self.__dict__

for key in self.paramList:

if key in setting:

d[key] = setting[key]

#----------------------------------------------------------------------

def onStart(self):

"""启动策略(必须由用户继承实现)"""

raise NotImplementedError

#----------------------------------------------------------------------

def onStop(self):

"""停止策略(必须由用户继承实现)"""

raise NotImplementedError

#----------------------------------------------------------------------

def confSettle(self, vtSymbol):

"""确认结算信息"""

self.ctaEngine.confSettle(vtSymbol)

#----------------------------------------------------------------------

def onTick(self, tick):

"""收到行情TICK推送(必须由用户继承实现)"""

if not self.backtesting:

hour = datetime.datetime.now().hour

if hour >= 16 and hour <= 19:

return

if hour >= 2 and hour <= 7:

return

if hour >= 12 and hour <= 12:

return

if tick.datetime.hour == 20 and tick.datetime.minute == 59:

self.output(u'开始确认结算信息')

self.confSettle(self.vtSymbol)

if tick.datetime.hour == 20 and tick.datetime.minute == 59:

self.ypos0L += self.tpos0L

self.tpos0L = 0

self.ypos0S += self.tpos0S

self.tpos0S = 0

self.ypos1L += self.tpos1L

self.tpos1L = 0

self.ypos1S += self.tpos1S

self.tpos1S = 0

#----------------------------------------------------------------------

def onOrder(self, order):

"""收到委托变化推送(必须由用户继承实现)"""

pass

#----------------------------------------------------------------------

def onTrade(self, trade):

"""收到成交推送(必须由用户继承实现)"""

# 对于无需做细粒度委托控制的策略,可以忽略onOrder

# CTA委托类型映射

if trade != None and trade.direction == u'多':

if trade.vtSymbol == self.vtSymbol:

self.pos += trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.pos1 += trade.volume

if trade != None and trade.direction == u'空':

if trade.vtSymbol == self.vtSymbol:

self.pos -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.pos1 -= trade.volume

if trade != None and trade.direction == u'多' and trade.offset == u'开仓':

if trade.vtSymbol == self.vtSymbol:

self.tpos0L += trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.tpos1L += trade.volume

elif trade != None and trade.direction == u'空' and trade.offset == u'开仓':

if trade.vtSymbol == self.vtSymbol:

self.tpos0S += trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.tpos1S += trade.volume

elif trade != None and trade.direction == u'多' and trade.offset == u'平仓':

if trade.vtSymbol == self.vtSymbol:

self.ypos0S -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.ypos1S -= trade.volume

elif trade != None and trade.direction == u'多' and trade.offset == u'平今':

if trade.vtSymbol == self.vtSymbol:

self.tpos0S -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.tpos1S -= trade.volume

elif trade != None and trade.direction == u'多' and trade.offset == u'平昨':

if trade.vtSymbol == self.vtSymbol:

self.ypos0S -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.ypos1S -= trade.volume

elif trade != None and trade.direction == u'空' and trade.offset == u'平仓':

if trade.vtSymbol == self.vtSymbol:

self.ypos0L -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.ypos1L -= trade.volume

elif trade != None and trade.direction == u'空' and trade.offset == u'平今':

if trade.vtSymbol == self.vtSymbol:

self.tpos0L -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.tpos1L -= trade.volume

elif trade != None and trade.direction == u'空' and trade.offset == u'平昨':

if trade.vtSymbol == self.vtSymbol:

self.ypos0L -= trade.volume

elif trade.vtSymbol == self.vtSymbol1:

self.ypos1L -= trade.volume

#----------------------------------------------------------------------

def onBar(self, bar):

"""收到Bar推送(必须由用户继承实现)"""

raise NotImplementedError

#----------------------------------------------------------------------

def buy(self, price, volume, stop=False):

"""买开"""

return self.sendOrder(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0L)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def sell_y(self, price, volume, stop=False):

"""卖平"""

return self.sendOrder(CTAORDER_SELL, price, volume, stop)

def sell_t(self, price, volume, stop=False):

"""卖平"""

return self.sendOrder(CTAORDER_SELL_TODAY, price, volume, stop)

#----------------------------------------------------------------------

def sell1_y(self, price, volume, stop=False):

"""卖平"""

return self.sendOrder1(CTAORDER_SELL, price, volume, stop)

def sell1_t(self, price, volume, stop=False):

"""卖平"""

return self.sendOrder1(CTAORDER_SELL_TODAY, price, volume, stop)

#----------------------------------------------------------------------

def short(self, price, volume, stop=False):

"""卖开"""

return self.sendOrder(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0S)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def cover_y(self, price, volume, stop=False):

"""买平"""

return self.sendOrder(CTAORDER_COVER, price, volume, stop)

#----------------------------------------------------------------------

def cover_t(self, price, volume, stop=False):

"""买平"""

return self.sendOrder(CTAORDER_COVER_TODAY, price, volume, stop)

#----------------------------------------------------------------------

def cover1_y(self, price, volume, stop=False):

"""买平"""

return self.sendOrder1(CTAORDER_COVER, price, volume, stop)

#----------------------------------------------------------------------

def cover1_t(self, price, volume, stop=False):

