class SpreadData:

""""""

def __init__(

self,

name: str,

legs: List[LegData],

price_multipliers: Dict[str, int],

trading_multipliers: Dict[str, int],

active_symbol: str,

inverse_contracts: Dict[str, bool],

min_volume: float

):

""""""

self.name: str = name

self.legs: Dict[str, LegData] = {}

self.active_leg: LegData = None

self.passive_legs: List[LegData] = []

self.min_volume: float = min_volume

self.pricetick: float = 0

# For calculating spread price

self.price_multipliers: Dict[str, int] = price_multipliers

# For calculating spread pos and sending orders

self.trading_multipliers: Dict[str, int] = trading_multipliers

self.inverse_contracts: Dict[str, bool] = inverse_contracts

self.price_formula: str = ""

self.trading_formula: str = ""

for leg in legs:

self.legs[leg.vt_symbol] = leg

if leg.vt_symbol == active_symbol:

self.active_leg = leg

else:

self.passive_legs.append(leg)

price_multiplier = self.price_multipliers[leg.vt_symbol]

if price_multiplier > 0:

self.price_formula += f"+{price_multiplier}*{leg.vt_symbol}"

else:

self.price_formula += f"{price_multiplier}*{leg.vt_symbol}"

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

if trading_multiplier > 0:

self.trading_formula += f"+{trading_multiplier}*{leg.vt_symbol}"

else:

self.trading_formula += f"{trading_multiplier}*{leg.vt_symbol}"

if not self.pricetick:

self.pricetick = leg.pricetick

else:

self.pricetick = min(self.pricetick, leg.pricetick)

# Spread data

self.bid_price: float = 0

self.ask_price: float = 0

self.bid_volume: float = 0

self.ask_volume: float = 0

self.net_pos: float = 0

self.datetime: datetime = None

def calculate_price(self):

""""""

self.clear_price()

# Go through all legs to calculate price

for n, leg in enumerate(self.legs.values()):

# Filter not all leg price data has been received

if not leg.bid_volume or not leg.ask_volume:

self.clear_price()

return

# Calculate price

price_multiplier = self.price_multipliers[leg.vt_symbol]

if price_multiplier > 0:

self.bid_price += leg.bid_price * price_multiplier

self.ask_price += leg.ask_price * price_multiplier

else:

self.bid_price += leg.ask_price * price_multiplier

self.ask_price += leg.bid_price * price_multiplier

# Round price to pricetick

if self.pricetick:

self.bid_price = round_to(self.bid_price, self.pricetick)

self.ask_price = round_to(self.ask_price, self.pricetick)

# Calculate volume

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

inverse_contract = self.inverse_contracts[leg.vt_symbol]

if not inverse_contract:

leg_bid_volume = leg.bid_volume

leg_ask_volume = leg.ask_volume

else:

leg_bid_volume = calculate_inverse_volume(

leg.bid_volume, leg.bid_price, leg.size)

leg_ask_volume = calculate_inverse_volume(

leg.ask_volume, leg.ask_price, leg.size)

if trading_multiplier > 0:

adjusted_bid_volume = floor_to(

leg_bid_volume / trading_multiplier,

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_ask_volume / trading_multiplier,

self.min_volume

)

else:

adjusted_bid_volume = floor_to(

leg_ask_volume / abs(trading_multiplier),

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_bid_volume / abs(trading_multiplier),

self.min_volume

)

# For the first leg, just initialize

if not n:

self.bid_volume = adjusted_bid_volume

self.ask_volume = adjusted_ask_volume

# For following legs, use min value of each leg quoting volume

else:

self.bid_volume = min(self.bid_volume, adjusted_bid_volume)

self.ask_volume = min(self.ask_volume, adjusted_ask_volume)

# Update calculate time

self.datetime = datetime.now(LOCAL_TZ)

def calculate_pos(self):

""""""

long_pos = 0

short_pos = 0

for n, leg in enumerate(self.legs.values()):

leg_long_pos = 0

leg_short_pos = 0

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

if not trading_multiplier:

continue

inverse_contract = self.inverse_contracts[leg.vt_symbol]

if not inverse_contract:

net_pos = leg.net_pos

else:

net_pos = calculate_inverse_volume(

leg.net_pos, leg.net_pos_price, leg.size)

adjusted_net_pos = net_pos / trading_multiplier

if adjusted_net_pos > 0:

adjusted_net_pos = floor_to(adjusted_net_pos, self.min_volume)

leg_long_pos = adjusted_net_pos

else:

adjusted_net_pos = ceil_to(adjusted_net_pos, self.min_volume)

leg_short_pos = abs(adjusted_net_pos)

if not n:

long_pos = leg_long_pos

short_pos = leg_short_pos

else:

long_pos = min(long_pos, leg_long_pos)

short_pos = min(short_pos, leg_short_pos)

if long_pos > 0:

self.net_pos = long_pos

else:

self.net_pos = -short_pos

def clear_price(self):

""""""

self.bid_price = 0

self.ask_price = 0

self.bid_volume = 0

self.ask_volume = 0

def calculate_leg_volume(self, vt_symbol: str, spread_volume: float) -> float:

""""""

leg = self.legs[vt_symbol]

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

leg_volume = spread_volume * trading_multiplier

return leg_volume

def calculate_spread_volume(self, vt_symbol: str, leg_volume: float) -> float:

""""""

leg = self.legs[vt_symbol]

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

spread_volume = leg_volume / trading_multiplier

if spread_volume > 0:

spread_volume = floor_to(spread_volume, self.min_volume)

else:

spread_volume = ceil_to(spread_volume, self.min_volume)

return spread_volume

def to_tick(self):

""""""

tick = TickData(

symbol=self.name,

exchange=Exchange.LOCAL,

datetime=self.datetime,

name=self.name,

last_price=(self.bid_price + self.ask_price) / 2,

bid_price_1=self.bid_price,

ask_price_1=self.ask_price,

bid_volume_1=self.bid_volume,

ask_volume_1=self.ask_volume,

gateway_name="SPREAD"

)

return tick

def is_inverse(self, vt_symbol: str) -> bool:

""""""

inverse_contract = self.inverse_contracts[vt_symbol]

return inverse_contract

def get_leg_size(self, vt_symbol: str) -> float:

""""""

leg = self.legs[vt_symbol]

return leg.sizeclass LegData:

""""""

def __init__(self, vt_symbol: str):

""""""

self.vt_symbol: str = vt_symbol

# Price and position data

self.bid_price: float = 0

self.ask_price: float = 0

self.bid_volume: float = 0

self.ask_volume: float = 0

self.long_pos: float = 0

self.short_pos: float = 0

self.net_pos: float = 0

self.last_price: float = 0

self.net_pos_price: float = 0 # Average entry price of net position

# Tick data buf

self.tick: TickData = None

# Contract data

self.size: float = 0

self.net_position: bool = False

self.min_volume: float = 0

self.pricetick: float = 0

def update_contract(self, contract: ContractData):

""""""

self.size = contract.size

self.net_position = contract.net_position

self.min_volume = contract.min_volume

self.pricetick = contract.pricetick

def update_tick(self, tick: TickData):

""""""

self.bid_price = tick.bid_price_1

self.ask_price = tick.ask_price_1

self.bid_volume = tick.bid_volume_1

self.ask_volume = tick.ask_volume_1

self.last_price = tick.last_price

self.tick = tick

def update_position(self, position: PositionData):

""""""

if position.direction == Direction.NET:

self.net_pos = position.volume

self.net_pos_price = position.price

else:

if position.direction == Direction.LONG:

self.long_pos = position.volume

else:

self.short_pos = position.volume

self.net_pos = self.long_pos - self.short_pos

def update_trade(self, trade: TradeData):

""""""

# Only update net pos for contract with net position mode

if self.net_position:

trade_cost = trade.volume * trade.price

old_cost = self.net_pos * self.net_pos_price

if trade.direction == Direction.LONG:

new_pos = self.net_pos + trade.volume

if self.net_pos >= 0:

new_cost = old_cost + trade_cost

self.net_pos_price = new_cost / new_pos

else:

# If all previous short position closed

if not new_pos:

self.net_pos_price = 0

# If only part short position closed

elif new_pos > 0:

self.net_pos_price = trade.price

else:

new_pos = self.net_pos - trade.volume

if self.net_pos <= 0:

new_cost = old_cost - trade_cost

self.net_pos_price = new_cost / new_pos

else:

# If all previous long position closed

if not new_pos:

self.net_pos_price = 0

# If only part long position closed

elif new_pos < 0:

self.net_pos_price = trade.price

self.net_pos = new_pos

else:

if trade.direction == Direction.LONG:

if trade.offset == Offset.OPEN:

self.long_pos += trade.volume

else:

self.short_pos -= trade.volume

else:

if trade.offset == Offset.OPEN:

self.short_pos += trade.volume

else:

self.long_pos -= trade.volume

self.net_pos = self.long_pos - self.short_pos从上面的代码可以知道,SpreadData中包含若干个腿,它的tick数据应该是有各腿的tick合成的,可是我们看SpreadData的to_tck()的代码,看不是这样的!