"""买平"""

return self.sendOrder1(CTAORDER_COVER_TODAY, price, volume, stop)

#----------------------------------------------------------------------

def buy_fok(self, price, volume, stop=False):

"""买开"""

return self.sendOrderFOK(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell_fok(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0L)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrderFOK(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrderFOK(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def short_fok(self, price, volume, stop=False):

"""卖开"""

return self.sendOrderFOK(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover_fok(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0S)

y_vol = volume - t_vol

if t_vol <= 0 and y_vol <=0:

self.output("买平出错")

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrderFOK(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrderFOK(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def buy_fak(self, price, volume, stop=False):

"""买开"""

return self.sendOrderFAK(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell_fak(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0L)

y_vol = volume - t_vol

if t_vol <= 0 and y_vol <=0:

self.output("卖平出错")

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrderFAK(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrderFAK(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def short_fak(self, price, volume, stop=False):

"""卖开"""

return self.sendOrderFAK(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover_fak(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos0S)

y_vol = volume - t_vol

if t_vol <= 0 and y_vol <=0:

self.output("买平出错")

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder_FAK(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder_FAK(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def sendOrder(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrder(self.vtSymbol, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def sendOrderFOK(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrderFOK(self.vtSymbol, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def sendOrderFAK(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrderFAK(self.vtSymbol, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def buy1(self, price, volume, stop=False):

"""买开"""

return self.sendOrder1(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell1(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1L)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def short1(self, price, volume, stop=False):

"""卖开"""

return self.sendOrder1(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover1(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1S)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def buy1_fok(self, price, volume, stop=False):

"""买开"""

return self.sendOrder1FOK(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell1_fok(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1L)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1FOK(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1FOK(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def short1_fok(self, price, volume, stop=False):

"""卖开"""

return self.sendOrder1FOK(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover1_fok(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1S)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1FOK(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1FOK(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def buy1_fak(self, price, volume, stop=False):

"""买开"""

return self.sendOrder1FAK(CTAORDER_BUY, price, volume, stop)

#----------------------------------------------------------------------

def sell1_fak(self, price, volume, stop=False):

"""卖平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1L)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1FAK(CTAORDER_SELL_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1FAK(CTAORDER_SELL, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def short1_fak(self, price, volume, stop=False):

"""卖开"""

return self.sendOrder1FAK(CTAORDER_SHORT, price, volume, stop)

#----------------------------------------------------------------------

def cover1_fak(self, price, volume, stop=False):

"""买平"""

t_vol = 0

y_vol = 0

t_vol = min(volume,self.tpos1S)

y_vol = volume - t_vol

orderId = None

orderId1 = None

orderIds = []

if t_vol > 0:

orderId=self.sendOrder1FAK(CTAORDER_COVER_TODAY, price, t_vol, stop)

if t_vol ==0 and y_vol > 0:

orderId1=self.sendOrder1FAK(CTAORDER_COVER, price, y_vol, stop)

if orderId:

orderIds.append(orderId)

if orderId1:

orderIds.append(orderId1)

return orderIds

#----------------------------------------------------------------------

def sendOrder1(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol1, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrder(self.vtSymbol1, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def sendOrder1FOK(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol1, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrderFOK(self.vtSymbol1, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def sendOrder1FAK(self, orderType, price, volume, stop=False):

"""发送委托"""

if self.trading:

# 如果stop为True,则意味着发本地停止单

if stop:

vtOrderID = self.ctaEngine.sendStopOrder(self.vtSymbol1, orderType, price, volume, self)

else:

vtOrderID = self.ctaEngine.sendOrderFAK(self.vtSymbol1, orderType, price, volume, self)

return vtOrderID

else:

return ''

#----------------------------------------------------------------------

def cancelOrder(self, vtOrderID):

"""撤单"""

return self.ctaEngine.cancelOrder(vtOrderID)

#if STOPORDERPREFIX in vtOrderID:

# return self.ctaEngine.cancelStopOrder(vtOrderID)

#else:

# return self.ctaEngine.cancelOrder(vtOrderID)

#----------------------------------------------------------------------

def insertTick(self, tick):

"""向数据库中插入tick数据"""

self.ctaEngine.insertData(self.tickDbName, self.vtSymbol, tick)

#----------------------------------------------------------------------

def insertBar(self, bar):

"""向数据库中插入bar数据"""

self.ctaEngine.insertData(self.barDbName, self.vtSymbol, bar)

#----------------------------------------------------------------------

def loadTick(self, days):

"""读取tick数据"""

return self.ctaEngine.loadTick(self.tickDbName, self.vtSymbol, days)

#----------------------------------------------------------------------

def loadBar(self, days):

"""读取bar数据"""

return self.ctaEngine.loadBar(self.barDbName, self.vtSymbol, days)

#----------------------------------------------------------------------

def writeCtaLog(self, content):

"""记录CTA日志"""

content = self.name + ':' + content

self.ctaEngine.writeCtaLog(content)

#----------------------------------------------------------------------

def putEvent(self):

"""发出策略状态变化事件"""

self.ctaEngine.putStrategyEvent(self.name)