def to_tick(self):

""""""

tick = TickData(

symbol=self.name,

exchange=Exchange.LOCAL,

datetime=self.datetime,

name=self.name,

last_price=(self.bid_price + self.ask_price) / 2,

bid_price_1=self.bid_price,

ask_price_1=self.ask_price,

bid_volume_1=self.bid_volume,

ask_volume_1=self.ask_volume,

gateway_name="SPREAD"

)

return tick假如价差(SpreadData)的实例S中包含两腿(LegData)L1和L2,L1、L2的价格乘数分别为1和-1,那么:

在任意时刻,当L1得到了最新tick1,L2得到最新tick2,

L1的

L1.last_price=tick1.last_price

L1.bid_price_1=tick1.bid_price_1

L1.ask_price_1=tick1.ask_price_1

L2的部分数据

L2.last_price=tick2.last_price

L2.bid_price_1=tick2.bid_price_1

L2.ask_price_1=tick2.ask_price_1

那么经过价差S的calculate_price()的计算后,

S.last_price=L1.last_price-L2.last_price

S.bid_price_1=L1.bid_price_1-L2.bid_price_1

S.ask_price_1=L1.ask_price_1-L2.ask_price_1

问题来了:如果腿L1已经得到了有效数据,而腿L2还没有得到有效数据,那么价差S的价格将是无效的!

if not leg.bid_volume or not leg.ask_volume:

self.clear_price()

return这里的条件意思是说如果价差的某个腿中的数据是无意义的,那么就清空价差的所有价格,那么此时SpreadData的to_tick()得到的tick就不是一个有效的tick数据!

只要价差的多个腿中有一个腿的数据没有使用实际的tick更新过,就会发生这种情况!

全部是0,因为clear_price()的代码如下:

def clear_price(self):

""""""

self.bid_price = 0

self.ask_price = 0

self.bid_volume = 0

self.ask_volume = 0我们知道价差的数据计算和更新是有SpreadDataEngine维护的,下面是SpreadDataEngine的process_tick_event():

def process_tick_event(self, event: Event) -> None:

""""""

tick = event.data

leg = self.legs.get(tick.vt_symbol, None)

if not leg:

return

leg.update_tick(tick)

for spread in self.symbol_spread_map[tick.vt_symbol]:

spread.calculate_price() # 这里并没有对价差的价格计算是否有效的判断

self.put_data_event(spread)

def put_data_event(self, spread: SpreadData) -> None:

""""""

event = Event(EVENT_SPREAD_DATA, spread)

self.event_engine.put(event)这里并没有对价差的价格计算是否有效的判断,就直接向价差发送了EVENT_SPREAD_DATA消息,这看引起价差和价差策略通过推送接口on_spread_data()得到错误的价差数据!!!

def calculate_price(self)->bool: # hxxjava change

""""""

self.clear_price()

# Go through all legs to calculate price

for n, leg in enumerate(self.legs.values()):

# Filter not all leg price data has been received

if not leg.bid_volume or not leg.ask_volume:

self.clear_price()

return False # hxxjava add

# Calculate price

price_multiplier = self.price_multipliers[leg.vt_symbol]

if price_multiplier > 0:

self.bid_price += leg.bid_price * price_multiplier

self.ask_price += leg.ask_price * price_multiplier

else:

self.bid_price += leg.ask_price * price_multiplier

self.ask_price += leg.bid_price * price_multiplier

# Round price to pricetick

if self.pricetick:

self.bid_price = round_to(self.bid_price, self.pricetick)

self.ask_price = round_to(self.ask_price, self.pricetick)

# Calculate volume

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

inverse_contract = self.inverse_contracts[leg.vt_symbol]

if not inverse_contract:

leg_bid_volume = leg.bid_volume

leg_ask_volume = leg.ask_volume

else:

leg_bid_volume = calculate_inverse_volume(

leg.bid_volume, leg.bid_price, leg.size)

leg_ask_volume = calculate_inverse_volume(

leg.ask_volume, leg.ask_price, leg.size)

if trading_multiplier > 0:

adjusted_bid_volume = floor_to(

leg_bid_volume / trading_multiplier,

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_ask_volume / trading_multiplier,

self.min_volume

)

else:

adjusted_bid_volume = floor_to(

leg_ask_volume / abs(trading_multiplier),

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_bid_volume / abs(trading_multiplier),

self.min_volume

)

# For the first leg, just initialize

if not n:

self.bid_volume = adjusted_bid_volume

self.ask_volume = adjusted_ask_volume

# For following legs, use min value of each leg quoting volume

else:

self.bid_volume = min(self.bid_volume, adjusted_bid_volume)

self.ask_volume = min(self.ask_volume, adjusted_ask_volume)

# Update calculate time

self.datetime = datetime.now(LOCAL_TZ)

return True # hxxjava addclass AdvancedSpreadData(SpreadData):

def calculate_price(self)->bool: # hxxjava change

""""""

self.clear_price()

# Go through all legs to calculate price

bid_data = {}

ask_data = {}

volume_inited = False

for variable, leg in self.variable_legs.items():

# Filter not all leg price data has been received

if not leg.bid_volume or not leg.ask_volume:

self.clear_price()

return False # hxxjava change

# Generate price dict for calculating spread bid/ask

variable_direction = self.variable_directions[variable]

if variable_direction > 0:

bid_data[variable] = leg.bid_price

ask_data[variable] = leg.ask_price

else:

bid_data[variable] = leg.ask_price

ask_data[variable] = leg.bid_price

# Calculate volume

trading_multiplier = self.trading_multipliers[leg.vt_symbol]

if not trading_multiplier:

continue

inverse_contract = self.inverse_contracts[leg.vt_symbol]

if not inverse_contract:

leg_bid_volume = leg.bid_volume

leg_ask_volume = leg.ask_volume

else:

leg_bid_volume = calculate_inverse_volume(

leg.bid_volume, leg.bid_price, leg.size)

leg_ask_volume = calculate_inverse_volume(

leg.ask_volume, leg.ask_price, leg.size)

if trading_multiplier > 0:

adjusted_bid_volume = floor_to(

leg_bid_volume / trading_multiplier,

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_ask_volume / trading_multiplier,

self.min_volume

)

else:

adjusted_bid_volume = floor_to(

leg_ask_volume / abs(trading_multiplier),

self.min_volume

)

adjusted_ask_volume = floor_to(

leg_bid_volume / abs(trading_multiplier),

self.min_volume

)

# For the first leg, just initialize

if not volume_inited:

self.bid_volume = adjusted_bid_volume

self.ask_volume = adjusted_ask_volume

volume_inited = True

# For following legs, use min value of each leg quoting volume

else:

self.bid_volume = min(self.bid_volume, adjusted_bid_volume)

self.ask_volume = min(self.ask_volume, adjusted_ask_volume)

# Calculate spread price

self.bid_price = self.parse_formula(self.price_code, bid_data)

self.ask_price = self.parse_formula(self.price_code, ask_data)

# Round price to pricetick

if self.pricetick:

self.bid_price = round_to(self.bid_price, self.pricetick)

self.ask_price = round_to(self.ask_price, self.pricetick)

# Update calculate time

self.datetime = datetime.now(LOCAL_TZ)

return True # hxxjava add def process_tick_event(self, event: Event) -> None:

""""""

tick = event.data

leg = self.legs.get(tick.vt_symbol, None)

if not leg:

return

leg.update_tick(tick)

for spread in self.symbol_spread_map[tick.vt_symbol]:

if spread.calculate_price(): # hxxjava change

self.put_data_event(spread)如果不做上述改动会,可能会出现策略在开盘的时间,由于价差没有收齐所有腿的tick,

导致价差的 lastest_price等数据为0,可是仍然被推价差数据,进而产生用错误的价差tick。

错误的价差tick会引发错误的价差交易信号,并且以错误的价格进行价差的开仓和平仓!!!

本人在实际的价差策略交易中已经发生过上述的错误!

这个价差策略的大致意思是:

说明:错误的地方我已知注释了。

from vnpy.trader.utility import BarGenerator, ArrayManager

from vnpy.app.spread_trading import (

SpreadStrategyTemplate,

SpreadAlgoTemplate,

SpreadData,

OrderData,

TradeData,

TickData,

BarData

)

class StatisticalArbitrageStrategy(SpreadStrategyTemplate):

""""""

author = "用Python的交易员"

boll_window = 20

boll_dev = 2

max_pos = 10

payup = 10

interval = 5

spread_pos = 0.0

boll_up = 0.0

boll_down = 0.0

boll_mid = 0.0

parameters = [

"boll_window",

"boll_dev",

"max_pos",

"payup",

"interval"

]

variables = [

"spread_pos",

"boll_up",

"boll_down",

"boll_mid"

]

def __init__(

self,

strategy_engine,

strategy_name: str,

spread: SpreadData,

setting: dict

):

""""""

super().__init__(

strategy_engine, strategy_name, spread, setting

)

self.bg = BarGenerator(self.on_spread_bar)

self.am = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(10)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

self.put_event()

def on_spread_data(self):

"""

Callback when spread price is updated.