# encoding: UTF-8

'''

本文件中包含的是CTA模块的回测引擎,回测引擎的API和CTA引擎一致,

可以使用和实盘相同的代码进行回测。

'''

from __future__ import division

from itertools import product

import copy

import os

import csv

import multiprocessing

import json

import pymongo

import threading

from datetime import datetime

from collections import OrderedDict

from progressbar import ProgressBar

from collections import deque

from ctaBase import *

from vtConstant import *

from vtBase import VtOrderData, VtTradeData

from vtFunction import loadMongoSetting

CAPITAL_DB_NAME = 'vt_trader_cap_db'

########################################################################

class BacktestingEngine(object):

"""

CTA回测引擎

函数接口和策略引擎保持一样,

从而实现同一套代码从回测到实盘。

增加双合约回测功能

增加快速慢速切换功能(挂单策略建议使用快速模式)

"""

TICK_MODE = 'tick'

BAR_MODE = 'bar'

bufferSize = 1000

Version = 20161122

#----------------------------------------------------------------------

def __init__(self,optimism=False):

"""Constructor"""

# 本地停止单编号计数

self.stopOrderCount = 0

# stopOrderID = STOPORDERPREFIX + str(stopOrderCount)

# 本地停止单字典

# key为stopOrderID,value为stopOrder对象

self.stopOrderDict = {} # 停止单撤销后不会从本字典中删除

self.workingStopOrderDict = {} # 停止单撤销后会从本字典中删除

# 回测相关

self.strategy = None # 回测策略

self.mode = self.BAR_MODE # 回测模式,默认为K线

self.shfe = True # 上期所

self.fast = False # 是否支持排队

self.plot = True

self.plotfile = False

self.optimism = False

self.leverage = 0.07

self.slippage = 0 # 回测时假设的滑点

self.rate = 0 # 回测时假设的佣金比例(适用于百分比佣金)

self.rate1 = 0 # 回测时假设的佣金比例(适用于百分比佣金)

self.size = 1 # 合约大小,默认为1

self.size1 = 1 # 合约大小,默认为1

self.mPrice = 1 # 最小价格变动,默认为1

self.mPrice1 = 1 # 最小价格变动,默认为1

self.dbClient = None # 数据库客户端

self.mcClient = None # 数据库客户端

self.dbCursor = None # 数据库指针

self.dbCursor1 = None # 数据库指针

self.backtestingData = deque([]) # 回测用的数据

self.backtestingData1 = deque([]) # 回测用的数据

self.dataStartDate = None # 回测数据开始日期,datetime对象

self.dataEndDate = None # 回测数据结束日期,datetime对象

self.strategyStartDate = None # 策略启动日期(即前面的数据用于初始化),datetime对象

self.limitOrderDict = OrderedDict() # 限价单字典

self.workingLimitOrderDict = OrderedDict() # 活动限价单字典,用于进行撮合用

self.limitOrderCount = 0 # 限价单编号

self.limitOrderDict1 = OrderedDict() # 合约2限价单字典

self.workingLimitOrderDict1 = OrderedDict() # 合约2活动限价单字典,用于进行撮合用

self.tradeCount = 0 # 成交编号

self.tradeDict = OrderedDict() # 成交字典

self.tradeCount1 = 0 # 成交编号1

self.tradeDict1 = OrderedDict() # 成交字典1

self.tradeSnap = OrderedDict() # 主合约市场快照

self.tradeSnap1 = OrderedDict() # 副合约市场快照

self.trade1Snap = OrderedDict() # 主合约市场快照1

self.trade1Snap1 = OrderedDict() # 副合约市场快照1

self.i=0 # 主合约数据准备进度

self.j=0 # 副合约数据准备进度

self.dataClass = None

self.logList = [] # 日志记录

self.orderPrice = {} # 主合约限价单价格

self.orderVolume = {} # 副合约限价单盘口

self.orderPrice1 = {} # 限价单价格

self.orderVolume1 = {} # 限价单盘口

# 当前最新数据,用于模拟成交用

self.tick = None

self.tick1 = None

self.lasttick = None

self.lasttick1 = None

self.bar = None

self.bar1 = None

self.dt = None # 最新的时间

#----------------------------------------------------------------------

def setStartDate(self, startDate='20100416', initDays=10):

"""设置回测的启动日期

支持两种日期模式"""

if len(startDate) == 8:

self.dataStartDate = datetime.strptime(startDate, '%Y%m%d')

else:

self.dataStartDate = datetime.strptime(startDate, '%Y%m%d %H:%M:%S')

#----------------------------------------------------------------------

def setEndDate(self, endDate='20100416'):

"""设置回测的结束日期

支持两种日期模式"""

if len(endDate) == 8:

self.dataEndDate= datetime.strptime(endDate, '%Y%m%d')

else:

self.dataEndDate= datetime.strptime(endDate, '%Y%m%d %H:%M:%S')

#----------------------------------------------------------------------

def setBacktestingMode(self, mode):

"""设置回测模式"""

self.mode = mode

if self.mode == self.BAR_MODE:

self.dataClass = CtaBarData

else:

self.dataClass = CtaTickData

#----------------------------------------------------------------------

def loadHistoryData1(self, dbName, symbol):

"""载入历史数据"""

host, port = loadMongoSetting()

if not self.dbClient:

self.dbClient = pymongo.MongoClient(host, port, socketKeepAlive=True)

collection = self.dbClient[dbName][symbol]

self.output(u'开始载入合约2数据')

# 首先根据回测模式,确认要使用的数据类

if self.mode == self.BAR_MODE:

dataClass = CtaBarData

func = self.newBar1

else:

dataClass = CtaTickData

func = self.newTick1

self.output("Start : " + str(self.dataStartDate))

self.output("End : " + str(self.dataEndDate))

# 载入回测数据

if not self.dataEndDate:

flt = {'datetime':{'$gte':self.dataStartDate}} # 数据过滤条件

else:

flt = {'datetime':{'$gte':self.dataStartDate,

'$lte':self.dataEndDate}}

self.dbCursor1 = collection.find(flt,no_cursor_timeout=True).batch_size(self.bufferSize)

self.output(u'载入完成,数据量:%s' %(self.dbCursor1.count()))

self.output(u' ')

#----------------------------------------------------------------------

def loadHistoryData(self, dbName, symbol):

"""载入历史数据"""

host, port = loadMongoSetting()

if not self.dbClient:

self.dbClient = pymongo.MongoClient(host, port, socketKeepAlive=True)

collection = self.dbClient[dbName][symbol]

self.output(u'开始载入数据')

# 首先根据回测模式,确认要使用的数据类

if self.mode == self.BAR_MODE:

dataClass = CtaBarData

func = self.newBar

else:

dataClass = CtaTickData

func = self.newTick

# 载入回测数据

self.output("Start : " + str(self.dataStartDate))

self.output("End : " + str(self.dataEndDate))

if not self.dataEndDate:

flt = {'datetime':{'$gte':self.dataStartDate}} # 数据过滤条件

else:

flt = {'datetime':{'$gte':self.dataStartDate,

'$lte':self.dataEndDate}}

self.dbCursor = collection.find(flt,no_cursor_timeout=True).batch_size(self.bufferSize)

self.output(u'载入完成,数据量:%s' %(self.dbCursor.count()))

self.output(u' ')

#----------------------------------------------------------------------

def prepareData(self,dbCursor_count,dbCursor_count1):

"""数据准备线程"""

while len(self.backtestingData) < self.bufferSize and self.j < dbCursor_count:

d = self.dbCursor.next()

data = self.dataClass()

data.__dict__ = d

self.backtestingData.append(data)

self.j += 1

while len(self.backtestingData1) < self.bufferSize and self.i < dbCursor_count1:

d1 = self.dbCursor1.next()

data1 = self.dataClass()

data1.__dict__ = d1

self.backtestingData1.append(data1)

self.i += 1

#----------------------------------------------------------------------

def runBacktesting(self):

"""运行回测

判断是否双合约"""

if self.strategy.vtSymbol1 == None:

self.runBacktesting_one()

else:

self.runBacktesting_two()

#----------------------------------------------------------------------

def runBacktesting_two(self):

"""运行回测"""

if self.mode == self.BAR_MODE:

self.dataClass = CtaBarData

func = self.newBar

func1 = self.newBar1

else:

self.dataClass = CtaTickData

func = self.newTick

func1 = self.newTick1

func2 = self.newTick01

self.output(u'开始回测')

self.strategy.inited = True

self.strategy.onInit()

self.output(u'策略初始化完成')

self.strategy.trading = True

self.strategy.onStart()

self.output(u'策略启动完成')

self.output(u'开始回放数据2')

dbCursor_count=self.dbCursor.count()

dbCursor_count1=self.dbCursor1.count()

self.i = 0;

self.j = 0;

lastData = None

lastData1 = None

t = None

# 双合约回测

while (self.i < dbCursor_count1 and self.j < dbCursor_count) or (self.backtestingData and self.backtestingData1):

# 启动数据准备线程

t = threading.Thread(target=self.prepareData,args=(dbCursor_count,dbCursor_count1))

t.start()

# 模拟撮合

while self.backtestingData and self.backtestingData1:

# 考虑切片数据可能不连续,同步两个合约的数据

if self.backtestingData1[0].datetime > self.backtestingData[0].datetime:

if lastData1:

func2(self.backtestingData[0],lastData1)

lastData = self.backtestingData.popleft()

elif self.backtestingData[0].datetime > self.backtestingData1[0].datetime:

if lastData:

func2(lastData,self.backtestingData1[0])

lastData1 = self.backtestingData1.popleft()

elif self.backtestingData and self.backtestingData1 and self.backtestingData1[0].datetime == self.backtestingData[0].datetime:

func2(self.backtestingData[0],self.backtestingData1[0])

lastData = self.backtestingData.popleft()

lastData1 = self.backtestingData1.popleft()

t.join()

self.strategy.onStop()

self.output(u'数据回放结束')

#----------------------------------------------------------------------

def runBacktesting_one(self):