"""

tick = self.get_spread_tick()

self.on_spread_tick(tick)

def on_spread_tick(self, tick: TickData):

"""

Callback when new spread tick data is generated.

"""

self.bg.update_tick(tick) # 这里有兼容性错误,BarGenerator处理不了最新价为0的tick

def on_spread_bar(self, bar: BarData):

"""

Callback when spread bar data is generated.

"""

self.stop_all_algos()

self.am.update_bar(bar)

if not self.am.inited:

return

self.boll_mid = self.am.sma(self.boll_window)

self.boll_up, self.boll_down = self.am.boll(

self.boll_window, self.boll_dev)

if not self.spread_pos:

if bar.close_price >= self.boll_up:

self.start_short_algo(

bar.close_price - 10,

self.max_pos,

payup=self.payup,

interval=self.interval

)

elif bar.close_price <= self.boll_down:

self.start_long_algo(

bar.close_price + 10,

self.max_pos,

payup=self.payup,

interval=self.interval

)

elif self.spread_pos < 0:

if bar.close_price <= self.boll_mid:

self.start_long_algo(

bar.close_price + 10,

abs(self.spread_pos),

payup=self.payup,

interval=self.interval

)

else:

if bar.close_price >= self.boll_mid:

self.start_short_algo(

bar.close_price - 10,

abs(self.spread_pos),

payup=self.payup,

interval=self.interval

)

self.put_event()

def on_spread_pos(self):

"""

Callback when spread position is updated.

"""

self.spread_pos = self.get_spread_pos()

self.put_event()

def on_spread_algo(self, algo: SpreadAlgoTemplate):

"""

Callback when algo status is updated.

"""

pass

def on_order(self, order: OrderData):

"""

Callback when order status is updated.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback when new trade data is received.

"""

pass

def stop_open_algos(self):

""""""

if self.buy_algoid:

self.stop_algo(self.buy_algoid)

if self.short_algoid:

self.stop_algo(self.short_algoid)

def stop_close_algos(self):

""""""

if self.sell_algoid: # self.sell_algoid没有定义

self.stop_algo(self.sell_algoid)

if self.cover_algoid: # self.cover_algoid没有定义

self.stop_algo(self.cover_algoid)下面是BarGenerator的update_tick()函数,错误的地方我已知注释了:

def update_tick(self, tick: TickData) -> None:

"""

Update new tick data into generator.

"""

new_minute = False

# Filter tick data with 0 last price

if not tick.last_price: # 这个过滤条件有点想当然了

return

# Filter tick data with older timestamp

if self.last_tick and tick.datetime < self.last_tick.datetime:

return

if not self.bar:

new_minute = True

elif (

(self.bar.datetime.minute != tick.datetime.minute)

or (self.bar.datetime.hour != tick.datetime.hour)

):

self.bar.datetime = self.bar.datetime.replace(

second=0, microsecond=0

)

self.on_bar(self.bar)

new_minute = True

if new_minute:

self.bar = BarData(

symbol=tick.symbol,

exchange=tick.exchange,

interval=Interval.MINUTE,

datetime=tick.datetime,

gateway_name=tick.gateway_name,

open_price=tick.last_price,

high_price=tick.last_price,

low_price=tick.last_price,

close_price=tick.last_price,

open_interest=tick.open_interest

)

else:

self.bar.high_price = max(self.bar.high_price, tick.last_price)

if tick.high_price > self.last_tick.high_price:

self.bar.high_price = max(self.bar.high_price, tick.high_price)

self.bar.low_price = min(self.bar.low_price, tick.last_price)

if tick.low_price < self.last_tick.low_price:

self.bar.low_price = min(self.bar.low_price, tick.low_price)

self.bar.close_price = tick.last_price

self.bar.open_interest = tick.open_interest

self.bar.datetime = tick.datetime

if self.last_tick:

volume_change = tick.volume - self.last_tick.volume

self.bar.volume += max(volume_change, 0)

self.last_tick = tick把我标识的错误的过滤条件改成下面的代码,把它注释掉:

# if not tick.last_price: # 这个过滤条件有点想当然了

# return修改之处见代码中的注释:

from vnpy.trader.utility import BarGenerator, ArrayManager

from vnpy.app.spread_trading import (

SpreadStrategyTemplate,

SpreadAlgoTemplate,

SpreadData,

OrderData,

TradeData,

TickData,

BarData

)

class StatisticalArbitrageStrategy(SpreadStrategyTemplate):

""""""

author = "用Python的交易员"

boll_window = 20

boll_dev = 2

max_pos = 10

payup = 10

interval = 5

spread_pos = 0.0

boll_up = 0.0

boll_down = 0.0

boll_mid = 0.0

parameters = [

"boll_window",

"boll_dev",

"max_pos",

"payup",

"interval"

]

variables = [

"spread_pos",

"boll_up",

"boll_down",

"boll_mid"

]

def __init__(

self,

strategy_engine,

strategy_name: str,

spread: SpreadData,

setting: dict

):

""""""

super().__init__(

strategy_engine, strategy_name, spread, setting

)

self.bg = BarGenerator(self.on_spread_bar)

self.am = ArrayManager()

self.buy_algoid:str = "" # hxxjava add

self.short_algoid:str = "" # hxxjava add

self.sell_algoid = "" # hxxjava add

self.cover_algoid = "" # hxxjava add

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(10)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

self.put_event()

def on_spread_data(self):

"""

Callback when spread price is updated.

"""

tick = self.get_spread_tick()

self.on_spread_tick(tick)

def on_spread_tick(self, tick: TickData):

"""

Callback when new spread tick data is generated.

"""

self.bg.update_tick(tick)

def on_spread_bar(self, bar: BarData):

"""

Callback when spread bar data is generated.

"""

self.stop_all_algos()

self.am.update_bar(bar)

if not self.am.inited:

return

self.boll_mid = self.am.sma(self.boll_window)

self.boll_up, self.boll_down = self.am.boll(

self.boll_window, self.boll_dev)

if not self.spread_pos:

if bar.close_price >= self.boll_up:

self.buy_algoid = self.start_short_algo( # hxxjava change

bar.close_price - 10,

self.max_pos,

payup=self.payup,

interval=self.interval

)

elif bar.close_price <= self.boll_down:

self.short_algoid = self.start_long_algo( # hxxjava change

bar.close_price + 10,

self.max_pos,

payup=self.payup,

interval=self.interval

)

elif self.spread_pos < 0:

if bar.close_price <= self.boll_mid:

self.sell_algoid = self.start_long_algo( # hxxjava change

bar.close_price + 10,

abs(self.spread_pos),

payup=self.payup,

interval=self.interval

)

else:

if bar.close_price >= self.boll_mid:

self.cover_algoid = self.start_short_algo( # hxxjava change

bar.close_price - 10,

abs(self.spread_pos),

payup=self.payup,

interval=self.interval

)

self.put_event()

def on_spread_pos(self):

"""

Callback when spread position is updated.

"""

self.spread_pos = self.get_spread_pos()

self.put_event()

def on_spread_algo(self, algo: SpreadAlgoTemplate):

"""

Callback when algo status is updated.

"""

if not algo.is_active(): # hxxjava add

if self.buy_algoid == algo.algoid:

self.buy_algoid = ""

elif self.sell_algoid == algo.algoid:

self.sell_algoid = ""

elif self.short_algoid == algo.algoid:

self.short_algoid = ""

else:

self.cover_algoid = ""

def on_order(self, order: OrderData):

"""

Callback when order status is updated.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback when new trade data is received.

"""

pass

def stop_open_algos(self):

""""""

if self.buy_algoid:

self.stop_algo(self.buy_algoid)

if self.short_algoid:

self.stop_algo(self.short_algoid)

def stop_close_algos(self):

""""""

if self.sell_algoid:

self.stop_algo(self.sell_algoid)

if self.cover_algoid:

self.stop_algo(self.cover_algoid)嗯,原来是有这一层考虑,谢谢回复!

您答非所问了。

我的意思是既然每腿的委托和成交都不推送给价差策略,为什么还要on_order()和on_trade()这两个推送接口?

def on_order(self, order: OrderData):

"""

Callback when order status is updated.

"""

print(f"{self.spread_name} {order}") def on_trade(self, trade: TradeData):

"""

Callback when new trade data is received.

"""

print(f"{self.spread_name} {trade}")roger wrote:

- 我只想看到实时的价差 不需要实盘下单

- 交易量改0..01是因为公式中参数是小数,不改小没法输入小数

- 即使不改交易量,输入整数类型公式,依然存在相同问题 ,如图

先研究跨期吧,这种3腿的价差,你的xA+yB+zC,x,y,z的选取决定了交易量v的设置,

如果单腿x,y,z的交易数量必须为整数,要保证xv,yv,zv同时为整数(无所谓正负),

可能你找到的v是你无法承受的下单量,你的资金可能压根就不够开仓价差一次的,搞了半天白玩。

输:

A-B或者

A*3-B*2之类的.