"""运行回测"""

if self.mode == self.BAR_MODE:

self.dataClass = CtaBarData

func = self.newBar

func1 = self.newBar1

else:

self.dataClass = CtaTickData

func = self.newTick

self.output(u'开始回测')

self.strategy.inited = True

self.strategy.onInit()

self.output(u'策略初始化完成')

self.strategy.trading = True

self.strategy.onStart()

self.output(u'策略启动完成')

self.output(u'开始回放数据1')

dbCursor_count=self.dbCursor.count()

self.j = 0;

self.i = 0;

dbCursor_count1 = 0

lastData = None

lastData1 = None

t = None

# 单合约回测

while self.j < dbCursor_count or self.backtestingData:

# 启动数据准备线程

t = threading.Thread(target=self.prepareData,args=(dbCursor_count,dbCursor_count1))

t.start()

# 模拟撮合

while self.backtestingData:

lastData = self.backtestingData.popleft()

func(lastData)

t.join()

self.strategy.onStop()

self.output(u'数据回放结束')

#----------------------------------------------------------------------

def newBar(self, bar):

"""新的K线"""

self.bar = bar

self.dt = bar.datetime

self.crossLimitOrder() # 先撮合限价单

#self.crossStopOrder() # 再撮合停止单

self.strategy.onBar(bar) # 推送K线到策略中

#----------------------------------------------------------------------

def newBar1(self, bar):

"""新的K线"""

self.bar1 = bar

self.dt = bar.datetime

self.crossLimitOrder1() # 先撮合限价单

self.strategy.onBar(bar) # 推送K线到策略中

#----------------------------------------------------------------------

def newTick(self, tick):

"""新的Tick"""

self.tick = tick

self.dt = tick.datetime

# 低速模式(延时1个Tick撮合)

self.crossLimitOrder()

self.strategy.onTick(tick)

# 高速模式(直接撮合)

if self.optimism:

self.crossLimitOrder()

self.lasttick = tick

#----------------------------------------------------------------------

def newTick1(self, tick):

"""新的Tick"""

self.tick1 = tick

self.dt = tick.datetime

# 低速模式(延时1个Tick撮合)

self.crossLimitOrder()

self.strategy.onTick(tick)

# 高速模式(直接撮合)

if self.optimism:

self.crossLimitOrder()

self.lasttick1 = tick

#----------------------------------------------------------------------

def newTick01(self, tick, tick1):

"""新的Tick"""

self.dt = tick.datetime

self.tick = tick

self.tick1 = tick1

# 低速模式(延时1个Tick撮合)

self.crossLimitOrder1()

self.crossLimitOrder()

# 没有切片的合约不发送行情(为了和实盘一致)

if tick1.datetime >= tick.datetime:

self.strategy.onTick(self.tick1)

if tick.datetime >= tick1.datetime:

self.strategy.onTick(self.tick)

# 高速模式(直接撮合)

if self.optimism:

self.crossLimitOrder1()

self.crossLimitOrder()

self.lasttick = self.tick

self.lasttick1 = self.tick1

#----------------------------------------------------------------------

def initStrategy(self, strategyClass, setting=None):

"""

初始化策略

setting是策略的参数设置,如果使用类中写好的默认设置则可以不传该参数

"""

self.strategy = strategyClass(self, setting)

#self.strategy.name = self.strategy.className

#----------------------------------------------------------------------

def sendOrder(self, vtSymbol, orderType, price, volume, strategy):

"""发单"""

self.limitOrderCount += 1

orderID = str(self.limitOrderCount)

order = VtOrderData()

order.vtSymbol = vtSymbol

order.price = price

order.priceType = PRICETYPE_LIMITPRICE

order.totalVolume = volume

order.status = STATUS_NOTTRADED # 刚提交尚未成交

order.orderID = orderID

order.vtOrderID = orderID

order.orderTime = str(self.dt)

# CTA委托类型映射

if orderType == CTAORDER_BUY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_SELL and not self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_SELL and self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_SELL_TODAY:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSETODAY

elif orderType == CTAORDER_SHORT:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_COVER and not self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_COVER and self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_COVER_TODAY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSETODAY

# 保存到限价单字典中

if vtSymbol == strategy.vtSymbol:

self.workingLimitOrderDict[orderID] = order

self.limitOrderDict[orderID] = order

elif vtSymbol == strategy.vtSymbol1:

self.workingLimitOrderDict1[orderID] = order

self.limitOrderDict1[orderID] = order

return orderID

#----------------------------------------------------------------------

def sendOrderFAK(self, vtSymbol, orderType, price, volume, strategy):

"""发单"""

self.limitOrderCount += 1

orderID = str(self.limitOrderCount)

order = VtOrderData()

order.vtSymbol = vtSymbol

order.price = price

order.priceType = PRICETYPE_FAK

order.totalVolume = volume

order.status = STATUS_NOTTRADED # 刚提交尚未成交

order.orderID = orderID

order.vtOrderID = orderID

order.orderTime = str(self.dt)

# CTA委托类型映射

if orderType == CTAORDER_BUY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_SELL and not self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_SELL and self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_SELL_TODAY:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSETODAY

elif orderType == CTAORDER_SHORT:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_COVER and not self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_COVER and self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_COVER_TODAY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSETODAY

# 保存到限价单字典中

if vtSymbol == strategy.vtSymbol:

self.workingLimitOrderDict[orderID] = order

self.limitOrderDict[orderID] = order

elif vtSymbol == strategy.vtSymbol1:

self.workingLimitOrderDict1[orderID] = order

self.limitOrderDict1[orderID] = order

return orderID

#----------------------------------------------------------------------

def sendOrderFOK(self, vtSymbol, orderType, price, volume, strategy):

"""发单"""

self.limitOrderCount += 1

orderID = str(self.limitOrderCount)

order = VtOrderData()

order.vtSymbol = vtSymbol

order.price = price

order.priceType = PRICETYPE_FOK

order.totalVolume = volume

order.status = STATUS_NOTTRADED # 刚提交尚未成交

order.orderID = orderID

order.vtOrderID = orderID

order.orderTime = str(self.dt)

# CTA委托类型映射

if orderType == CTAORDER_BUY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_SELL and not self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_SELL and self.shfe:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_SELL_TODAY:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_CLOSETODAY

elif orderType == CTAORDER_SHORT:

order.direction = DIRECTION_SHORT

order.offset = OFFSET_OPEN

elif orderType == CTAORDER_COVER and not self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSE

elif orderType == CTAORDER_COVER and self.shfe:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSEYESTERDAY

elif orderType == CTAORDER_COVER_TODAY:

order.direction = DIRECTION_LONG

order.offset = OFFSET_CLOSETODAY

# 保存到限价单字典中

if vtSymbol == strategy.vtSymbol:

self.workingLimitOrderDict[orderID] = order

self.limitOrderDict[orderID] = order

elif vtSymbol == strategy.vtSymbol1:

self.workingLimitOrderDict1[orderID] = order

self.limitOrderDict1[orderID] = order

return orderID

#----------------------------------------------------------------------

def cancelOrder(self, vtOrderID):

"""撤单"""

# 找到订单

if vtOrderID in self.workingLimitOrderDict:

order = self.workingLimitOrderDict[vtOrderID]

elif vtOrderID in self.workingLimitOrderDict1:

order = self.workingLimitOrderDict1[vtOrderID]

else:

order = None

return False

# 委托回报

if order.status == STATUS_NOTTRADED:

order.status = STATUS_CANCELLED

order.cancelTime = str(self.dt)

self.strategy.onOrder(order)

else:

order.status = STATUS_PARTTRADED_PARTCANCELLED

order.cancelTime = str(self.dt)

self.strategy.onOrder(order)

# 删除数据

if vtOrderID in self.workingLimitOrderDict:

self.removeOrder(vtOrderID)

elif vtOrderID in self.workingLimitOrderDict1:

self.removeOrder1(vtOrderID)

return True

#----------------------------------------------------------------------

def sendStopOrder(self, vtSymbol, orderType, price, volume, strategy):

"""发停止单(本地实现)"""

self.stopOrderCount += 1

stopOrderID = STOPORDERPREFIX + str(self.stopOrderCount)

so = StopOrder()

so.vtSymbol = vtSymbol

so.price = price

so.volume = volume

so.strategy = strategy

so.stopOrderID = stopOrderID

so.status = STOPORDER_WAITING

if orderType == CTAORDER_BUY:

so.direction = DIRECTION_LONG

so.offset = OFFSET_OPEN

elif orderType == CTAORDER_SELL:

so.direction = DIRECTION_SHORT

so.offset = OFFSET_CLOSE

elif orderType == CTAORDER_SHORT:

so.direction = DIRECTION_SHORT

so.offset = OFFSET_OPEN

elif orderType == CTAORDER_COVER:

so.direction = DIRECTION_LONG

so.offset = OFFSET_CLOSE

# 保存stopOrder对象到字典中

self.stopOrderDict[stopOrderID] = so

self.workingStopOrderDict[stopOrderID] = so

return stopOrderID

#----------------------------------------------------------------------

def cancelStopOrder(self, stopOrderID):

"""撤销停止单"""

# 检查停止单是否存在

if stopOrderID in self.workingStopOrderDict:

so = self.workingStopOrderDict[stopOrderID]

so.status = STOPORDER_CANCELLED

del self.workingStopOrderDict[stopOrderID]

#----------------------------------------------------------------------

def filterTradeTime(self):

"""过滤非交易时间"""

if self.dt:

hour = self.dt.hour

# 丢弃非交易时间错误数据

if (hour >= 15 and hour < 20) or (hour >= 2 and hour < 8):

return True

# 清空隔交易日订单

elif hour == 8:

self.lasttick = None

self.lasttick1 = None

for orderID in self.workingLimitOrderDict:

self.cancelOrder(orderID)

for orderID in self.workingLimitOrderDict1:

self.cancelOrder(orderID)

return True

elif hour == 20:

self.lasttick = None

self.lasttick1 = None

for orderID in self.workingLimitOrderDict:

self.cancelOrder(orderID)

for orderID in self.workingLimitOrderDict1:

self.cancelOrder(orderID)

return True

return False

#----------------------------------------------------------------------

def calcTickVolume(self,tick,lasttick,size):

"""计算两边盘口的成交量"""

if (not lasttick):

currentVolume = tick.volume

currentTurnOver = tick.turnover

pOnAsk = tick.askPrice1

pOnBid = tick.bidPrice1

else:

currentVolume = tick.volume - lasttick.volume

currentTurnOver = tick.turnover - lasttick.turnover

pOnAsk = lasttick.askPrice1

pOnBid = lasttick.bidPrice1

if lasttick and currentVolume > 0:

currentPrice = currentTurnOver/currentVolume/size

ratio = (currentPrice-lasttick.bidPrice1)/(lasttick.askPrice1-lasttick.bidPrice1)

ratio = max(ratio,0)

ratio = min(ratio,1)

volOnAsk = ratio*currentVolume

volOnBid = currentVolume - volOnAsk

else:

volOnAsk = 0

volOnBid = 0

return volOnBid,volOnAsk,pOnBid,pOnAsk

#----------------------------------------------------------------------

def removeOrder(self, orderID):

"""清除订单信息"""

del self.workingLimitOrderDict[orderID]

if orderID in self.orderPrice:

del self.orderPrice[orderID]

if orderID in self.orderVolume:

del self.orderVolume[orderID]

#----------------------------------------------------------------------

def removeOrder1(self, orderID):

"""清除订单信息"""

del self.workingLimitOrderDict1[orderID]

if orderID in self.orderPrice1:

del self.orderPrice1[orderID]

if orderID in self.orderVolume1:

del self.orderVolume1[orderID]

#----------------------------------------------------------------------

def snapMarket(self, tradeID):

"""快照市场"""

if self.mode == self.TICK_MODE:

self.tradeSnap[tradeID] = copy.copy(self.tick)

self.tradeSnap1[tradeID] = copy.copy(self.tick1)

else:

self.tradeSnap[tradeID] = copy.copy(self.bar)

self.tradeSnap1[tradeID] = copy.copy(self.bar1)

#----------------------------------------------------------------------

def strategyOnTrade(self, order, volumeTraded, priceTraded):

"""处理成交回报"""

# 推送成交数据,

self.tradeCount += 1

tradeID = str(self.tradeCount)

trade = VtTradeData()

#省略回测无关内容

#trade.tradeID = tradeID

#trade.vtTradeID = tradeID

#trade.orderID = order.orderID

#trade.vtOrderID = order.orderID

trade.dt = self.dt

trade.vtSymbol = order.vtSymbol

trade.direction = order.direction

trade.offset = order.offset

trade.tradeTime = self.dt.strftime('%Y%m%d %H:%M:%S.')+self.dt.strftime('%f')[:1]

trade.volume = volumeTraded

trade.price = priceTraded

self.strategy.onTrade(copy.copy(trade))

# 快照市场,用于计算持仓盈亏,暂不支持

# self.snapMarket(tradeID)

if trade.vtSymbol == self.strategy.vtSymbol:

self.tradeDict[tradeID] = trade

else:

self.tradeDict1[tradeID] = trade

#----------------------------------------------------------------------

def crossLimitOrder(self):

"""基于最新数据撮合限价单"""

# 缓存数据

tick = self.tick

lasttick = self.lasttick

# 过滤数据

if self.filterTradeTime():

return

# 确定撮合价格

if self.mode == self.BAR_MODE:

# Bar价格撮合,目前不支持FokopenFak

buyCrossPrice = self.bar.low # 若买入方向限价单价格高于该价格,则会成交

sellCrossPrice = self.bar.high # 若卖出方向限价单价格低于该价格,则会成交

else:

# Tick采用对价撮合,支持Fok,Fak

buyCrossPrice = tick.askPrice1 if tick.askPrice1 > 0 else tick.bidPrice1+self.mPrice

sellCrossPrice = tick.bidPrice1 if tick.bidPrice1 > 0 else tick.askPrice1-self.mPrice

# 遍历限价单字典中的所有限价单

for orderID, order in self.workingLimitOrderDict.items():

# 判断是否会成交

buyCross = order.direction==DIRECTION_LONG and order.price>=buyCrossPrice

sellCross = order.direction==DIRECTION_SHORT and order.price<=sellCrossPrice

# 如果可以对价撮合

if buyCross or sellCross:

# 计算成交量

volumeTraded = (order.totalVolume-order.tradedVolume)

if self.mode == self.TICK_MODE:

volumeTraded = min(volumeTraded, tick.askVolume1) if buyCross \

else min(volumeTraded, tick.bidVolume1)

volumeTraded = max(volumeTraded,1)

# 计算成交价

if orderID in self.orderPrice and order.tradedVolume == 0:

priceTraded = order.price

else:

priceTraded = min(order.price,buyCrossPrice) if buyCross \

else max(order.price,sellCrossPrice)