另外,你的最小交易量输错了,应该是1,au2110这类单边合约交易不了0.001手

CTA策略的交易标的是一个具体的单边合约。假如我们运行两个CTA策略A和B实例,它们交易的合约都是C。同时运行A和B,那么我们可以发现A和B可以独立地统计各自的持仓,也就是说它们的pos可能是不一样的,不会相互干扰。

而价差交易策略的交易标的是价差。假如我们运行两个价差交易策略SA和SB实例,它们交易的价差都是S1。同时运行SA和SB,SA和SB也应该可以独立地统计各自的持仓,也就是说它们的spread_pos也应该是不一样的,不应该相互干扰。

然而,我们可以发现SA对S1开仓成功后,SB并没有开仓过,可是我们发现SB的spread_pos已经变成和SA的spread_pos相同的数量!

有点迷糊,细想一下,是啊,谁让你交易了相同的价差标的呢?

不行就改,咱们按照价差S1的设置再创建一个价差S2,但是给它取一个不同的名称,区别一下!

接下来吧价差交易策略SB的标的该出S2,再次运行价差交易策略SB。

奇怪的现象发生了:SB并没有开仓过,可是SB的spread_pos仍然变成和SA的spread_pos相同的数量!

查看一下委托单:

其中"来源"一栏中的内容为 “SpreadTrading_价差名称”,就是这里过于简单,导致委托单只关联了价差,而没有关联价差交易策略名称,

所以在价差交易的SpreadTradeEngine引擎无法按照价差策略来推送类似委托单order,成交单trade和价差持仓信息等。

价差交易策略一旦发出委托,调用了SpreadStrategyTemplate的start_long_algo()或者start_short_algo(),而这两个函数最终调用了SpreadStrategyEngine的start_algo()

def start_algo(

self,

direction: Direction,

price: float,

volume: float,

payup: int,

interval: int,

lock: bool,

offset: Offset

) -> str:

""""""

if not self.trading:

return ""

algoid: str = self.strategy_engine.start_algo(

self,

self.spread_name, # 这里只有价差名称,没有传递策略名称

direction,

offset,

price,

volume,

payup,

interval,

lock

)

self.algoids.add(algoid)

return algoid这里只讨论原则性问题:

当然,这样的改动是大了些,可是已经存在目前的问题,修改是必须的!

例如下面的DemoStrategy价差策略的代码:

class DemoStrategy(SpreadStrategyTemplate):

"""

利用BOLL通道进行套利的一种价差交易

"""

author = "hxxjava"

bar_window = 5 # K线周期

boll_window = 26 # BOLL参数1

boll_dev = 2 # BOLL参数2

target_pos = 1 # 开仓数量

payup = 10

interval = 5

spread_pos = 0.0

boll_mid = None

boll_up = None

boll_down = None

sk_algoid:str = ""

bp_algoid:str = ""

bk_algoid:str = ""

sp_algoid:str = ""

parameters = [

"bar_window",

"boll_window",

"boll_dev",

"target_pos",

"payup",

"interval"

]

variables = [

"spread_pos",

"boll_mid",

"boll_up",

"boll_down",

"sk_algoid",

"bp_algoid",

"bk_algoid",

"sp_algoid"

]

def __init__(

self,

strategy_engine,

strategy_name: str,

spread: SpreadData,

setting: dict

):

""""""

super().__init__(

strategy_engine, strategy_name, spread, setting

)

self.bg = BarGenerator(self.on_spread_bar,self.bar_window,self.on_xmin_spread_bar)

self.am = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(days=10,callback=self.on_spread_bar)

def on_spread_bar(self,bar:BarData):

"""

Callback when 1 min spread bar data is generated.

"""

print(f"on_spread_bar bar={bar}") # 看看价差策略的bar长的是什么样子

self.bg.update_bar(bar)

。。。其他省略进去查找,原来问题出在这里:

DemoStrategy调用的load_bar()是从SpreadStrateyTemplate继承的,而SpreadStrateyTemplate是load_bar()又调用了strategy_engine的load_bar()。

strategy_engine的load_bar()的代码如下:

def load_bar(

self, spread: SpreadData, days: int, interval: Interval, callback: Callable

):

""""""

end = datetime.now()

start = end - timedelta(days)

bars = load_bar_data(spread, interval, start, end)

for bar in bars:

callback(bar)load_bar_data()的代码:

@lru_cache(maxsize=999)

def load_bar_data(

spread: SpreadData,

interval: Interval,

start: datetime,

end: datetime,

pricetick: float = 0

):

""""""

# Load bar data of each spread leg

leg_bars: Dict[str, Dict] = {}

for vt_symbol in spread.legs.keys():

symbol, exchange = extract_vt_symbol(vt_symbol)

bar_data: List[BarData] = database_manager.load_bar_data(

symbol, exchange, interval, start, end

)

bars: Dict[datetime, BarData] = {bar.datetime: bar for bar in bar_data}

leg_bars[vt_symbol] = bars

# Calculate spread bar data

spread_bars: List[BarData] = []

for dt in bars.keys():

spread_price = 0

spread_value = 0

spread_available = True

for leg in spread.legs.values():

leg_bar = leg_bars[leg.vt_symbol].get(dt, None)

if leg_bar:

price_multiplier = spread.price_multipliers[leg.vt_symbol]

spread_price += price_multiplier * leg_bar.close_price

spread_value += abs(price_multiplier) * leg_bar.close_price

else:

spread_available = False

if spread_available:

if pricetick:

spread_price = round_to(spread_price, pricetick)

spread_bar = BarData(

symbol=spread.name,

exchange=exchange.LOCAL,

datetime=dt,

interval=interval,

open_price=spread_price,

high_price=spread_price,

low_price=spread_price,

close_price=spread_price,

gateway_name="SPREAD",

)

spread_bar.value = spread_value

spread_bars.append(spread_bar)

return spread_bars原来load_bar_data()中只考虑了从本地数据库加载1分钟价差K线数据(当然是用价差组合中的多个合约的1分钟K线数据合成的)。

而我因为没有事先下载过rb2109.SHFE和rb2201.SHFE的合约的1分钟K线数据,所以加载不到这10天中的任何1分钟价差K线数据!

就算加载不到1分钟价差K线的原因已经找到,可是这样的设计仍然是有问题的:

鉴于以上的分析,把app\spread_trading\base.py做如下修改:

# hxxjava debug spread_trading

def query_bar_from_rq(

symbol: str, exchange: Exchange, interval: Interval, start: datetime, end: datetime

):

"""

Query bar data from RQData.

"""

from vnpy.trader.rqdata import rqdata_client

from vnpy.trader.object import HistoryRequest

if not rqdata_client.inited:

rqdata_client.init()

req = HistoryRequest(

symbol=symbol,

exchange=exchange,

interval=interval,

start=start,

end=end

)

data = rqdata_client.query_history(req)

return data@lru_cache(maxsize=999)

def load_bar_data(

spread: SpreadData,

interval: Interval,

start: datetime,

end: datetime,

pricetick: float = 0

):

""""""

# Load bar data of each spread leg

leg_bars: Dict[str, Dict] = {}

for vt_symbol in spread.legs.keys():

symbol, exchange = extract_vt_symbol(vt_symbol)

# hxxjava debug spread_trading

bar_data = query_bar_from_rq(

symbol=symbol, exchange=exchange,

interval=interval,start=start,end=end

)

# if bar_data:

# print(f"load {symbol}.{exchange} {interval} bar_data, len of = {len(bar_data)}")

if not bar_data:

bar_data: List[BarData] = database_manager.load_bar_data(

symbol, exchange, interval, start, end

)

bars: Dict[datetime, BarData] = {bar.datetime: bar for bar in bar_data}

leg_bars[vt_symbol] = bars

# Calculate spread bar data

spread_bars: List[BarData] = []

for dt in bars.keys():

spread_price = 0

spread_value = 0

spread_available = True

for leg in spread.legs.values():

leg_bar = leg_bars[leg.vt_symbol].get(dt, None)

if leg_bar:

price_multiplier = spread.price_multipliers[leg.vt_symbol]

spread_price += price_multiplier * leg_bar.close_price

spread_value += abs(price_multiplier) * leg_bar.close_price

else:

spread_available = False

if spread_available:

if pricetick:

spread_price = round_to(spread_price, pricetick)

spread_bar = BarData(

symbol=spread.name,

exchange=exchange.LOCAL,

datetime=dt,

interval=interval,

open_price=spread_price,

high_price=spread_price,

low_price=spread_price,

close_price=spread_price,

gateway_name="SPREAD",

)

spread_bar.value = spread_value

spread_bars.append(spread_bar)

return spread_bars看看 load_bar()从本地数据库加载的1分钟价差K线数据,如下所示:

你会发现其的成交量,volume=0,在使用过程从必须加以注意!

也就是说,需要成交量参与计算的指标是不可利用价差K线序列来计算的!

bar=BarData(gateway_name='SPREAD', symbol='rb2110&rb2201', exchange=<Exchange.LOCAL: 'LOCAL'>, datetime=datetime.datetime(2021, 6, 17, 11, 15, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>), interval=<Interval.MINUTE: '1m'>, volume=0, open_interest=0, open_price=109.0, high_price=109.0, low_price=109.0, close_price=109.0)

bar=BarData(gateway_name='SPREAD', symbol='rb2110&rb2201', exchange=<Exchange.LOCAL: 'LOCAL'>, datetime=datetime.datetime(2021, 6, 17, 11, 16, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>), interval=<Interval.MINUTE: '1m'>, volume=0, open_interest=0, open_price=108.0, high_price=108.0, low_price=108.0, close_price=108.0)

bar=BarData(gateway_name='SPREAD', symbol='rb2110&rb2201', exchange=<Exchange.LOCAL: 'LOCAL'>, datetime=datetime.datetime(2021, 6, 17, 11, 17, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>), interval=<Interval.MINUTE: '1m'>, volume=0, open_interest=0, open_price=106.0, high_price=106.0, low_price=106.0, close_price=106.0)建议在图中:

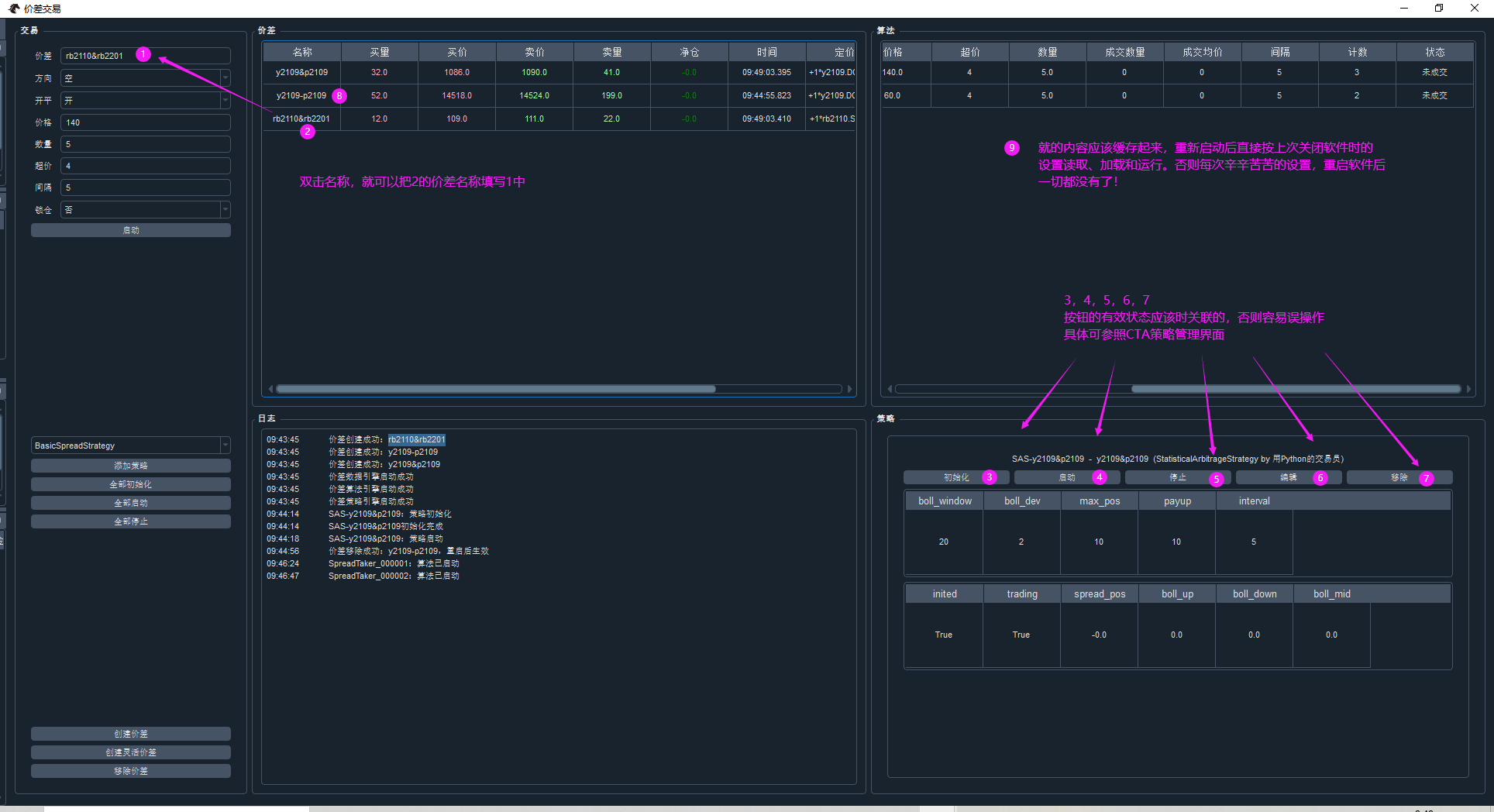

另外图中的⑧是创建错误的价差组合,软件运行删除,可是删除了之后还必须重新启动了之后才会消失,是否可以考虑直接有软件清除释放该价差组合?

这个组合策略实质上是价差交易。

我理解其本意是选择两个相关的合约进行价差交易,它有两个腿:leg1和leg2,将其leg1和leg2按照leg1_ratio和leg2_ratio设定的比例进行配比做出价差K线。

该组合的开仓信号为:

价差K线突破BOLL上轨或者上轨时,卖出leg1,买入leg2

价差K线突破BOLL上轨或者下轨时,买入leg1,卖出leg2

该组合的平仓信号为:

leg1有持多仓并且价差K线在BOLL中轨之上时,分别平仓leg1和leg2

leg1有持空仓并且价差K线在BOLL中轨之下时,分别平仓leg1和leg2

当leg1_ratio和leg2_ratio相等的时候,一起都没有毛病。

当leg1_ratio和leg2_ratio不相等的时候,就有问题了。你会发现它们开仓的数量总是一样多,这是不对的。

比如leg1为i2109.DCE, leg2为rb2110.DCE。

我们知道i2109的合约乘数是100,atr=2.7,而rb2109的合约乘数是10,atr=7.7,

leg2_ratio/leg1_ratio =(2.7100)/(7.710) ≈ 7/2

那么我们应该配比leg1_ratio=2和leg2_ratio=7,这意味着i2109.DCE开仓2手,就需要反向开仓rb2110.DCE 开仓7手。

因为价差的计算是这样的:

self.current_spread = (

leg1_bar.close_price * self.leg1_ratio - leg2_bar.close_price * self.leg2_ratio

)而实际开仓却是(1手,-1手)或(-1手,1手)的组合,与价差计算不符合。

代码如下,修改部分见注释:

from typing import List, Dict

from datetime import datetime

import numpy as np

from vnpy.app.portfolio_strategy import StrategyTemplate, StrategyEngine

from vnpy.trader.utility import BarGenerator

from vnpy.trader.object import TickData, BarData

class PairTradingStrategy(StrategyTemplate):

""""""

author = "用Python的交易员"

price_add = 5

boll_window = 20

boll_dev = 2

# fixed_size = 1 # 没有使用,去掉

leg1_ratio = 1

leg2_ratio = 1

leg1_symbol = ""

leg2_symbol = ""

current_spread = 0.0

boll_mid = 0.0

boll_down = 0.0

boll_up = 0.0

parameters = [

"price_add",

"boll_window",

"boll_dev",

# "fixed_size", # 没有使用,去掉

"leg1_ratio",

"leg2_ratio",

]

variables = [

"leg1_symbol",

"leg2_symbol",

"current_spread",

"boll_mid",

"boll_down",

"boll_up",

]

def __init__(

self,

strategy_engine: StrategyEngine,

strategy_name: str,

vt_symbols: List[str],

setting: dict

):

""""""

super().__init__(strategy_engine, strategy_name, vt_symbols, setting)

self.bgs: Dict[str, BarGenerator] = {}

self.targets: Dict[str, int] = {}

self.last_tick_time: datetime = None

self.spread_count: int = 0

self.spread_data: np.array = np.zeros(100)

# Obtain contract info

self.leg1_symbol, self.leg2_symbol = vt_symbols

def on_bar(bar: BarData):

""""""

pass

for vt_symbol in self.vt_symbols:

self.targets[vt_symbol] = 0

self.bgs[vt_symbol] = BarGenerator(on_bar)

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bars(1)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

if (

self.last_tick_time

and self.last_tick_time.minute != tick.datetime.minute

):

bars = {}

for vt_symbol, bg in self.bgs.items():

bars[vt_symbol] = bg.generate()

self.on_bars(bars)

bg: BarGenerator = self.bgs[tick.vt_symbol]

bg.update_tick(tick)

self.last_tick_time = tick.datetime

def on_bars(self, bars: Dict[str, BarData]):

""""""

self.cancel_all()

# Return if one leg data is missing

if self.leg1_symbol not in bars or self.leg2_symbol not in bars:

return

# Calculate current spread

leg1_bar = bars[self.leg1_symbol]

leg2_bar = bars[self.leg2_symbol]

# Filter time only run every 5 minutes

if (leg1_bar.datetime.minute + 1) % 5:

return

self.current_spread = (

leg1_bar.close_price * self.leg1_ratio - leg2_bar.close_price * self.leg2_ratio

)

# Update to spread array

self.spread_data[:-1] = self.spread_data[1:]

self.spread_data[-1] = self.current_spread

self.spread_count += 1

if self.spread_count <= self.boll_window:

return

# Calculate boll value

buf: np.array = self.spread_data[-self.boll_window:]

std = buf.std()

self.boll_mid = buf.mean()

self.boll_up = self.boll_mid + self.boll_dev * std

self.boll_down = self.boll_mid - self.boll_dev * std

# Calculate new target position

leg1_pos = self.get_pos(self.leg1_symbol)

if not leg1_pos:

if self.current_spread >= self.boll_up:

self.targets[self.leg1_symbol] = -1*self.leg1_ratio # hxxjava add *self.leg1_ratio

self.targets[self.leg2_symbol] = 1*self.leg2_ratio # hxxjava add *self.leg2_ratio

elif self.current_spread <= self.boll_down:

self.targets[self.leg1_symbol] = 1*self.leg1_ratio # hxxjava add *self.leg1_ratio

self.targets[self.leg2_symbol] = -1*self.leg2_ratio # hxxjava add *self.leg2_ratio

elif leg1_pos > 0:

if self.current_spread >= self.boll_mid:

self.targets[self.leg1_symbol] = 0

self.targets[self.leg2_symbol] = 0

else:

if self.current_spread <= self.boll_mid:

self.targets[self.leg1_symbol] = 0

self.targets[self.leg2_symbol] = 0

# Execute orders

for vt_symbol in self.vt_symbols:

target_pos = self.targets[vt_symbol]

current_pos = self.get_pos(vt_symbol)

pos_diff = target_pos - current_pos

volume = abs(pos_diff)

bar = bars[vt_symbol]

if pos_diff > 0:

price = bar.close_price + self.price_add

if current_pos < 0:

self.cover(vt_symbol, price, volume)

else:

self.buy(vt_symbol, price, volume)

elif pos_diff < 0:

price = bar.close_price - self.price_add

if current_pos > 0:

self.sell(vt_symbol, price, volume)

else:

self.short(vt_symbol, price, volume)

self.put_event()当leg1与leg2正相关时,leg1_ratio和leg2_ratio同为正整数;

当leg1与leg2负相关时,leg1_ratio为正整数和leg2_ratio同为负整数。

战略性聊天 wrote:

如题请问如何调用呢?谢谢

class NewArrayManager(ArrayManager):

def __init__(self, size: int = 100):

""""""

super().__init__(size)

def VWAP(self, n:int = 20, array: bool = True) -> Union[Tuple[float, float, float], np.ndarray]:

"""

定义VWAP指标

"""

close = self.close

vol = self.volume

vwap, vwap10, vwap20 = bnlib.VWAP(close, vol, n, array)

if array:

return vwap, vwap10, vwap20

else:

return vwap[-1], vwap10[-1], vwap20[-1] self.am = NewArrayMannager() vwap, vwap10, vwap20 = self.am.VWAP(n=20)那么 vwap, vwap10, vwap20 就分别表示20周期的vwap,vwap10表示10周期的vwap平均值,vwap20表示20周期的vwap平均值。

OnRtnInstrumentStatus

合约交易状态通知,主动推送。公有流回报。

各交易所的合约状态变化详见合约状态变化说明。

◇ 1.函数原型virtual void OnRtnInstrumentStatus(CThostFtdcInstrumentStatusField *pInstrumentStatus) {};struct CThostFtdcInstrumentStatusField

{

///交易所代码

TThostFtdcExchangeIDType ExchangeID;

///保留的无效字段

TThostFtdcOldExchangeInstIDType reserve1;

///结算组代码

TThostFtdcSettlementGroupIDType SettlementGroupID;

///保留的无效字段

TThostFtdcOldInstrumentIDType reserve2;

///合约交易状态

TThostFtdcInstrumentStatusType InstrumentStatus;

///交易阶段编号

TThostFtdcTradingSegmentSNType TradingSegmentSN;

///进入本状态时间

TThostFtdcTimeType EnterTime;

///进入本状态原因

TThostFtdcInstStatusEnterReasonType EnterReason;

///合约在交易所的代码

TThostFtdcExchangeInstIDType ExchangeInstID;

///合约代码

TThostFtdcInstrumentIDType InstrumentID;

};

EnterTime:只有郑商所的时间戳是CTP的本地时间,其他交易所的是交易所时间class CtaTemplate(ABC):

""""""

author = ""

parameters = []

variables = []

def __init__(

self,

cta_engine: Any,

strategy_name: str,

vt_symbol: str,

setting: dict,

):

""""""

self.cta_engine = cta_engine

self.strategy_name = strategy_name

self.vt_symbol = vt_symbol

self.inited = False

self.trading = False # 策略是否处于交易状态

self.pos = 0

... ... 其他略去你会发现self.trading除了初始化时赋值为False之外,并没有在CtaTemplate的任何其他地方被修改赋值。

我们的CTA策略都是从CtaTemplate模版扩展而来。当我们的CTA策略被实例化为运行策略时,self.trading就被缓冲到以CTA策略实例名称为文件名的json文件中。之后随着CTA策略被初始化、启动、停止,self.trading的状态在False和True之间做相应的变化,并调用put_event()函数写入json文件,调用sync_data()函数从json文件中读出。这两个函数中都是调用了self.cta_engine的功能。

def put_event(self):

"""

Put an strategy data event for ui update.

"""

if self.inited:

self.cta_engine.put_strategy_event(self) def sync_data(self):

"""

Sync strategy variables value into disk storage.

"""

if self.trading:

self.cta_engine.sync_strategy_data(self) def put_strategy_event(self, strategy: CtaTemplate):

"""

Put an event to update strategy status.

"""

data = strategy.get_data() # 策略的变量,包含的trading

event = Event(EVENT_CTA_STRATEGY, data)

self.event_engine.put(event) # 发送消息EVENT_CTA_STRATEGY给订阅者,通知策略变量变化了 def sync_strategy_data(self, strategy: CtaTemplate):

"""

Sync strategy data into json file.

"""

data = strategy.get_variables()

# 下面的两句把inited和trading都剔除了

data.pop("inited") # Strategy status (inited, trading) should not be synced.

data.pop("trading")

self.strategy_data[strategy.strategy_name] = data

save_json(self.data_filename, self.strategy_data) # 把其他策略变量写入json文件由上面的代码分析发现,策略的trading并没有考虑交易合约是否可以处在交易状态。

策略的trading是会影响到策略的委托行为的,下面是CtaTemplate的send_order()函数:

def send_order(

self,

direction: Direction,

offset: Offset,

price: float,

volume: float,

stop: bool = False,

lock: bool = False,

net: bool = False

):

"""

Send a new order.

"""

if self.trading: # 只要self.trading==True就可以委托

vt_orderids = self.cta_engine.send_order(

self, direction, offset, price, volume, stop, lock, net

)

return vt_orderids

else:

return []实际使用中会发现策略可能会在休市或者非交易时间,因为收到的错误数据而误动作,导致出现委托无法得到回应或者是拒单。

其原因也是因为作为委托条件的self.trading并没有考虑委托时刻,交易合约是否可以处在交易状态!

合约品种交易状态推送接口函数是onRtnInstrumentStatus()。

具体方法我已经在再谈集合竞价 里详细地讨论过了,文章很长,希望有耐心看完,这里就不再赘述。

注:其他网关接口也应该类似。

/////////////////////////////////////////////////////////////////////////

///TFtdcInstrumentStatusType是一个合约交易状态类型

/////////////////////////////////////////////////////////////////////////

///开盘前

#define THOST_FTDC_IS_BeforeTrading '0'

///非交易

#define THOST_FTDC_IS_NoTrading '1'

///连续交易

#define THOST_FTDC_IS_Continous '2'

///集合竞价报单

#define THOST_FTDC_IS_AuctionOrdering '3'

///集合竞价价格平衡

#define THOST_FTDC_IS_AuctionBalance '4'

///集合竞价撮合

#define THOST_FTDC_IS_AuctionMatch '5'

///收盘

#define THOST_FTDC_IS_Closed '6'

typedef char TThostFtdcInstrumentStatusType;只有在交易合约在“连续交易”和 “集合竞价报单”这两种状态下,同时交易者也启动了策略(trading==True)情况下,策略才可以执行委托。

也就是说 :委托执行条件 = 合约交易状态 + self.trading。

待续...

战略性聊天 wrote:

self.fast_ma0=fast_ma[-1]

请问-1是指最新的不断变化价格的均线还是当前时间点上一根的均线,谢谢

是根据已经完成的K线序列计算而得到的均线序列的最后一个,不是正在变化的临时K线不参与计算的。

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

tick_time = tick.datetime.time()

time1 = time(20,55,0)

time2 = time(21,0,1)

if time1 <= tick_time <= time2:

print(f"【集合竞价数据 tick_time={tick_time} tick={tick}】")

if ("IF" in tick.vt_symbol) and ("CFFEX" in tick.vt_symbol):

time1 = time(9,25,0)

time2 = time(9,30,1)

if time1 <= tick_time <= time2:

print(f"【集合竞价数据 tick_time={tick_time} tick={tick}】")

super().on_tick(tick)【集合竞价tick数据

tick_time=09:29:00.500000

tick=TickData(

gateway_name='CTP',

symbol='IF2107',

exchange=<Exchange.CFFEX: 'CFFEX'>,

datetime=datetime.datetime(2021, 6, 9, 9, 29, 0, 500000, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>),

name='沪深300指数2107',

volume=7,

open_interest=22276.0,

last_price=5183.8,

last_volume=0,

limit_up=5698.200000000001,

limit_down=4662.2,

open_price=5183.8,

high_price=5183.8,

low_price=5183.8,

pre_close=5184.0,

bid_price_1=5180.2,

bid_price_2=0,

bid_price_3=0,

bid_price_4=0,

bid_price_5=0,

ask_price_1=5184.0,

ask_price_2=0,

ask_price_3=0,

ask_price_4=0,

ask_price_5=0,

bid_volume_1=4,

bid_volume_2=0,

bid_volume_3=0,

bid_volume_4=0,

bid_volume_5=0,

ask_volume_1=3,

ask_volume_2=0,

ask_volume_3=0,

ask_volume_4=0,

ask_volume_5=0)】tick_time=09:30:00.500000

tick=TickData(

gateway_name='CTP',

symbol='IF2107',

exchange=<Exchange.CFFEX: 'CFFEX'>,

datetime=datetime.datetime(2021, 6, 9, 9, 30, 0, 500000, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>),

name='沪深300指数2107',

volume=10,

open_interest=22274.0,

last_price=5180.2,

last_volume=0,

limit_up=5698.200000000001,

limit_down=4662.2,

open_price=5183.8,

high_price=5183.8,

low_price=5180.2,

pre_close=5184.0,

bid_price_1=5180.2,

bid_price_2=0,

bid_price_3=0,

bid_price_4=0,

bid_price_5=0,

ask_price_1=5180.4,

ask_price_2=0,

ask_price_3=0,

ask_price_4=0,

ask_price_5=0,

bid_volume_1=2,

bid_volume_2=0,

bid_volume_3=0,

bid_volume_4=0,

bid_volume_5=0,

ask_volume_1=1,

ask_volume_2=0,

ask_volume_3=0,

ask_volume_4=0,

ask_volume_5=0)】tick_time=09:30:01

tick=TickData(

gateway_name='CTP',

symbol='IF2107',

exchange=<Exchange.CFFEX: 'CFFEX'>,

datetime=datetime.datetime(2021, 6, 9, 9, 30, 1, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>),

name='沪深300 指数2107',

volume=13,

open_interest=22272.0,

last_price=5180.2,

last_volume=0,

limit_up=5698.200000000001,

limit_down=4662.2,

open_price=5183.8,

high_price=5183.8,

low_price=5180.2,

pre_close=5184.0,

bid_price_1=5177.4,

bid_price_2=0,

bid_price_3=0,

bid_price_4=0,

bid_price_5=0,

ask_price_1=5179.2,

ask_price_2=0,

ask_price_3=0,

ask_price_4=0,

ask_price_5=0,

bid_volume_1=5,

bid_volume_2=0,

bid_volume_3=0,

bid_volume_4=0,

bid_volume_5=0,

ask_volume_1=1,

ask_volume_2=0,

ask_volume_3=0,

ask_volume_4=0,

ask_volume_5=0)】以白云机场为例,它的集合竞价是每个交易日的14:56-14:59,但是它这三分钟却只形成1根1分钟K线!

下面是白云机场的1分钟K线图:

由上图可知:

深交所的股票在集合竞价阶段1分钟K线就是3分钟时长,其它时段的又是1分钟;

上交所的股票在集合竞价阶段是没有1分钟K线的,它发生在9:25-9:29,却被合并到开市后的第一根1分钟K线中,也就是说这根K线代表的交易时长为5分钟。

国内期货日盘合约的集合竞价阶段发生在上午开市前5分钟的前4分钟内,却被合并到开市后的第一根1分钟K线中,也就是说这根K线代表的交易时长为5分钟。

国内期货夜盘合约的集合竞价阶段发生在前一交易日的夜间20:55-21:00的前4分钟内,却被合并到开市后的第一根1分钟K线中,也就是说这根K线代表的交易时长为5分钟。

这个问题我之前已经有文章讨论过了,需要修改是肯定的!

位于vnpy_ctp\api\include\ctp\ThostFtdcUserApiDataType.h

/////////////////////////////////////////////////////////////////////////

///TFtdcInstrumentStatusType是一个合约交易状态类型

/////////////////////////////////////////////////////////////////////////

///开盘前

#define THOST_FTDC_IS_BeforeTrading '0'

///非交易

#define THOST_FTDC_IS_NoTrading '1'

///连续交易

#define THOST_FTDC_IS_Continous '2'

///集合竞价报单

#define THOST_FTDC_IS_AuctionOrdering '3'

///集合竞价价格平衡

#define THOST_FTDC_IS_AuctionBalance '4'

///集合竞价撮合

#define THOST_FTDC_IS_AuctionMatch '5'

///收盘

#define THOST_FTDC_IS_Closed '6'

typedef char TThostFtdcInstrumentStatusType;

/////////////////////////////////////////////////////////////////////////

///TFtdcInstStatusEnterReasonType是一个品种进入交易状态原因类型

/////////////////////////////////////////////////////////////////////////

///自动切换

#define THOST_FTDC_IER_Automatic '1'

///手动切换

#define THOST_FTDC_IER_Manual '2'

///熔断

#define THOST_FTDC_IER_Fuse '3'

typedef char TThostFtdcInstStatusEnterReasonType;class InstrumentStatus(Enum):

"""

合约交易状态类型 hxxjava debug

"""

BEFORE_TRADING = "开盘前"

NO_TRADING = "非交易"

CONTINOUS = "连续交易"

AUCTION_ORDERING = "集合竞价报单"

AUCTION_BALANCE = "集合竞价价格平衡"

AUCTION_MATCH = "集合竞价撮合"

CLOSE = "收盘"@dataclass

class StatusData(BaseData):

"""

合约状态 hxxjava debug

"""

# 合约代码

symbol:str

# 交易所代码

exchange : Exchange

# 结算组代码

settlement_group_id : str = ""

# 合约交易状态

instrument_status : InstrumentStatus = None

# 交易阶段编号

trading_segment_sn : int = None

# 进入本状态时间

enter_time : str = ""

# 进入本状态原因

enter_reason : str = ""

# 合约在交易所的代码

exchange_inst_id : str = ""

def __post_init__(self):

""" """

self.vt_symbol = f"{self.symbol}.{self.exchange.value}"EVENT_STATUS = "eStatus" # hxxjava debug def on_status(self, status: StatusData) -> None: # hxxjava debug

"""

Instrument Status event push.

"""

self.on_event(EVENT_STATUS, status) def onRtnInstrumentStatus(self,data:dict):

"""

当接收到合约状态信息 # hxxjava debug

"""

if data:

status = StatusData(

symbol = data["InstrumentID"],

exchange = EXCHANGE_CTP2VT[data["ExchangeID"]],

settlement_group_id = data["SettlementGroupID"],

instrument_status = data["InstrumentStatus"],

trading_segment_sn = data["TradingSegmentSN"],

enter_time = data["EnterTime"],

enter_reason = data["EnterReason"],

exchange_inst_id = data["ExchangeInstID"],

gateway_name=self.gateway_name

)

# print(f"status = {status}")

self.gateway.on_status(status)status=StatusData(gateway_name='CTP', symbol='nr', exchange=<Exchange.INE: 'INE'>, settlement_group_id='00000001', instrument_status='1', trading_segment_sn=4, enter_time='19:58:37', enter_reason='1', exchange_inst_id='nr')

status=StatusData(gateway_name='CTP', symbol='lu', exchange=<Exchange.INE: 'INE'>, settlement_group_id='00000001', instrument_status='1', trading_segment_sn=4, enter_time='19:58:37', enter_reason='1', exchange_inst_id='lu')

status=StatusData(gateway_name='CTP', symbol='sc', exchange=<Exchange.INE: 'INE'>, settlement_group_id='00000001', instrument_status='1', trading_segment_sn=4, enter_time='19:58:37', enter_reason='1', exchange_inst_id='sc')

... ... 相同略去 内容太多,包括了这个CTP接口中所有合约品种的合约状态信息,其他省略了合约状态信息是有交易服务器推送到客户端的,其中包含如下的合约状态:

BEFORE_TRADING = "开盘前"

NO_TRADING = "非交易"

CONTINOUS = "连续交易"

AUCTION_ORDERING = "集合竞价报单"

AUCTION_BALANCE = "集合竞价价格平衡"

AUCTION_MATCH = "集合竞价撮合"

CLOSE = "收盘"

并且还有进入的时间和原因,这些信息正是我们解决BarGenerator在处理集合竞价时段的tick数据错误问题所需要的!

在vnpy\trader\engine.py文件中,为OmsEngine做如下的修改:

class OmsEngine(BaseEngine):

"""

Provides order management system function for VN Trader.

"""

def __init__(self, main_engine: MainEngine, event_engine: EventEngine):

""""""

super(OmsEngine, self).__init__(main_engine, event_engine, "oms")

self.ticks: Dict[str, TickData] = {}

self.orders: Dict[str, OrderData] = {}

self.trades: Dict[str, TradeData] = {}

self.positions: Dict[str, PositionData] = {}

self.accounts: Dict[str, AccountData] = {}

self.contracts: Dict[str, ContractData] = {}

self.statuses: Dict[str, StatusData] = {} # hxxjava debug

self.active_orders: Dict[str, OrderData] = {}

self.add_function()

self.register_event()

def add_function(self) -> None:

"""Add query function to main engine."""

self.main_engine.get_tick = self.get_tick

self.main_engine.get_order = self.get_order

self.main_engine.get_trade = self.get_trade

self.main_engine.get_position = self.get_position

self.main_engine.get_account = self.get_account

self.main_engine.get_contract = self.get_contract

self.main_engine.get_all_ticks = self.get_all_ticks

self.main_engine.get_all_orders = self.get_all_orders

self.main_engine.get_all_trades = self.get_all_trades

self.main_engine.get_all_positions = self.get_all_positions

self.main_engine.get_all_accounts = self.get_all_accounts

self.main_engine.get_all_contracts = self.get_all_contracts

self.main_engine.get_all_statuses = self.get_all_statuses # hxxjava debug

self.main_engine.get_all_active_orders = self.get_all_active_orders

def register_event(self) -> None:

""""""

self.event_engine.register(EVENT_TICK, self.process_tick_event)

self.event_engine.register(EVENT_ORDER, self.process_order_event)

self.event_engine.register(EVENT_TRADE, self.process_trade_event)

self.event_engine.register(EVENT_POSITION, self.process_position_event)

self.event_engine.register(EVENT_ACCOUNT, self.process_account_event)

self.event_engine.register(EVENT_CONTRACT, self.process_contract_event)

self.event_engine.register(EVENT_STATUS, self.process_status_event) # hxxjava debug

... ... 相同略去

def process_status_event(self, event: Event) -> None: # hxxjava debug

""""""

status = event.data

# print(f"got a status = {status}")

self.statuses[status.vt_symbol] = status

... ... 相同略去

def get_all_statuses(self) -> List[StatusData]: # hxxjava debug

"""

Get all status data.

"""

return list(self.statuses.values())

... ... 相同略去注意:

这个步骤的目的:

把CTP接口接收到的所有合约品种的状态信息保存到self.statuses字典中。

为系统的主引擎main_engine提供访问所有合约品种的状态信息函数get_all_statuses()

修改app\cta_strategy\engine.py文件中的CtaEngine,下面只给出主要的代码修改部分:

class CtaEngine(BaseEngine):

""""""

... ... 相同略去

def register_event(self):

""""""

self.event_engine.register(EVENT_TICK, self.process_tick_event)

self.event_engine.register(EVENT_ORDER, self.process_order_event)

self.event_engine.register(EVENT_TRADE, self.process_trade_event)

self.event_engine.register(EVENT_POSITION, self.process_position_event)

self.event_engine.register(EVENT_STATUS,self.process_status_event) # hxxjava debug

... ... 相同略去

def process_status_event(self,event:Event): # hxxjava debug

""" 分发合约某种状态信息到相应的策略 """

status:StatusData = event.data

for vt_symbol in self.symbol_strategy_map.keys():

symbol,exchange = extract_vt_symbol(vt_symbol)

instrument = left_alphas(symbol)

if (status.vt_symbol.upper() in [symbol.upper(),instrument.upper()]) and (status.exchange == exchange):

# 分发合约某种状态信息到相应的所有策略中

strategies = self.symbol_strategy_map[vt_symbol]

for strategy in strategies:

self.call_strategy_func(strategy, strategy.on_status, status)

... ... 相同略去在app\cta_strategy\template.py文件中,为cta_template模版增加下面的接口:

@virtual

def on_status(self, status: StatusData): # hxxjava debug

"""

Callback of status data

"""

pass简单举例如下:

def on_status(self, status: StatusData): # hxxjava debug

print(f"strategy {self.strategy_name} got a status event {status}")到这里,您可以让你的CTA策略在感知到策略正在交易的合约交易状态变化了。

具体如何使用合约交易状态信息, 这么做取决于您的需求了。举例如下:

在这个文件里:

vnpy_ctp\api\include\ctp\ThostFtdcUserApiStruct.h

定义如下:

///深度行情

struct CThostFtdcDepthMarketDataField

{

///交易日

TThostFtdcDateType TradingDay;

///保留的无效字段

TThostFtdcOldInstrumentIDType reserve1;

///交易所代码

TThostFtdcExchangeIDType ExchangeID;

///保留的无效字段

TThostFtdcOldExchangeInstIDType reserve2;

///最新价

TThostFtdcPriceType LastPrice;

///上次结算价

TThostFtdcPriceType PreSettlementPrice;

///昨收盘

TThostFtdcPriceType PreClosePrice;

///昨持仓量

TThostFtdcLargeVolumeType PreOpenInterest;

///今开盘

TThostFtdcPriceType OpenPrice;

///最高价

TThostFtdcPriceType HighestPrice;

///最低价

TThostFtdcPriceType LowestPrice;

///数量

TThostFtdcVolumeType Volume;

///成交金额

TThostFtdcMoneyType Turnover;

///持仓量

TThostFtdcLargeVolumeType OpenInterest;

///今收盘

TThostFtdcPriceType ClosePrice;

///本次结算价

TThostFtdcPriceType SettlementPrice;

///涨停板价

TThostFtdcPriceType UpperLimitPrice;

///跌停板价

TThostFtdcPriceType LowerLimitPrice;

///昨虚实度

TThostFtdcRatioType PreDelta;

///今虚实度

TThostFtdcRatioType CurrDelta;

///最后修改时间

TThostFtdcTimeType UpdateTime;

///最后修改毫秒

TThostFtdcMillisecType UpdateMillisec;

///申买价一

TThostFtdcPriceType BidPrice1;

///申买量一

TThostFtdcVolumeType BidVolume1;

///申卖价一

TThostFtdcPriceType AskPrice1;

///申卖量一

TThostFtdcVolumeType AskVolume1;

///申买价二

TThostFtdcPriceType BidPrice2;

///申买量二

TThostFtdcVolumeType BidVolume2;

///申卖价二

TThostFtdcPriceType AskPrice2;

///申卖量二

TThostFtdcVolumeType AskVolume2;

///申买价三

TThostFtdcPriceType BidPrice3;

///申买量三

TThostFtdcVolumeType BidVolume3;

///申卖价三

TThostFtdcPriceType AskPrice3;

///申卖量三

TThostFtdcVolumeType AskVolume3;

///申买价四

TThostFtdcPriceType BidPrice4;

///申买量四

TThostFtdcVolumeType BidVolume4;

///申卖价四

TThostFtdcPriceType AskPrice4;

///申卖量四

TThostFtdcVolumeType AskVolume4;

///申买价五

TThostFtdcPriceType BidPrice5;

///申买量五

TThostFtdcVolumeType BidVolume5;

///申卖价五

TThostFtdcPriceType AskPrice5;

///申卖量五

TThostFtdcVolumeType AskVolume5;

///当日均价

TThostFtdcPriceType AveragePrice;

///业务日期

TThostFtdcDateType ActionDay;

///合约代码

TThostFtdcInstrumentIDType InstrumentID;

///合约在交易所的代码

TThostFtdcExchangeInstIDType ExchangeInstID;

};linhertz wrote:

请问在币安也有同样的问题吗?是不是可以把 Int去掉就解决了这个问题。不过去掉Int之后,那么其他的策略,例如股指期货策略是不是会受影响?对于新手来讲怎么解决最好?

谢谢

不可以。因为去掉int虽然可以在PaperAccount模拟时能够下单,但是一旦实盘交易是无法开仓比合约资料中规定的最小手数的。