# 推送委托数据

order.tradedVolume += volumeTraded

# 分别处理普通限价,FOK,FAK订单

if order.priceType == PRICETYPE_FOK:

if order.tradedVolume < order.totalVolume:

order.status = STATUS_CANCELLED

volumeTraded = 0

else:

order.status = STATUS_ALLTRADED

elif order.priceType == PRICETYPE_FAK:

if order.tradedVolume < order.totalVolume:

order.status = STATUS_PARTTRADED_PARTCANCELLED

else:

order.status = STATUS_ALLTRADED

else:

if order.tradedVolume < order.totalVolume:

order.status = STATUS_PARTTRADED

self.orderPrice[orderID] = order.price

self.orderVolume[orderID] = 0

else:

order.status = STATUS_ALLTRADED

# 推送委托回报

self.strategy.onOrder(order)

# 推送成交回报

if volumeTraded > 0:

self.strategyOnTrade(order, volumeTraded,priceTraded)

# 处理完毕,删除数据

if not order.status == STATUS_PARTTRADED:

self.removeOrder(orderID)

# 模拟排队撮合部分,TICK模式有效(使用Tick内成交均价简单估计两边盘口的成交量)

elif self.mode == self.TICK_MODE and not self.fast:

# 计算估计的两边盘口的成交量

volOnBid,volOnAsk,pOnBid,pOnAsk = self.calcTickVolume(tick, lasttick, self.size)

# 排队队列维护

if orderID in self.orderPrice:

# 非首次进入队列

if orderID not in self.orderVolume:

if order.price == sellCrossPrice and order.direction==DIRECTION_LONG:

self.orderVolume[orderID] = tick.bidVolume1

elif order.price == buyCrossPrice and order.direction==DIRECTION_SHORT:

self.orderVolume[orderID] = tick.askVolume1

# 首先排队进入,然后被打穿(不允许直接在买卖盘中间成交)

elif order.price > sellCrossPrice and order.direction==DIRECTION_LONG:

self.orderVolume[orderID] = 0

elif order.price < buyCrossPrice and order.direction==DIRECTION_SHORT:

self.orderVolume[orderID] = 0

# 更新排队值

elif order.price == pOnBid and order.direction==DIRECTION_LONG:

self.orderVolume[orderID] -= volOnBid

elif order.price == pOnAsk and order.direction==DIRECTION_SHORT:

self.orderVolume[orderID] -= volOnAsk

else:

# 首次进入队列

self.orderPrice[orderID] = order.price

if order.direction==DIRECTION_SHORT and order.price == tick.askPrice1:

self.orderVolume[orderID] = tick.askVolume1

elif order.direction==DIRECTION_LONG and order.price == tick.bidPrice1:

self.orderVolume[orderID] = tick.bidVolume1

# 排队成交,注意,目前简单一次性全部成交!!

if orderID in self.orderVolume and self.orderVolume[orderID] <= 0:

# 推送委托数据

priceTraded = order.price

volumeTraded = order.totalVolume - order.tradedVolume

order.tradedVolume = order.totalVolume

order.status = STATUS_ALLTRADED

self.strategy.onOrder(order)

# 推送成交回报

self.strategyOnTrade(order, volumeTraded, priceTraded)

# 从字典中删除该限价单

self.removeOrder(orderID)

else:

order.tradedVolume = 0

order.status = STATUS_NOTTRADED

if order.priceType == PRICETYPE_FOK or order.priceType == PRICETYPE_FAK:

order.status = STATUS_CANCELLED

self.removeOrder(orderID)

self.strategy.onOrder(order)

#----------------------------------------------------------------------

def crossLimitOrder1(self):

"""基于最新数据撮合限价单"""

# 缓存数据

lasttick1 = self.lasttick1

tick1 = self.tick1

bar1 = self.bar1

if self.filterTradeTime():

return

# 区分K线撮合和TICK撮合模式

if self.mode == self.BAR_MODE:

buyCrossPrice = bar1.low # 若买入方向限价单价格高于该价格,则会成交

sellCrossPrice = bar1.high # 若卖出方向限价单价格低于该价格,则会成交

else:

# TICK对价撮合,并过滤涨跌停板

buyCrossPrice = tick1.askPrice1 if tick1.askPrice1 > 0 else tick1.bidPrice1+self.mPrice1

sellCrossPrice = tick1.bidPrice1 if tick1.bidPrice1 > 0 else tick1.askPrice1-self.mPrice1

# 遍历限价单字典中的所有限价单

for orderID, order in self.workingLimitOrderDict1.items():

# 判断是否对价直接成交

buyCross = order.direction==DIRECTION_LONG and order.price>=buyCrossPrice

sellCross = order.direction==DIRECTION_SHORT and order.price<=sellCrossPrice

# 如果直接对价成交

if buyCross or sellCross:

# 计算成交量

volumeTraded = (order.totalVolume-order.tradedVolume)

if self.mode == self.TICK_MODE:

volumeTraded = min(volumeTraded, tick1.askVolume1) if buyCross \

else min(volumeTraded, tick1.bidVolume1)

volumeTraded = max(volumeTraded,1)

# 计算成交价

if orderID in self.orderPrice1 and order.tradedVolume == 0:

priceTraded = order.price

else:

priceTraded = min(order.price,buyCrossPrice) if buyCross else max(order.price,sellCrossPrice)

# 委托回报,区分普通限价单,FOK,FAK

order.tradedVolume += volumeTraded

if order.priceType == PRICETYPE_FOK:

if order.tradedVolume < order.totalVolume: