达哥242b4bb891d6461b wrote:

感谢分享!从中学到很多。

不过在以上代码中未发现有关TradingWidget定义的代码,望大佬分享。

答复:

有关TradingWidget定义的代码已经补上。

aqua-pink wrote:

您好,请问

发起条件单

cond_order = ConditionOrder(... ...)

self.send_condition_order(cond_order)这一部分的入参应该是什么样的?

可以作为on_trade()成交后设定条件单吗?

def execute(self,strategy:CtaTemplate):

"""

一段将交易指令转化为条件单的例子 ,其中:

self.price:开仓价

self.stop_price:止盈价

self.exit_price:止损价

"""

if self.offset == Offset.OPEN:

open_condition = Condition.LE if self.direction == Direction.LONG else Condition.BE

stop_condition = Condition.BT if self.direction == Direction.LONG else Condition.LT

exit_condition = Condition.LT if self.direction == Direction.LONG else Condition.BT

# 止盈条件单

stop_order = ConditionOrder(strategy_name=strategy.strategy_name,vt_symbol=self.vt_symbol,

direction=self.direction,offset=self.offset,

price=self.stop_price,volume=self.volume/2,condition=stop_condition)

# 开仓条件单

open_order = ConditionOrder(strategy_name=strategy.strategy_name,vt_symbol=self.vt_symbol,

direction=self.direction,offset=self.offset,

price=self.price,volume=self.volume,condition=open_condition)

# 止损条件单

exit_order = ConditionOrder(strategy_name=strategy.strategy_name,vt_symbol=self.vt_symbol,

direction=self.direction,offset=self.offset,

price=self.exit_price,volume=self.volume,condition=exit_condition)

for cond_order in [open_order,stop_order,exit_order]:

result = strategy.send_condition_order(cond_order)

print(f"{strategy.strategy_name}发送开仓条件单{'成功' if result else '成功'}:{cond_order}")

elif self.offset == Offset.CLOSE:

tj1 = self.direction == Direction.LONG and strategy.pos < 0

tj2 = self.direction == Direction.SHORT and strategy.pos > 0

if tj1 or tj2:

exit_condition = Condition.LT if self.direction == Direction.LONG else Condition.BT

exit_order = ConditionOrder(strategy_name=strategy.strategy_name,vt_symbol=self.vt_symbol,

direction=self.direction,offset=self.offset,

price=self.price,volume=abs(strategy.pos),condition=exit_condition,

execute_price=ExecutePrice.MARKET)

result = strategy.send_condition_order(exit_order)

print(f"{strategy.strategy_name}发送平仓条件单{'成功' if result else '成功'}:{exit_order}")G_will wrote:

当前默认的 tick 驱动 bar 合成,在一些非活跃合约上很不平滑,大概想直接用定时器估计更合适一些,但是估计需要考虑tick 接收时间误差、定时器周期准确等等。大佬有什么思路吗?

当你想以比市场价更高的价格买,或者以比市场价更低的价格卖时,使用send_order()是会立即执行的,但是用停止单却可以做到这一点,这是停止单的优点。

但是实际使用中停止单也是有缺点的:

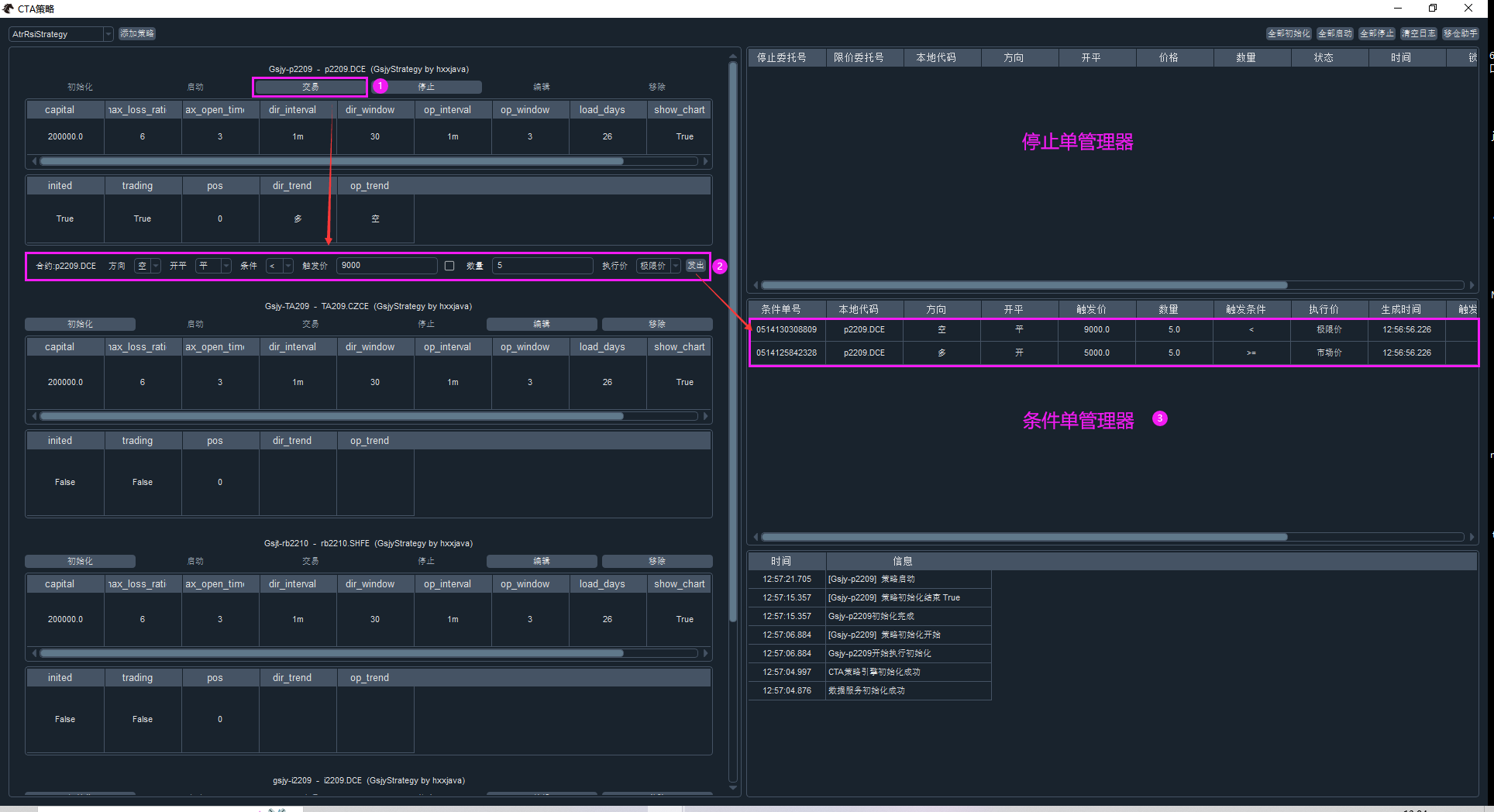

这是本人给它取的名字,它其实是本人以前提到的交易线(TradeLine)的改进和增强。

它主要就是为解决停止单上述缺点而设计的,当然应该具备上述优点。

在vnpy_ctastrategy\base.py中增加如下代码:

class Condition(Enum): # hxxjava add

""" 条件单的条件 """

BT = ">"

LT = "<"

BE = ">="

LE = "<="

class ExecutePrice(Enum): # hxxjava add

""" 执行价格 """

SETPRICE = "设定价"

MARKET = "市场价"

EXTREME = "极限价"

class CondOrderStatus(Enum): # hxxjava add

""" 条件单状态 """

WAITING = "等待中"

CANCELLED = "已撤销"

TRIGGERED = "已触发"

@dataclass

class ConditionOrder: # hxxjava add

""" 条件单 """

strategy_name: str

vt_symbol: str

direction: Direction

offset: Offset

price: float

volume: float

condition:Condition

execute_price:ExecutePrice = ExecutePrice.SETPRICE

create_time: datetime = datetime.now()

trigger_time: datetime = None

cond_orderid: str = "" # 条件单编号

status: CondOrderStatus = CondOrderStatus.WAITING

def __post_init__(self):

""" """

if not self.cond_orderid:

self.cond_orderid = datetime.now().strftime("%m%d%H%M%S%f")[:13]

EVENT_CONDITION_ORDER = "eConditionOrder" # hxxjava add修改vnpy_ctastrategy\ui\widget.py中的class CtaManager,代码如下:

class CtaManager(QtWidgets.QWidget):

""""""

signal_log: QtCore.Signal = QtCore.Signal(Event)

signal_strategy: QtCore.Signal = QtCore.Signal(Event)

def __init__(self, main_engine: MainEngine, event_engine: EventEngine) -> None:

""""""

super().__init__()

self.main_engine: MainEngine = main_engine

self.event_engine: EventEngine = event_engine

self.cta_engine: CtaEngine = main_engine.get_engine(APP_NAME)

self.managers: Dict[str, StrategyManager] = {}

self.init_ui()

self.register_event()

self.cta_engine.init_engine()

self.update_class_combo()

def init_ui(self) -> None:

""""""

self.setWindowTitle("CTA策略")

# Create widgets

self.class_combo: QtWidgets.QComboBox = QtWidgets.QComboBox()

add_button: QtWidgets.QPushButton = QtWidgets.QPushButton("添加策略")

add_button.clicked.connect(self.add_strategy)

init_button: QtWidgets.QPushButton = QtWidgets.QPushButton("全部初始化")

init_button.clicked.connect(self.cta_engine.init_all_strategies)

start_button: QtWidgets.QPushButton = QtWidgets.QPushButton("全部启动")

start_button.clicked.connect(self.cta_engine.start_all_strategies)

stop_button: QtWidgets.QPushButton = QtWidgets.QPushButton("全部停止")

stop_button.clicked.connect(self.cta_engine.stop_all_strategies)

clear_button: QtWidgets.QPushButton = QtWidgets.QPushButton("清空日志")

clear_button.clicked.connect(self.clear_log)

roll_button: QtWidgets.QPushButton = QtWidgets.QPushButton("移仓助手")

roll_button.clicked.connect(self.roll)

self.scroll_layout: QtWidgets.QVBoxLayout = QtWidgets.QVBoxLayout()

self.scroll_layout.addStretch()

scroll_widget: QtWidgets.QWidget = QtWidgets.QWidget()

scroll_widget.setLayout(self.scroll_layout)

self.scroll_area: QtWidgets.QScrollArea = QtWidgets.QScrollArea()

self.scroll_area.setWidgetResizable(True)

self.scroll_area.setWidget(scroll_widget)

self.log_monitor: LogMonitor = LogMonitor(self.main_engine, self.event_engine)

self.stop_order_monitor: StopOrderMonitor = StopOrderMonitor(

self.main_engine, self.event_engine

)

self.strategy_combo = QtWidgets.QComboBox()

self.strategy_combo.setMinimumWidth(200)

find_button = QtWidgets.QPushButton("查找")

find_button.clicked.connect(self.find_strategy)

# hxxjava add

self.condition_order_monitor = ConditionOrderMonitor(self.cta_engine)

# Set layout

hbox1: QtWidgets.QHBoxLayout = QtWidgets.QHBoxLayout()

hbox1.addWidget(self.class_combo)

hbox1.addWidget(add_button)

hbox1.addStretch()

hbox1.addWidget(self.strategy_combo)

hbox1.addWidget(find_button)

hbox1.addStretch()

hbox1.addWidget(init_button)

hbox1.addWidget(start_button)

hbox1.addWidget(stop_button)

hbox1.addWidget(clear_button)

hbox1.addWidget(roll_button)

grid = QtWidgets.QGridLayout()

# grid.addWidget(self.scroll_area, 0, 0, 2, 1)

grid.addWidget(self.scroll_area, 0, 0, 3, 1) # hxxjava change 3 rows , 1 column

grid.addWidget(self.stop_order_monitor, 0, 1)

grid.addWidget(self.condition_order_monitor, 1, 1) # hxxjava add

# grid.addWidget(self.log_monitor, 1, 1)

grid.addWidget(self.log_monitor, 2, 1) # hxxjava change

vbox: QtWidgets.QVBoxLayout = QtWidgets.QVBoxLayout()

vbox.addLayout(hbox1)

vbox.addLayout(grid)

self.setLayout(vbox)

def update_class_combo(self) -> None:

""""""

names = self.cta_engine.get_all_strategy_class_names()

names.sort()

self.class_combo.addItems(names)

def update_strategy_combo(self) -> None:

""""""

names = list(self.managers.keys())

names.sort()

self.strategy_combo.clear()

self.strategy_combo.addItems(names)

def register_event(self) -> None:

""""""

self.signal_strategy.connect(self.process_strategy_event)

self.event_engine.register(

EVENT_CTA_STRATEGY, self.signal_strategy.emit

)

def process_strategy_event(self, event) -> None:

"""

Update strategy status onto its monitor.

"""

data = event.data

strategy_name: str = data["strategy_name"]

if strategy_name in self.managers:

manager: StrategyManager = self.managers[strategy_name]

manager.update_data(data)

else:

manager: StrategyManager = StrategyManager(self, self.cta_engine, data)

self.scroll_layout.insertWidget(0, manager)

self.managers[strategy_name] = manager

self.update_strategy_combo()

def remove_strategy(self, strategy_name) -> None:

""""""

manager: StrategyManager = self.managers.pop(strategy_name)

manager.deleteLater()

self.update_strategy_combo()

def add_strategy(self) -> None:

""""""

class_name: str = str(self.class_combo.currentText())

if not class_name:

return

parameters: dict = self.cta_engine.get_strategy_class_parameters(class_name)

editor: SettingEditor = SettingEditor(parameters, class_name=class_name)

n: int = editor.exec_()

if n == editor.Accepted:

setting: dict = editor.get_setting()

vt_symbol: str = setting.pop("vt_symbol")

strategy_name: str = setting.pop("strategy_name")

self.cta_engine.add_strategy(

class_name, strategy_name, vt_symbol, setting

)

def find_strategy(self) -> None:

""""""

strategy_name = self.strategy_combo.currentText()

manager = self.managers[strategy_name]

self.scroll_area.ensureWidgetVisible(manager)

def clear_log(self) -> None:

""""""

self.log_monitor.setRowCount(0)

def show(self) -> None:

""""""

self.showMaximized()

def roll(self) -> None:

""""""

dialog: RolloverTool = RolloverTool(self)

dialog.exec_()在vnpy_ctastrategy\ui\widget.py中增加如下代码:

class ConditionOrderMonitor(BaseMonitor): # hxxjava add

"""

Monitor for condition order.

"""

event_type = EVENT_CONDITION_ORDER

data_key = "cond_orderid"

sorting = True

headers = {

"cond_orderid": {

"display": "条件单号",

"cell": BaseCell,

"update": False,

},

"vt_symbol": {"display": "本地代码", "cell": BaseCell, "update": False},

"direction": {"display": "方向", "cell": EnumCell, "update": False},

"offset": {"display": "开平", "cell": EnumCell, "update": False},

"price": {"display": "触发价", "cell": BaseCell, "update": False},

"volume": {"display": "数量", "cell": BaseCell, "update": False},

"condition": {"display": "触发条件", "cell": EnumCell, "update": False},

"execute_price": {"display": "执行价", "cell": EnumCell, "update": False},

"create_time": {"display": "生成时间", "cell": TimeCell, "update": False},

"trigger_time": {"display": "触发时间", "cell": TimeCell, "update": False},

"status": {"display": "状态", "cell": EnumCell, "update": True},

"strategy_name": {"display": "策略名称", "cell": BaseCell, "update": False},

}

def __init__(self,cta_engine : MyCtaEngine):

""""""

super().__init__(cta_engine.main_engine, cta_engine.event_engine)

self.cta_engine = cta_engine

def init_ui(self):

"""

Connect signal.

"""

super().init_ui()

self.setToolTip("双击单元格可停止条件单")

self.itemDoubleClicked.connect(self.stop_condition_order)

def stop_condition_order(self, cell):

"""

Stop algo if cell double clicked.

"""

order = cell.get_data()

if order:

self.cta_engine.cancel_condition_order(order.cond_orderid)修改策略管理器StrategyManager的代码如下:

class StrategyManager(QtWidgets.QFrame):

"""

Manager for a strategy

"""

def __init__(

self, cta_manager: CtaManager, cta_engine: CtaEngine, data: dict

):

""""""

super(StrategyManager, self).__init__()

self.cta_manager = cta_manager

self.cta_engine = cta_engine

self.strategy_name = data["strategy_name"]

self._data = data

self.tradetool : TradingWidget = None # hxxjava add

self.init_ui()

def init_ui(self):

""""""

self.setFixedHeight(300)

self.setFrameShape(self.Box)

self.setLineWidth(1)

self.init_button = QtWidgets.QPushButton("初始化")

self.init_button.clicked.connect(self.init_strategy)

self.start_button = QtWidgets.QPushButton("启动")

self.start_button.clicked.connect(self.start_strategy)

self.start_button.setEnabled(False)

self.stop_button = QtWidgets.QPushButton("停止")

self.stop_button.clicked.connect(self.stop_strategy)

self.stop_button.setEnabled(False)

self.trade_button = QtWidgets.QPushButton("交易") # hxxjava add

self.trade_button.clicked.connect(self.show_tradetool) # hxxjava add

self.trade_button.setEnabled(False) # hxxjava add

self.edit_button = QtWidgets.QPushButton("编辑")

self.edit_button.clicked.connect(self.edit_strategy)

self.remove_button = QtWidgets.QPushButton("移除")

self.remove_button.clicked.connect(self.remove_strategy)

strategy_name = self._data["strategy_name"]

vt_symbol = self._data["vt_symbol"]

class_name = self._data["class_name"]

author = self._data["author"]

label_text = (

f"{strategy_name} - {vt_symbol} ({class_name} by {author})"

)

label = QtWidgets.QLabel(label_text)

label.setAlignment(QtCore.Qt.AlignCenter)

self.parameters_monitor = DataMonitor(self._data["parameters"])

self.variables_monitor = DataMonitor(self._data["variables"])

hbox = QtWidgets.QHBoxLayout()

hbox.addWidget(self.init_button)

hbox.addWidget(self.start_button)

hbox.addWidget(self.trade_button) # hxxjava add

hbox.addWidget(self.stop_button)

hbox.addWidget(self.edit_button)

hbox.addWidget(self.remove_button)

# hxxjava change to self.vbox,old is vbox

self.vbox = QtWidgets.QVBoxLayout()

self.vbox.addWidget(label)

self.vbox.addLayout(hbox)

self.vbox.addWidget(self.parameters_monitor)

self.vbox.addWidget(self.variables_monitor)

self.setLayout(self.vbox)

def update_data(self, data: dict):

""""""

self._data = data

self.parameters_monitor.update_data(data["parameters"])

self.variables_monitor.update_data(data["variables"])

# Update button status

variables = data["variables"]

inited = variables["inited"]

trading = variables["trading"]

if not inited:

return

self.init_button.setEnabled(False)

if trading:

self.start_button.setEnabled(False)

self.trade_button.setEnabled(True) # hxxjava

self.stop_button.setEnabled(True)

self.edit_button.setEnabled(False)

self.remove_button.setEnabled(False)

else:

self.start_button.setEnabled(True)

self.trade_button.setEnabled(False) # hxxjava

self.stop_button.setEnabled(False)

self.edit_button.setEnabled(True)

self.remove_button.setEnabled(True)

def init_strategy(self):

""""""

self.cta_engine.init_strategy(self.strategy_name)

def start_strategy(self):

""""""

self.cta_engine.start_strategy(self.strategy_name)

def show_tradetool(self): # hxxjava add

""" 为策略显示交易工具 """

if not self.tradetool:

strategy = self.cta_engine.strategies.get(self.strategy_name,None)

if strategy and strategy.trading:

self.tradetool = TradingWidget(strategy,self.cta_engine.event_engine)

self.vbox.addWidget(self.tradetool)

else:

is_visible = self.tradetool.isVisible()

self.tradetool.setVisible(not is_visible)

def stop_strategy(self):

""""""

self.cta_engine.stop_strategy(self.strategy_name)

def edit_strategy(self):

""""""

strategy_name = self._data["strategy_name"]

parameters = self.cta_engine.get_strategy_parameters(strategy_name)

editor = SettingEditor(parameters, strategy_name=strategy_name)

n = editor.exec_()

if n == editor.Accepted:

setting = editor.get_setting()

self.cta_engine.edit_strategy(strategy_name, setting)

def remove_strategy(self):

""""""

result = self.cta_engine.remove_strategy(self.strategy_name)

# Only remove strategy gui manager if it has been removed from engine

if result:

self.cta_manager.remove_strategy(self.strategy_name)创建vnpy\usertools\trading_widget.py文件,其中内容:

"""

条件单交易组件

作者:hxxjava

日线:2022-5-10

"""

from vnpy.trader.ui import QtCore, QtWidgets, QtGui

from vnpy.trader.constant import Direction,Offset

from vnpy.trader.event import EVENT_TICK

from vnpy.event.engine import Event,EventEngine

from vnpy_ctastrategy.base import Condition,CondOrderStatus,ExecutePrice,ConditionOrder

from vnpy_ctastrategy.template import CtaTemplate

class TradingWidget(QtWidgets.QWidget):

"""

CTA strategy manual trading widget.

"""

signal_tick = QtCore.pyqtSignal(Event)

def __init__(self, strategy: CtaTemplate, event_engine: EventEngine):

""""""

super().__init__()

self.strategy: CtaTemplate = strategy

self.event_engine: EventEngine = event_engine

self.vt_symbol: str = strategy.vt_symbol

self.price_digits: int = 0

self.init_ui()

self.register_event()

def init_ui(self) -> None:

""""""

# 交易方向:多/空

self.direction_combo = QtWidgets.QComboBox()

self.direction_combo.addItems(

[Direction.LONG.value, Direction.SHORT.value])

# 开平选择:开/平

self.offset_combo = QtWidgets.QComboBox()

self.offset_combo.addItems([offset.value for offset in Offset])

# 条件类型

conditions = [Condition.BE,Condition.LE,Condition.BT,Condition.LT]

self.condition_combo = QtWidgets.QComboBox()

self.condition_combo.addItems(

[condition.value for condition in conditions])

double_validator = QtGui.QDoubleValidator()

double_validator.setBottom(0)

self.price_line = QtWidgets.QLineEdit()

self.price_line.setValidator(double_validator)

self.exit_line = QtWidgets.QLineEdit()

self.exit_line.setValidator(double_validator)

self.volume_line = QtWidgets.QLineEdit()

self.volume_line.setValidator(double_validator)

self.price_check = QtWidgets.QCheckBox()

self.price_check.setToolTip("设置价格随行情更新")

execute_prices = [ExecutePrice.SETPRICE,ExecutePrice.MARKET,ExecutePrice.EXTREME]

self.execute_price_combo = QtWidgets.QComboBox()

self.execute_price_combo.addItems(

[execute_price.value for execute_price in execute_prices])

send_button = QtWidgets.QPushButton("发出")

send_button.clicked.connect(self.send_condition_order)

hbox = QtWidgets.QHBoxLayout()

hbox.addWidget(QtWidgets.QLabel(f"合约:{self.vt_symbol}"))

hbox.addWidget(QtWidgets.QLabel("方向"))

hbox.addWidget(self.direction_combo)

hbox.addWidget(QtWidgets.QLabel("开平"))

hbox.addWidget(self.offset_combo)

hbox.addWidget(QtWidgets.QLabel("条件"))

hbox.addWidget(self.condition_combo)

hbox.addWidget(QtWidgets.QLabel("触发价"))

hbox.addWidget(self.price_line)

hbox.addWidget(self.price_check)

hbox.addWidget(QtWidgets.QLabel("数量"))

hbox.addWidget(self.volume_line)

hbox.addWidget(QtWidgets.QLabel("执行价"))

hbox.addWidget(self.execute_price_combo)

hbox.addWidget(send_button)

# Overall layout

self.setLayout(hbox)

def register_event(self) -> None:

""""""

self.signal_tick.connect(self.process_tick_event)

self.event_engine.register(EVENT_TICK, self.signal_tick.emit)

def process_tick_event(self, event: Event) -> None:

""""""

tick = event.data

if tick.vt_symbol != self.vt_symbol:

return

if self.price_check.isChecked():

self.price_line.setText(f"{tick.last_price}")

def send_condition_order(self) -> bool:

"""

Send new order manually.

"""

try:

direction = Direction(self.direction_combo.currentText())

offset = Offset(self.offset_combo.currentText())

condition = Condition(self.condition_combo.currentText())

price = float(self.price_line.text())

volume = float(self.volume_line.text())

execute_price = ExecutePrice(self.execute_price_combo.currentText())

order = ConditionOrder(

strategy_name = self.strategy.strategy_name,

vt_symbol=self.vt_symbol,

direction=direction,

offset=offset,

price=price,

volume=volume,

condition=condition,

execute_price=execute_price

)

self.strategy.send_condition_order(order=order)

print(f"发出条件单 : vt_symbol={self.vt_symbol},success ! {order}")

return True

except:

print(f"发出条件单 : vt_symbol={self.vt_symbol},input error !")

return False在vnpy_ctastrategy\engine.py中对CtaEngine进行如下扩展:

class MyCtaEngine(CtaEngine):

""" """

condition_filename = "condition_order.json" # 历史条件单存储文件

def __init__(self, main_engine: MainEngine, event_engine: EventEngine):

""""""

super().__init__(main_engine,event_engine)

self.condition_orders:Dict[str,ConditionOrder] = {} # strategy_name: dict

def load_active_condtion_orders(self):

""" """

return {}

def process_tick_event(self,event:Event):

""" 用tick的价格检查条件单 """

super().process_tick_event(event)

tick:TickData = event.data

all_condition_orders = [order for order in self.condition_orders.values() \

if order.vt_symbol == tick.vt_symbol and order.status == CondOrderStatus.WAITING]

for order in all_condition_orders:

# 检查条件单是否满足条件

self.check_condition_order(order,tick)

def check_condition_order(self,order:ConditionOrder,tick:TickData):

""" 检查条件单是否满足条件 """

strategy = self.strategies.get(order.strategy_name,None)

if not strategy or not strategy.trading:

return False

price = tick.last_price

is_be = order.condition == Condition.BE and price >= order.price

is_le = order.condition == Condition.LE and price <= order.price

is_bt = order.condition == Condition.BT and price > order.price

is_lt = order.condition == Condition.LT and price < order.price

if is_be or is_le or is_bt or is_lt:

# 满足触发条件

if order.execute_price == ExecutePrice.MARKET:

# 取市场价

price = tick.last_price

elif order.execute_price == ExecutePrice.EXTREME:

# 取极限价

price = tick.limit_up if order.direction == Direction.LONG else tick.limit_down

else:

# 取设定价

price = order.price

# 执行委托

order_ids = strategy.send_order(

direction = order.direction,

offset=order.offset,

price=price,

volume=order.volume

)

if order_ids:

order.trigger_time = tick.datetime

order.status = CondOrderStatus.TRIGGERED

self.event_engine.put(Event(EVENT_CONDITION_ORDER,order))

def send_condition_order(self,order:ConditionOrder):

""" """

strategy = self.strategies.get(order.strategy_name,None)

if not strategy or not strategy.trading:

return False

if order.cond_orderid not in self.condition_orders:

self.condition_orders[order.cond_orderid] = order

self.event_engine.put(Event(EVENT_CONDITION_ORDER,order))

return True

return False

def cancel_condition_order(self,cond_orderid:str):

""" """

order:ConditionOrder = self.condition_orders.get(cond_orderid,None)

if not order:

return False

order.status = CondOrderStatus.CANCELLED

self.event_engine.put(Event(EVENT_CONDITION_ORDER,order))

return True

def cancel_all_condition_orders(self,strategy_name:str):

""" """

for order in self.condition_orders.values():

if order.strategy_name == strategy_name and order.status == CondOrderStatus.WAITING:

order.status = CondOrderStatus.CANCELLED

self.call_strategy_func(strategy,strategy.on_condition_order)

self.event_engine.put(Event(EVENT_CONDITION_ORDER,order))

return True对vnpy_ctastrategy__init__.py中的CtaTemplate进行如下修改:

from .engine import MyCtaEngine # hxxjava addclass CtaStrategyApp(BaseApp):

""""""

app_name = APP_NAME

app_module = __module__

app_path = Path(__file__).parent

display_name = "CTA策略"

# engine_class = CtaEngine

engine_class = MyCtaEngine # hxxjava add

widget_name = "CtaManager"

icon_name = str(app_path.joinpath("ui", "cta.ico"))对vnpy_ctastrategy\template.py中的CtaTemplate进行如下扩展:

@virtual

def on_condition_order(self, cond_order: ConditionOrder):

"""

Callback of condition order update.

"""

pass

def send_condition_order(self,order:ConditionOrder): # hxxjava add

""" """

if not self.trading:

return False

return self.cta_engine.send_condition_order(order)

def cancel_condition_order(self,cond_orderid:str): # hxxjava add

""" """

return self.cta_engine.cancel_condition_order(cond_orderid)

def cancel_all_condition_orders(self): # hxxjava add

""" """

return self.cta_engine.cancel_all_condition_orders(self)1)CTA策略中的条件单被触发点回调通知:

def on_condition_order(self, cond_order: ConditionOrder):

"""

Callback of condition order update.

"""

print(f"条件单已经执行,cond_order = {cond_order}")2)发起条件单

cond_order = ConditionOrder(... ...)

self.send_condition_order(cond_order)3)取消条件单

self.cancel_condition_order(cond_orderid)4)取消策略的所有条件单

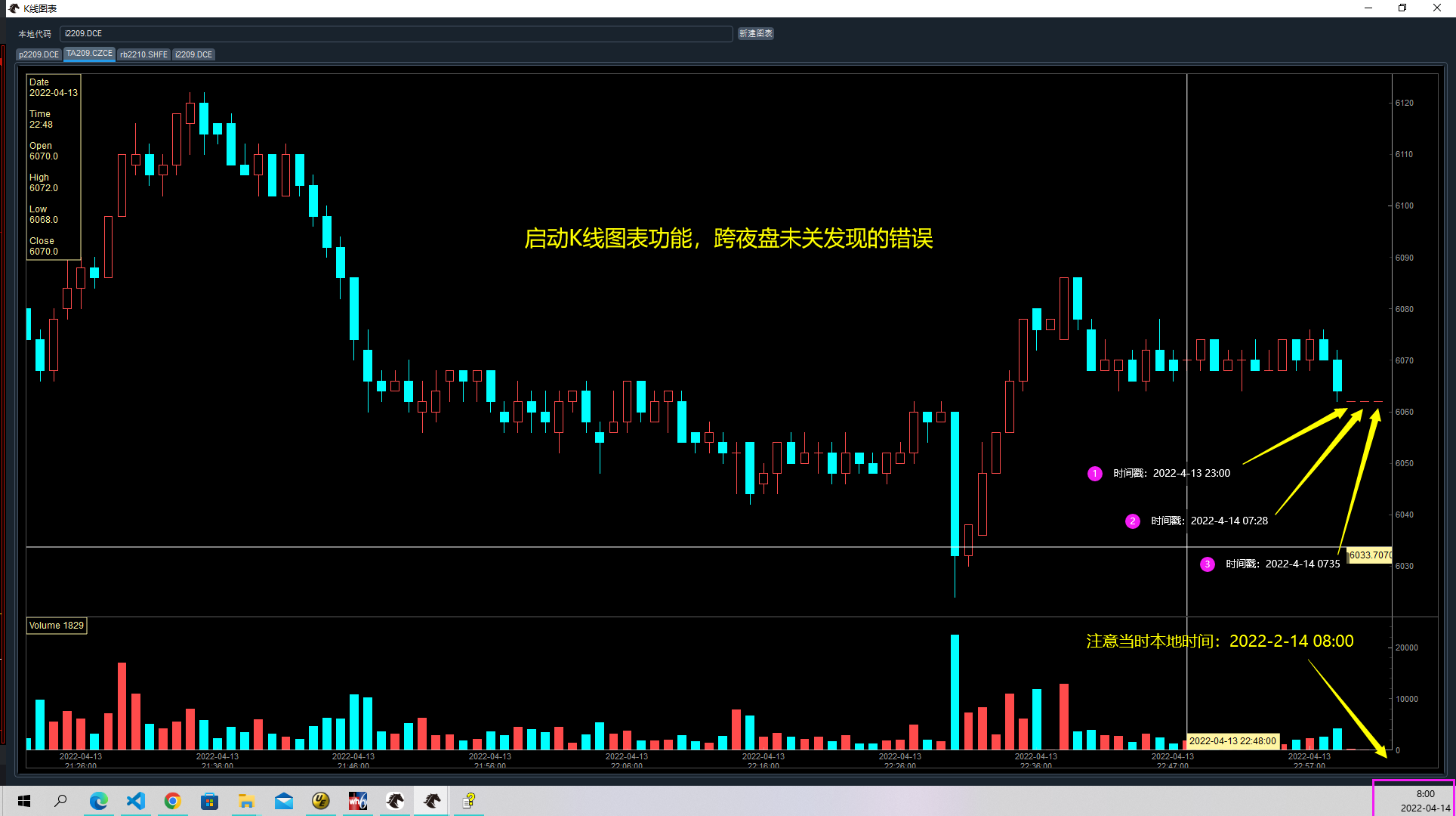

self.cancel_all_condition_orders()如果您在启动vntrader的时候勾选了【ChartWizard 实时K线图表模块】,您会简单主界面上vnpy系统提供的K线图表功能图标,进入该功能模块后就可以输入本地代码,新建K线图表了。

使用了该功能之后,你会发现它有如下缺点:

这样一个太简单的K线图表是远远满足了交易者对K线图表的需求的,有多少人使用就可想而知了。

绝大多数交易策略都是基于K线来实现的。可是很少部分是只在1分钟K线的基础上运行的,可能是n分钟,n小时,n天...,只能提供一分钟的K线图是不够用的。

所以应该提供用户如下的选择:

用户之所以想看K线图,可能是想看看自己策略的算法是否正确,这一般都是使用了一个或者多个运行在窗口K线上指标计算的值计算的入场和出场信号。

这也是可以显示的,而这种指标不可能全部是系统自带的指标显示控件能够涵盖的,所以应该有方法让用户自己增加自己的指标显示部件。

所以应该提供下面功能:

由于vnpy系统升级之最新的3.0版本,python底层的对象继承机制发生变化,导致原来的一部分绘图部件因为多继承而发生初始化失败,无法使用,必须升级。

近期不少vnpy的会员朋友不断地私信我,反映这些绘图部件用不了了,因为本人最近忙于交易策略的开发,无暇顾及,实在是抽不出时间,请大家谅解!

现在问题已经解决,可以放心使用。

修改vnpy\chart\manager.py中的BarManager,为它添加一个函数:

def get_bar_idx(self,trade_dt:datetime) -> int: # hxxjava add

"""

get the index of a bar which the trade time belongs to.

return:

-1 : belongs to none

0,1,... : bar's index

"""

a1 = np.array(sorted(self._datetime_index_map.keys()))

a2 = a1 <= trade_dt

return np.sum(a2 == True) - 1当然别忘了在该文件的引用部分添加下面的语句

import numpy as np # hxxjava addfrom datetime import datetime

from typing import List, Tuple, Dict

from vnpy.trader.ui import create_qapp, QtCore, QtGui, QtWidgets

from pyqtgraph import ScatterPlotItem

import pyqtgraph as pg

import numpy as np

import talib

import copy

from vnpy.chart import ChartWidget, VolumeItem, CandleItem

from vnpy.chart.item import ChartItem

from vnpy.chart.manager import BarManager

from vnpy.trader.object import (

BarData,

OrderData,

TradeData

)

from vnpy.trader.object import Direction, Exchange, Interval, Offset, Status, Product, OptionType, OrderType

class BarItem(CandleItem):

""" 美国线 """

BAR_WIDTH = 0.3

def __init__(self, manager: BarManager):

""""""

super().__init__(manager)

self.bar_pen: QtGui.QPen = pg.mkPen(color="w", width=2)

self.bar_brush: QtGui.QBrush = pg.mkBrush(color="w")

def _draw_bar_picture(self, ix: int, bar: BarData) -> QtGui.QPicture:

""""""

# Create objects

candle_picture = QtGui.QPicture()

painter = QtGui.QPainter(candle_picture)

# Set painter color

painter.setPen(self.bar_pen)

painter.setBrush(self.bar_brush)

open,high,low,close = bar.open_price,bar.high_price,bar.low_price,bar.close_price

painter.drawLine(QtCore.QPointF(ix - self.BAR_WIDTH, open),QtCore.QPointF(ix, open))

painter.drawLine(QtCore.QPointF(ix, high),QtCore.QPointF(ix, low))

painter.drawLine(QtCore.QPointF(ix + self.BAR_WIDTH, close),QtCore.QPointF(ix, close))

# Finish

painter.end()

return candle_picture

class LineItem(CandleItem):

""""""

def __init__(self, manager: BarManager):

""""""

super().__init__(manager)

self.white_pen: QtGui.QPen = pg.mkPen(color=(255, 255, 255), width=1)

def _draw_bar_picture(self, ix: int, bar: BarData) -> QtGui.QPicture:

""""""

last_bar = self._manager.get_bar(ix - 1)

# Create objects

picture = QtGui.QPicture()

painter = QtGui.QPainter(picture)

# Set painter color

painter.setPen(self.white_pen)

# Draw Line

end_point = QtCore.QPointF(ix, bar.close_price)

if last_bar:

start_point = QtCore.QPointF(ix - 1, last_bar.close_price)

else:

start_point = end_point

painter.drawLine(start_point, end_point)

# Finish

painter.end()

return picture

def get_info_text(self, ix: int) -> str:

""""""

text = ""

bar = self._manager.get_bar(ix)

if bar:

text = f"Close:{bar.close_price}"

return text

class SmaItem(CandleItem):

""""""

def __init__(self, manager: BarManager):

""""""

super().__init__(manager)

self.line_pen: QtGui.QPen = pg.mkPen(color=(100, 100, 255), width=2)

self.sma_window = 10

self.sma_data: Dict[int, float] = {}

def set_pen(self,pen:QtGui.QPen):

""" 设置绘图的笔 """

self.line_pen = pen

def set_sma_window(self,sma_window:int):

""" 设置Sma的窗口 """

self.sma_window = sma_window

def get_sma_value(self, ix: int) -> float:

""""""

if ix < 0:

return 0

# When initialize, calculate all rsi value

if not self.sma_data:

bars = self._manager.get_all_bars()

close_data = [bar.close_price for bar in bars]

sma_array = talib.SMA(np.array(close_data), self.sma_window)

for n, value in enumerate(sma_array):

self.sma_data[n] = value

# Return if already calcualted

if ix in self.sma_data:

return self.sma_data[ix]

# Else calculate new value

close_data = []

for n in range(ix - self.sma_window, ix + 1):

bar = self._manager.get_bar(n)

close_data.append(bar.close_price)

sma_array = talib.SMA(np.array(close_data), self.sma_window)

sma_value = sma_array[-1]

self.sma_data[ix] = sma_value

return sma_value

def _draw_bar_picture(self, ix: int, bar: BarData) -> QtGui.QPicture:

""""""

sma_value = self.get_sma_value(ix)

last_sma_value = self.get_sma_value(ix - 1)

# Create objects

picture = QtGui.QPicture()

painter = QtGui.QPainter(picture)

# Set painter color

painter.setPen(self.line_pen)

# Draw Line

start_point = QtCore.QPointF(ix-1, last_sma_value)

end_point = QtCore.QPointF(ix, sma_value)

painter.drawLine(start_point, end_point)

# Finish

painter.end()

return picture

def get_info_text(self, ix: int) -> str:

""""""

if ix in self.sma_data:

sma_value = self.sma_data[ix]

text = f"SMA{self.sma_window} {sma_value:.1f}"

else:

text = "SMA{self.sma_window} -"

return text

class RsiItem(ChartItem):

""""""

def __init__(self, manager: BarManager):

""""""

super().__init__(manager)

self.white_pen: QtGui.QPen = pg.mkPen(color=(255, 255, 255), width=1)

self.yellow_pen: QtGui.QPen = pg.mkPen(color=(255, 255, 0), width=2)

self.rsi_window = 14

self.rsi_data: Dict[int, float] = {}

def get_rsi_value(self, ix: int) -> float:

""""""

if ix < 0:

return 50

# When initialize, calculate all rsi value

if not self.rsi_data:

bars = self._manager.get_all_bars()

close_data = [bar.close_price for bar in bars]

rsi_array = talib.RSI(np.array(close_data), self.rsi_window)

for n, value in enumerate(rsi_array):

self.rsi_data[n] = value

# Return if already calcualted

if ix in self.rsi_data:

return self.rsi_data[ix]

# Else calculate new value

close_data = []

for n in range(ix - self.rsi_window, ix + 1):

bar = self._manager.get_bar(n)

close_data.append(bar.close_price)

rsi_array = talib.RSI(np.array(close_data), self.rsi_window)

rsi_value = rsi_array[-1]

self.rsi_data[ix] = rsi_value

return rsi_value

def _draw_bar_picture(self, ix: int, bar: BarData) -> QtGui.QPicture:

""""""

rsi_value = self.get_rsi_value(ix)

last_rsi_value = self.get_rsi_value(ix - 1)

# Create objects

picture = QtGui.QPicture()

painter = QtGui.QPainter(picture)

# Draw RSI line

painter.setPen(self.yellow_pen)

if np.isnan(last_rsi_value) or np.isnan(rsi_value):

# print(ix - 1, last_rsi_value,ix, rsi_value,)

pass

else:

end_point = QtCore.QPointF(ix, rsi_value)

start_point = QtCore.QPointF(ix - 1, last_rsi_value)

painter.drawLine(start_point, end_point)

# Draw oversold/overbought line

painter.setPen(self.white_pen)

painter.drawLine(

QtCore.QPointF(ix, 70),

QtCore.QPointF(ix - 1, 70),

)

painter.drawLine(

QtCore.QPointF(ix, 30),

QtCore.QPointF(ix - 1, 30),

)

# Finish

painter.end()

return picture

def boundingRect(self) -> QtCore.QRectF:

""""""

# min_price, max_price = self._manager.get_price_range()

rect = QtCore.QRectF(

0,

0,

len(self._bar_picutures),

100

)

return rect

def get_y_range( self, min_ix: int = None, max_ix: int = None) -> Tuple[float, float]:

""" """

return 0, 100

def get_info_text(self, ix: int) -> str:

""""""

if ix in self.rsi_data:

rsi_value = self.rsi_data[ix]

text = f"RSI {rsi_value:.1f}"

# print(text)

else:

text = "RSI -"

return text

def to_int(value: float) -> int:

""""""

return int(round(value, 0))

def adjust_range(in_range:Tuple[float, float])->Tuple[float, float]:

""" 将y方向的显示范围扩大到1.1 """

ret_range:Tuple[float, float]

diff = abs(in_range[0] - in_range[1])

ret_range = (in_range[0]-diff*0.05,in_range[1]+diff*0.05)

return ret_range

class MacdItem(ChartItem):

""""""

_values_ranges: Dict[Tuple[int, int], Tuple[float, float]] = {}

last_range:Tuple[int, int] = (-1,-1) # 最新显示K线索引范围

def __init__(self, manager: BarManager):

""""""

super().__init__(manager)

self.white_pen: QtGui.QPen = pg.mkPen(color=(255, 255, 255), width=1)

self.yellow_pen: QtGui.QPen = pg.mkPen(color=(255, 255, 0), width=1)

self.red_pen: QtGui.QPen = pg.mkPen(color=(255, 0, 0), width=1)

self.green_pen: QtGui.QPen = pg.mkPen(color=(0, 255, 0), width=1)

self.short_window = 12

self.long_window = 26

self.M = 9

self.macd_data: Dict[int, Tuple[float,float,float]] = {}

def get_macd_value(self, ix: int) -> Tuple[float,float,float]:

""""""

if ix < 0:

return (0.0,0.0,0.0)

# When initialize, calculate all macd value

if not self.macd_data:

bars = self._manager.get_all_bars()

close_data = [bar.close_price for bar in bars]

diffs,deas,macds = talib.MACD(np.array(close_data),

fastperiod=self.short_window,

slowperiod=self.long_window,

signalperiod=self.M)

for n in range(0,len(diffs)):

self.macd_data[n] = (diffs[n],deas[n],macds[n])

# Return if already calcualted

if ix in self.macd_data:

return self.macd_data[ix]

# Else calculate new value

close_data = []

for n in range(ix-self.long_window-self.M+1, ix + 1):

bar = self._manager.get_bar(n)

close_data.append(bar.close_price)

diffs,deas,macds = talib.MACD(np.array(close_data),

fastperiod=self.short_window,

slowperiod=self.long_window,

signalperiod=self.M)

diff,dea,macd = diffs[-1],deas[-1],macds[-1]

self.macd_data[ix] = (diff,dea,macd)

return (diff,dea,macd)

def _draw_bar_picture(self, ix: int, bar: BarData) -> QtGui.QPicture:

""""""

macd_value = self.get_macd_value(ix)

last_macd_value = self.get_macd_value(ix - 1)

# # Create objects

picture = QtGui.QPicture()

painter = QtGui.QPainter(picture)

# # Draw macd lines

if np.isnan(macd_value[0]) or np.isnan(last_macd_value[0]):

# print("略过macd lines0")

pass

else:

end_point0 = QtCore.QPointF(ix, macd_value[0])

start_point0 = QtCore.QPointF(ix - 1, last_macd_value[0])

painter.setPen(self.white_pen)

painter.drawLine(start_point0, end_point0)

if np.isnan(macd_value[1]) or np.isnan(last_macd_value[1]):

# print("略过macd lines1")

pass

else:

end_point1 = QtCore.QPointF(ix, macd_value[1])

start_point1 = QtCore.QPointF(ix - 1, last_macd_value[1])

painter.setPen(self.yellow_pen)

painter.drawLine(start_point1, end_point1)

if not np.isnan(macd_value[2]):

if (macd_value[2]>0):

painter.setPen(self.red_pen)

painter.setBrush(pg.mkBrush(255,0,0))

else:

painter.setPen(self.green_pen)

painter.setBrush(pg.mkBrush(0,255,0))

painter.drawRect(QtCore.QRectF(ix-0.3,0,0.6,macd_value[2]))

else:

# print("略过macd lines2")

pass

painter.end()

return picture

def boundingRect(self) -> QtCore.QRectF:

""""""

min_y, max_y = self.get_y_range()

rect = QtCore.QRectF(

0,

min_y,

len(self._bar_picutures),

max_y

)

return rect

def get_y_range(self, min_ix: int = None, max_ix: int = None) -> Tuple[float, float]:

# 获得3个指标在y轴方向的范围

# hxxjava 修改,2020-6-29

# 当显示范围改变时,min_ix,max_ix的值不为None,当显示范围不变时,min_ix,max_ix的值不为None,

offset = max(self.short_window,self.long_window) + self.M - 1

if not self.macd_data or len(self.macd_data) < offset:

# print(f'(min_ix,max_ix){(min_ix,max_ix)} offset={offset},len(self.macd_data)={len(self.macd_data)}')

# hxxjava 修改,2021-5-8,因为升级vnpy,其依赖的pyqtgraph版本也升级了,原来为return 0,1

return -100, 100

# print("len of range dict:",len(self._values_ranges),",macd_data:",len(self.macd_data),(min_ix,max_ix))

if min_ix != None: # 调整最小K线索引

min_ix = max(min_ix,offset)

if max_ix != None: # 调整最大K线索引

max_ix = min(max_ix, len(self.macd_data)-1)

last_range = (min_ix,max_ix) # 请求的最新范围

if last_range == (None,None): # 当显示范围不变时

if self.last_range in self._values_ranges:

# 如果y方向范围已经保存

# 读取y方向范围

result = self._values_ranges[self.last_range]

# print("1:",self.last_range,result)

return adjust_range(result)

else:

# 如果y方向范围没有保存

# 从macd_data重新计算y方向范围

min_ix,max_ix = 0,len(self.macd_data)-1

macd_list = list(self.macd_data.values())[min_ix:max_ix + 1]

ndarray = np.array(macd_list)

max_price = np.nanmax(ndarray)

min_price = np.nanmin(ndarray)

# 保存y方向范围,同时返回结果

result = (min_price, max_price)

self.last_range = (min_ix,max_ix)

self._values_ranges[self.last_range] = result

# print("2:",self.last_range,result)

return adjust_range(result)

""" 以下为显示范围变化时 """

if last_range in self._values_ranges:

# 该范围已经保存过y方向范围

# 取得y方向范围,返回结果

result = self._values_ranges[last_range]

# print("3:",last_range,result)

return adjust_range(result)

# 该范围没有保存过y方向范围

# 从macd_data重新计算y方向范围

macd_list = list(self.macd_data.values())[min_ix:max_ix + 1]

ndarray = np.array(macd_list)

max_price = np.nanmax(ndarray)

min_price = np.nanmin(ndarray)

# 取得y方向范围,返回结果

result = (min_price, max_price)

self.last_range = last_range

self._values_ranges[self.last_range] = result

# print("4:",self.last_range,result)

return adjust_range(result)

def get_info_text(self, ix: int) -> str:

""" """

barscount = len(self._manager._bars) # hxxjava debug

if ix in self.macd_data:

diff,dea,macd = self.macd_data[ix]

words = [

f"diff {diff:.3f}"," ",

f"dea {dea:.3f}"," ",

f"macd {macd:.3f}",

f"barscount={ix,barscount}"

]

text = "\n".join(words)

else:

text = "diff - \ndea - \nmacd -"

return text

def tip_func(x,y,data):

""" """

return f"{data}"

class BaseScatter(pg.ScatterPlotItem):

""" """

def __init__(self, plot:pg.PlotItem,manager:BarManager,*args, **kargs):

""" """

super().__init__(args=args,kargs=kargs)

self.plot = plot

self.manager = manager

self.plot.addItem(self)

self.opts['hoverable'] = True

def hoverEvent(self, ev):

""" """

if self.opts['hoverable']:

old = self.data['hovered']

if ev.exit:

new = np.zeros_like(self.data['hovered'])

else:

new = self._maskAt(ev.pos())

if self._hasHoverStyle():

self.data['sourceRect'][old ^ new] = 0

self.data['hovered'] = new

self.updateSpots()

points = self.points()[new][::-1]

# Show information about hovered points in a tool tip

vb = self.getViewBox()

if vb is not None and self.opts['tip'] is not None:

cutoff = 10

# tip = [self.opts['tip'](x=pt.pos().x(), y=pt.pos().y(), data=pt.data())

tip = [tip_func(x=pt.pos().x(), y=pt.pos().y(), data=pt.data()) for pt in points[:cutoff]]

if len(points) > cutoff:

tip.append('({} others...)'.format(len(points) - cutoff))

vb.setToolTip('\n\n'.join(tip))

self.sigHovered.emit(self, points, ev)

class TradeItem(BaseScatter):

""" 成交单绘图部件 """

TRADE_COLOR_MAP = {

(Direction.LONG,Offset.OPEN):'red',

(Direction.LONG,Offset.CLOSE):'magenta',

(Direction.LONG,Offset.CLOSETODAY):'magenta',

(Direction.LONG,Offset.CLOSEYESTERDAY):'magenta',

(Direction.SHORT,Offset.OPEN):'green',

(Direction.SHORT,Offset.CLOSE):'yellow',

(Direction.SHORT,Offset.CLOSETODAY):'yellow',

(Direction.SHORT,Offset.CLOSEYESTERDAY):'yellow',

}

TRADE_COMMAND_MAP = {

(Direction.LONG,Offset.OPEN):'买开',

(Direction.LONG,Offset.CLOSE):'买平',

(Direction.LONG,Offset.CLOSETODAY):'买平今',

(Direction.LONG,Offset.CLOSEYESTERDAY):'买平昨',

(Direction.SHORT,Offset.OPEN):'卖开',

(Direction.SHORT,Offset.CLOSE):'卖平',

(Direction.SHORT,Offset.CLOSETODAY):'卖平今',

(Direction.SHORT,Offset.CLOSEYESTERDAY):'卖平昨',

}

def __init__(self, plot:pg.PlotItem,manager:BarManager):

""" """

super().__init__(plot=plot,manager=manager,size=15, pxMode=True,pen=pg.mkPen(None), brush=pg.mkBrush(255, 255, 255, 120))

self.trades : List = []

def _to_scatter_data(self,trade:TradeData):

""" """

idx = self.manager.get_bar_idx(trade.datetime)

if idx == -1:

return {}

bar:BarData = self.manager.get_bar(idx)

color = self.TRADE_COLOR_MAP[(trade.direction,trade.offset)]

size = 10

LL,HH = self.manager.get_price_range()

y_adjustment = (HH-LL) * 0.01

if trade.direction == Direction.LONG:

symbol = 't1'

y = bar.low_price - y_adjustment

else:

symbol = 't'

y = bar.high_price + y_adjustment

# pen = pg.mkPen(QtGui.QColor(color))

# brush = pg.mkBrush(QtGui.QColor(color))

scatter_data = {

"pos": (idx, y),

"size": size,

"pen": color,

"brush": color,

"symbol": symbol,

"data": "成交单:{},单号:{},指令:{},价格:{},手数:{},时间:{}".format(

trade.vt_symbol,

trade.vt_tradeid,

self.TRADE_COMMAND_MAP[(trade.direction,trade.offset)],

trade.price,trade.volume,

trade.datetime.strftime('%Y-%m-%d %H:%M:%S')

)

}

return scatter_data

def add_trades(self, trades: List[TradeData]):

""""""

# 将trade转换为scatter数据

# self.updated = False

self.trades.extend(trades)

spots = []

for trade in self.trades:

scatter = self._to_scatter_data(trade)

if not scatter:

continue

spots.append(scatter)

# self.clear()

# self.plot.removeItem(self)

self.setData(spots,hoverable=True)

def add_trade(self,trade:TradeData):

""" """

self.trades.append(trade)

spots = []

for trade in self.trades:

scatter = self._to_scatter_data(trade)

if not scatter:

continue

spots.append(scatter)

# self.clear()

# self.plot.removeItem(self)

self.setData(spots,hoverable=True)

class OrderItem(BaseScatter):

""" 成交单绘图部件 """

ORDER_COLOR_MAP = {

(Direction.LONG,Offset.OPEN):'red',

(Direction.LONG,Offset.CLOSE):'magenta',

(Direction.LONG,Offset.CLOSETODAY):'magenta',

(Direction.LONG,Offset.CLOSEYESTERDAY):'magenta',

(Direction.SHORT,Offset.OPEN):'green',

(Direction.SHORT,Offset.CLOSE):'yellow',

(Direction.SHORT,Offset.CLOSETODAY):'yellow',

(Direction.SHORT,Offset.CLOSEYESTERDAY):'yellow',

}

ORDER_COMMAND_MAP = {

(Direction.LONG,Offset.OPEN):'买开',

(Direction.LONG,Offset.CLOSE):'买平',

(Direction.LONG,Offset.CLOSETODAY):'买平今',

(Direction.LONG,Offset.CLOSEYESTERDAY):'买平昨',

(Direction.SHORT,Offset.OPEN):'卖开',

(Direction.SHORT,Offset.CLOSE):'卖平',

(Direction.SHORT,Offset.CLOSETODAY):'卖平今',

(Direction.SHORT,Offset.CLOSEYESTERDAY):'卖平昨',

}

def __init__(self, plot:pg.PlotItem,manager:BarManager):

""" """

super().__init__(plot=plot,manager=manager,size=15, pxMode=True,pen=pg.mkPen(None), brush=pg.mkBrush(255, 255, 255, 120))

self.orders : List[OrderData] = []

def _to_scatter_data(self,order:OrderData):

""" """

if not order.datetime:

return {}

idx = self.manager.get_bar_idx(order.datetime)

if idx == -1:

return {}

bar:BarData = self.manager.get_bar(idx)

color = self.ORDER_COLOR_MAP[(order.direction,order.offset)]

size = 10

LL,HH = self.manager.get_price_range()

y_adjustment = (HH-LL) * 0.02

if order.direction == Direction.LONG:

symbol = 'o'

y = bar.low_price - y_adjustment

else:

symbol = 'o'

y = bar.high_price + y_adjustment

# pen = pg.mkPen(QtGui.QColor(color))

# brush = pg.mkBrush(QtGui.QColor(color))

scatter_data = {

"pos": (idx, y),

"size": size,

"pen": color,

"brush": color,

"symbol": symbol,

"data": "委托单:{},单号:{},指令:{},价格:{},手数:{},时间:{}".format(

order.vt_symbol,

order.vt_orderid,

self.ORDER_COMMAND_MAP[(order.direction,order.offset)],

order.price,order.volume,

order.datetime.strftime('%Y-%m-%d %H:%M:%S')

)

}

return scatter_data

def add_orders(self, orders: List[OrderData]):

""""""

# 将trade转换为scatter数据

# self.updated = False

filter_orders = [order for order in orders if order.datetime is not None and order.traded > 0]

if not filter_orders:

return

self.orders.extend(filter_orders)

spots = []

for order in self.orders:

scatter = self._to_scatter_data(order)

if not scatter:

continue

spots.append(scatter)

print(f"spots={spots}")

# self.clear()

# self.plot.removeItem(self)

self.setData(spots,hoverable=True)

def add_order(self,order:OrderData):

""" """

if order.datetime is None or order.traded == 0:

return

self.orders.append(order)

spots = []

for order in self.orders:

scatter = self._to_scatter_data(order)

if not scatter:

continue

spots.append(scatter)

print(f"spots={spots}")

# self.clear()

# self.plot.removeItem(self)

self.setData(spots,hoverable=True)创建OrderItem和TradeItem时,必须传递主图或者附图的plot和bar管理器BarManager,示例代码如下:

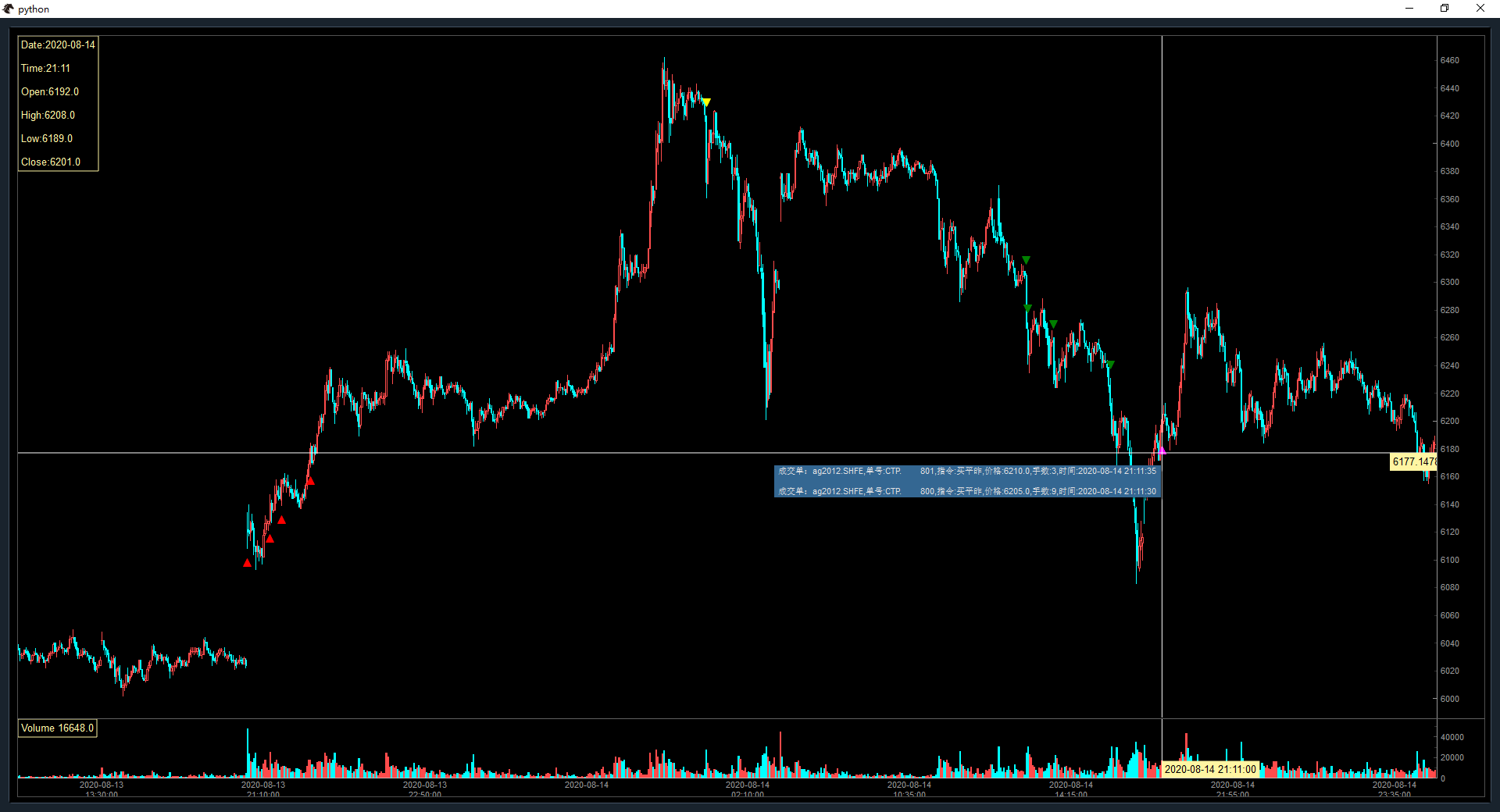

candle_plot = self.chart.get_plot('candle')

manager = self.chart._manager

self.trade_item:TradeItem = TradeItem(plot=candle_plot,manager=manager)当十字光标移动到成交单图标时,如果当根K线上发生过多次成交,你可能只看见一个图标,但其实是有多个图标被绘制的,这反应在图中的光标提示中,如图所示:

看效果图:

heavywater wrote:

大佬能解释一下get_tick_status吗?看了几遍都没看懂,主要是不明白里面的current_status和next_status是怎么确定的。多谢啦

def get_tick_status(self,tick:TickData):

"""

得到一个tick数据的合约所处交易状态

"""

status:StatusData = None

instrument = left_alphas(tick.symbol) # 提取tick所属的品种

tick_time = tick.datetime.strftime("%H:%M:%S")

vt_symbol = f"{instrument}.{tick.exchange.value}" # 例如:rb.SHFE,TA.CZCE,因为状态字典是按 "品种.交易所" 为字典键值的

if vt_symbol in self.trade_status_map:

status_dict = self.trade_status_map[vt_symbol]

curr_key = status_dict["current"] # 得到当前交易状态的键值,当前状态是有CTP接口收到状态时更新的,这里只是使用

next_key = status_dict["next"] # 得到下一个交易状态的键值,当前状态是有CTP接口收到状态时更新的,这里只是使用,

# 使用一个完整交易日后,它就是会肯定指向一个有意义的值了

curr_status:StatusData = status_dict[curr_key] # 得到当前交易状态

next_status:StatusData = status_dict[next_key] # 得到下一个交易状态

if curr_status.enter_time < next_status.enter_time:

# 交易时间段不跨日

if curr_status.enter_time <= tick_time < next_status.enter_time:

status = curr_status

elif next_status.enter_time <= tick_time:

# 超过了当前时间段和下一时间段的开始时间,并且在下一个交易时间段开始时间之后,认为是找到了

# 正确的前提条件是,current和next状态的更是是正常的。

status = next_status

else:

# 交易时间段跨日

if curr_status.enter_time <= tick_time:

status = curr_status

elif next_status.enter_time <= tick_time:

status = next_status

return status交易时间段是对客户端委托是否有效的规定,不是对行情播报的限制。

但是反过来行情又是客户委托最终成交的果,因为某种原因导致对撮合成功超过交易时间段的截止时间,可是交易所仍然要报告结果,这种结果一般会在几秒内就结束了。

打个比方:

知道,是因为3.0版本升级,导致OrderItem和TradeItem的多继承出了问题。

目前没有时间,等有空再重写这两个主图组件就可以了。

尽管此时还是没有开盘,甚至还没有开始集合竞价,可是您的策略已经从on_tick()接口被推送了一个tick,而且该tick的时间不是当天下午的收盘,也不是您订阅该合约的时间 ! 我把这个tick打印出来了,请看:

TickData(

gateway_name='CTP',

symbol='TA205',

exchange=<Exchange.CZCE: 'CZCE'>,

datetime=datetime.datetime(2022, 4, 12, 20, 1, 18, 500000, tzinfo=<DstTzInfo 'Asia/Shanghai' CST+8:00:00 STD>),

name='精对苯二甲酸205',

volume=0,

turnover=0.0,

open_interest=441112.0,

last_price=6128.0,

last_volume=0,

limit_up=6374.0,

limit_down=5538.0,

open_price=0,

high_price=0,

low_price=0,

pre_close=6128.0,

bid_price_1=0,

bid_price_2=0,

bid_price_3=0,

bid_price_4=0,

bid_price_5=0,

ask_price_1=0,

ask_price_2=0,

ask_price_3=0,

ask_price_4=0,

ask_price_5=0,

bid_volume_1=0,

bid_volume_2=0,

bid_volume_3=0,

bid_volume_4=0,

bid_volume_5=0,

ask_volume_1=0,

ask_volume_2=0,

ask_volume_3=0,

ask_volume_4=0,

ask_volume_5=0,

localtime=None

)很快开始集合竞价,在20:59的时候,策略可能又会收到一个包含开盘价的tick。

1分钟后是21:00,正式进入连续竞价阶段,策略又会收到等多的tick。

为了后面叙述的方便,我们把20:50时收到tick叫tick1,20:59时收到tick叫tick2。

假如CTA策略使用了30分钟K线,那么随着集合竞价结束,在21:00的时候,策略中的BarGeneraor对象,就会为您生成两个莫名其妙的30分钟K线:

启动策略不到10分钟时间,就已经虚多了2个30分钟K线。

CTA策略的初始化是由CtaEngine驱动的,其执行逻辑在vnpy_ctastrategy\engine的CtaEngine._init_strategy()中:

def _init_strategy(self, strategy_name: str):

"""

Init strategies in queue.

"""

strategy = self.strategies[strategy_name]

if strategy.inited:

self.write_log(f"{strategy_name}已经完成初始化,禁止重复操作")

return

self.write_log(f"{strategy_name}开始执行初始化")

# Call on_init function of strategy

self.call_strategy_func(strategy, strategy.on_init)

# Restore strategy data(variables)

data = self.strategy_data.get(strategy_name, None)

if data:

for name in strategy.variables:

value = data.get(name, None)

if value is not None:

setattr(strategy, name, value)

# Subscribe market data

contract = self.main_engine.get_contract(strategy.vt_symbol)

if contract:

req = SubscribeRequest(

symbol=contract.symbol, exchange=contract.exchange)

self.main_engine.subscribe(req, contract.gateway_name)

else:

self.write_log(f"行情订阅失败,找不到合约{strategy.vt_symbol}", strategy)

# Put event to update init completed status.

strategy.inited = True

self.put_strategy_event(strategy)

self.write_log(f"{strategy_name}初始化完成")_init_strategy()执行过程是先为策略加载历史数据,再订阅策略交易合约的行情。

要想解决问题,就必须问题的根源在哪里?

因为订阅合约行情执行的是CtpMdApi的subscribe():

def subscribe(self, req: SubscribeRequest) -> None:

"""订阅行情"""

if self.login_status:

self.subscribeMarketData(req.symbol)

self.subscribed.add(req.symbol)self.subscribeMarketData(req.symbol)只要是首次订阅,接口都会立即从OnRtnDepthMarketData推送1个该合约最新的深度行情通知,而时间是:

///最后修改时间

TThostFtdcTimeType UpdateTime;

///最后修改毫秒

TThostFtdcMillisecType UpdateMillisec;这里的最后修改时间和最后修改毫秒本应该是该合约最后交易的时间,也可能是交易所行情服务器中CTP行情接口重新打开的时间!这就是为什么我们开动tick1的时间是2022-4-12 20:1:18.500000的原因。

TA205.CZCE在每个交易日的集合竞价时段的第4分钟会产生一个集合竞价tick。

你可能会说这个没有毛病,从20:30~21:00,确实是可以生成一个30分钟K线,为什么它不可以只包含一个tick呢?

这么说也过得去,可是问题是咱们在加载其他历史数据的时候,无论我们使用米筐、tushare或者什么其他第三方历史数据时,加载的1分钟K线,从来都没有这样的数据。

或者我们把策略产生的30分钟K线与通达信、大智慧或者文华6等软件生成的30分钟K线比较一下,它们都是没有出现这第二个30分钟K线情况的。从这种种也可以看出来这个tick的处理是不对的,tick2必须归入到21:00~21:30。

struct CThostFtdcDepthMarketDataField

{

///交易日

TThostFtdcDateType TradingDay;

///合约代码

TThostFtdcInstrumentIDType InstrumentID;

///交易所代码

TThostFtdcExchangeIDType ExchangeID;

///合约在交易所的代码

TThostFtdcExchangeInstIDType ExchangeInstID;

///最新价

TThostFtdcPriceType LastPrice;

///上次结算价

TThostFtdcPriceType PreSettlementPrice;

///昨收盘

TThostFtdcPriceType PreClosePrice;

///昨持仓量

TThostFtdcLargeVolumeType PreOpenInterest;

///今开盘

TThostFtdcPriceType OpenPrice;

///最高价

TThostFtdcPriceType HighestPrice;

///最低价

TThostFtdcPriceType LowestPrice;

///数量

TThostFtdcVolumeType Volume;

///成交金额

TThostFtdcMoneyType Turnover;

///持仓量

TThostFtdcLargeVolumeType OpenInterest;

///今收盘

TThostFtdcPriceType ClosePrice;

///本次结算价

TThostFtdcPriceType SettlementPrice;

///涨停板价

TThostFtdcPriceType UpperLimitPrice;

///跌停板价

TThostFtdcPriceType LowerLimitPrice;

///昨虚实度

TThostFtdcRatioType PreDelta;

///今虚实度

TThostFtdcRatioType CurrDelta;

///最后修改时间

TThostFtdcTimeType UpdateTime;

///最后修改毫秒

TThostFtdcMillisecType UpdateMillisec;

///申买价一

TThostFtdcPriceType BidPrice1;

///申买量一

TThostFtdcVolumeType BidVolume1;

///申卖价一

TThostFtdcPriceType AskPrice1;

///申卖量一

TThostFtdcVolumeType AskVolume1;

///申买价二

TThostFtdcPriceType BidPrice2;

///申买量二

TThostFtdcVolumeType BidVolume2;

///申卖价二

TThostFtdcPriceType AskPrice2;

///申卖量二

TThostFtdcVolumeType AskVolume2;

///申买价三

TThostFtdcPriceType BidPrice3;

///申买量三

TThostFtdcVolumeType BidVolume3;

///申卖价三

TThostFtdcPriceType AskPrice3;

///申卖量三

TThostFtdcVolumeType AskVolume3;

///申买价四

TThostFtdcPriceType BidPrice4;

///申买量四

TThostFtdcVolumeType BidVolume4;

///申卖价四

TThostFtdcPriceType AskPrice4;

///申卖量四

TThostFtdcVolumeType AskVolume4;

///申买价五

TThostFtdcPriceType BidPrice5;

///申买量五

TThostFtdcVolumeType BidVolume5;

///申卖价五

TThostFtdcPriceType AskPrice5;

///申卖量五

TThostFtdcVolumeType AskVolume5;

///当日均价

TThostFtdcPriceType AveragePrice;

///业务日期

TThostFtdcDateType ActionDay;

};其中 UpdateMillisec 为最后修改毫秒,int型

错误和不合适之处已经改正,见注释:

def onRtnDepthMarketData(self, data: dict) -> None:

"""行情数据推送"""

# 过滤没有时间戳的异常行情数据

if not data["UpdateTime"]:

return

# 过滤还没有收到合约数据前的行情推送

symbol: str = data["InstrumentID"]

contract: ContractData = symbol_contract_map.get(symbol, None)

if not contract:

return

# 对大商所的交易日字段取本地日期

if not data["ActionDay"] or contract.exchange == Exchange.DCE:

# 这里废了那么大的劲,却使用了一个更新滞后的变量,属实不应该

# self.current_date是由定时器几秒更新一次,

# 对于一些跨夜品种,会导致几秒钟的tick的日期错误

# date_str: str = self.current_date

date_str: str = datetime.now().strftime("%Y%m%d") # hxxjava change

else:

date_str: str = data["ActionDay"]

# 这里不好,为什么要故意降低接口的时间精度,放着毫秒不要而费劲地变化为0.1秒精度?

# timestamp: str = f"{date_str} {data['UpdateTime']}.{int(data['UpdateMillisec']/100)}"

timestamp: str = f"{date_str} {data['UpdateTime']}." + str(data['UpdateMillisec']*1000).zfill(6) # hxxjava edit

dt: datetime = datetime.strptime(timestamp, "%Y%m%d %H:%M:%S.%f")

dt: datetime = CHINA_TZ.localize(dt)

tick: TickData = TickData(

symbol=symbol,

exchange=contract.exchange,

datetime=dt,

name=contract.name,

volume=data["Volume"],

turnover=data["Turnover"],

open_interest=data["OpenInterest"],

last_price=adjust_price(data["LastPrice"]),

limit_up=data["UpperLimitPrice"],

limit_down=data["LowerLimitPrice"],

open_price=adjust_price(data["OpenPrice"]),

high_price=adjust_price(data["HighestPrice"]),

low_price=adjust_price(data["LowestPrice"]),

pre_close=adjust_price(data["PreClosePrice"]),

bid_price_1=adjust_price(data["BidPrice1"]),

ask_price_1=adjust_price(data["AskPrice1"]),

bid_volume_1=data["BidVolume1"],

ask_volume_1=data["AskVolume1"],

gateway_name=self.gateway_name

)

if data["BidVolume2"] or data["AskVolume2"]:

tick.bid_price_2 = adjust_price(data["BidPrice2"])

tick.bid_price_3 = adjust_price(data["BidPrice3"])

tick.bid_price_4 = adjust_price(data["BidPrice4"])

tick.bid_price_5 = adjust_price(data["BidPrice5"])

tick.ask_price_2 = adjust_price(data["AskPrice2"])

tick.ask_price_3 = adjust_price(data["AskPrice3"])

tick.ask_price_4 = adjust_price(data["AskPrice4"])

tick.ask_price_5 = adjust_price(data["AskPrice5"])

tick.bid_volume_2 = data["BidVolume2"]

tick.bid_volume_3 = data["BidVolume3"]

tick.bid_volume_4 = data["BidVolume4"]

tick.bid_volume_5 = data["BidVolume5"]

tick.ask_volume_2 = data["AskVolume2"]

tick.ask_volume_3 = data["AskVolume3"]

tick.ask_volume_4 = data["AskVolume4"]

tick.ask_volume_5 = data["AskVolume5"]

self.gateway.on_tick(tick)文章太长,再分一贴吧。

一个合约的交易时间段信息,就包含在一个字符串中。通常看起来是这样的:

"21:00-23:00,09:00-10:15,10:30-11:30,13:30-15:00"它看似简单,实则非常复杂!简单在于它只是一个字符串,其实它能够表达非常复杂的交易时间规定。例如交易时间可以少到只有1段,也可以4到5个段,可跨日,也可以跨多日,如遇到周末或者长假。但是长假太难处理了,我们这也不处理各种各样的假日规定,因为那个太复杂了!不过好在时下很多软件,著名的和非著名的软件,几乎都不处理跨长假的问题,不处理的原因也是和我分析的一样,不过这也没有影响他们多软件被广大用户接受的程度。所以我们也不处理跨长假的问题。

当然想处理跨长假也不成,条件不具备呀。因为毕竟我们不是交易所,不知道各种各样的休假规定,不同市场,不同国家的节假日,千奇百怪,太难处理了。而且我们也不能说不处理哪个市场或者国家的投资品种吧?绝大部分软件都不处理长假对K线对齐方式的影响,原因就在于此,没有什么别的说辞!

在vnpy\usertools下创建一个名称为trading_hours.py,其代码如下:

"""

本文件主要实现合约的交易时间段:TradingHours

作者:hxxjava

日期:2022-03-28

修改:2022-06-09 修改内容:TradingHours的get_intraday_window()处理时间段错误

"""

from calendar import month

from typing import Callable,List,Dict, Tuple, Union

from enum import Enum

from datetime import datetime,date,timedelta, tzinfo

import numpy as np

import pytz

CHINA_TZ = pytz.timezone("Asia/Shanghai")

from vnpy.trader.constant import Interval

def to_china_tz(dt: datetime) -> datetime:

"""

Convert a datetime object to a CHINA_TZ localize datetime object

"""

return CHINA_TZ.localize(dt.replace(tzinfo=None))

INTERVAL_MAP = {

Interval.MINUTE:60,

Interval.HOUR:3600,

Interval.DAILY:3600*24,

Interval.WEEKLY:3600*24*7,

}

def get_time_segments(trading_hours:str) -> List:

"""

从交易时间段字符串中提取出各段的起止时间(天内的秒数) 列表

"""

time_sepments = []

# 提取各段

str_segments = trading_hours.split(',')

pre_start,day_offset = None,0

for s in reversed(str_segments): # 反向遍历各段

# 提取段的起止时间

start,stop = s.split('-')

# 计算开始时间天内秒

hh,mm = start.split(':')

start_s = int(hh)*3600+int(mm)*60

# 计算截止时间天内秒

hh,mm = stop.split(':')

stop_s = int(hh)*3600+int(mm)*60

if pre_start and start > pre_start:

day_offset -= 1

pre_start = start

# 加入列表

time_sepments.insert(0,(day_offset,start_s,stop_s))

return time_sepments

def in_segments(trade_segments:List,trade_dt:datetime):

""" 判断一个时间是否在一个交易时间段列表中 """

trade_dt = to_china_tz(trade_dt)

for start,stop in trade_segments:

if start <= trade_dt < stop:

return True

return False

class TradingHours(object):

"""

交易时间段处理

"""

def __init__(self,trading_hours:str):

"""

初始化函数 。

参数说明:

trading_hours:交易时间段字符串,例如:"21:00-23:00,09:00-10:15,10:30-11:30,13:30-15:00"

pre_open: 集合竞价时段长度,单位分钟。例如:国内期货pre_open=5

after_close: 交易日收盘后结算时长。例如国内期货持续到15:20,那么after_close=20

"""

self.time_segments:List[Tuple[int,int,int]] = get_time_segments(trading_hours)

def day_trade_time(self,interval:Interval) -> int:

"""

一个交易日的交易时长,单位由interval 规定,不足的部分+1

"""

seconds = 0.0

for _,start,stop in self.time_segments:

seconds += stop - start + (0 if start < stop else INTERVAL_MAP[Interval.DAILY])

if not interval:

return seconds

else:

return np.ceil(seconds/INTERVAL_MAP[interval])

def get_auction_closes_segments(self,trade_dt:datetime) -> Tuple[date,List]:

"""

得到一个交易时间所在的交易日及集合竞价时间段和所有休市时段的列表

"""

if not self.auction_closes:

return (None,[])

trade_dt = to_china_tz(trade_dt)

dates = [trade_dt.date()+timedelta(days=i) for i in range(-3,4)]

# 根据 self.auction_closes 构造出一周内的日期时间格式的非连续交易时间段字典

week_seqments = {

dt:

[(to_china_tz(datetime(dt.year,dt.month,dt.day))+timedelta(days=days-(2 if days == -1 and dt.weekday()==0 else 0),seconds=start),

to_china_tz(datetime(dt.year,dt.month,dt.day))+timedelta(days=days-(2 if days == -1 and dt.weekday()==0 else 0)+(1 if start>stop else 0),seconds=stop))

for days,start,stop in self.auction_closes]

for dt in dates if dt.weekday() not in [5,6]

}

# 在非交易时间段字典中查找trade_dt所在集合竞价时间段,确定所属交易日

for dt,datetime_segments in week_seqments.items():

# 遍历一周中的每日

if in_segments(datetime_segments,trade_dt):

return (dt,datetime_segments)

return (None,[])

def get_trade_hours(self,trade_dt:datetime) -> Tuple[date,List[Tuple[datetime,datetime]]]:

"""

得到一个时间的交易日及日期时间格式的交易时间段列表,无效交易时间返回空

"""

# 构造trade_dt加前后三天共7的日期

trade_dt = to_china_tz(trade_dt)

dates = [trade_dt.date()+timedelta(days=i) for i in range(-3,4)]

# 根据 self.time_segments 构造出一周内的日期时间格式的交易时间段字典

week_seqments = {

dt:

[(to_china_tz(datetime(dt.year,dt.month,dt.day))+timedelta(days=days-(2 if days == -1 and dt.weekday()==0 else 0),seconds=start),

to_china_tz(datetime(dt.year,dt.month,dt.day))+timedelta(days=days-(2 if days == -1 and dt.weekday()==0 else 0)+(1 if start>stop else 0),seconds=stop))

for days,start,stop in self.time_segments]

for dt in dates if dt.weekday() not in [5,6]

}

trade_day,trading_segments = None,[]

# 在交易时间段字典中查找trade_dt所在交易时间段,确定所属交易日

for dt,datetime_segments in week_seqments.items():

# 遍历一周中的每日

for start,stop in datetime_segments:

# 遍历一日中的每个交易时间段

if start <= trade_dt < stop:

# 找到了,确定dt为trade_dt的交易日

trade_day = dt

break

if trade_day:

# 已经找到,停止

trading_segments = datetime_segments

break

return (trade_day,trading_segments)

def get_trading_segments(self,tradeday:date): # List[Tuple[datetime,datetime]]

"""

得到某个交易日的就要时间段。注:只考虑周末,不考虑法定假

"""

segments = []

weekday = tradeday.weekday()

if weekday not in [5,6]:

# 周一至周五

# 周一跨日需插入2天

insert_days = -2 if tradeday.weekday() == 0 else 0

y,m,d = tradeday.year,tradeday.month,tradeday.day

for day,start,stop in self.time_segments:

days = insert_days + day if day < 0 else day

start_dt = datetime(y,m,d,0,0,0) + timedelta(days=days,seconds=start)

stop_dt = datetime(y,m,d,0,0,0) + timedelta(days=days+(0 if start < stop else 1),seconds=stop)

segments.append((start_dt,stop_dt))

return segments

def get_intraday_window(self,trade_dt:datetime,window:int) -> Tuple[date,List[Tuple[datetime,datetime]]]:

"""

得到一个时间的日内交易时间、窗口索引、窗口开始时间和截止时间

"""

trade_dt = to_china_tz(trade_dt)

interval = Interval.MINUTE

oneday_minutes = self.day_trade_time(interval)

if window > oneday_minutes:

raise f"In day window can't exceed {oneday_minutes} minutes !"

result = (None,[])

if window == 0:

# window==0 无意义

return result

# 求dt的交易日

trade_day,segment_datetimes = self.get_trade_hours(trade_dt)

if not trade_day:

# 无效的交易日

return result

if np.sum([start <= trade_dt < stop for start,stop in segment_datetimes]) == 0:

# 如果dt不在各个交易时间段内为无效的交易时间

return result

# 交易日的开盘时间

t0 = segment_datetimes[0][0]

# 构造各个交易时间段的起止数组

starts = np.array([(seg_dt[0]-t0).seconds*1.0 for seg_dt in segment_datetimes])

stops = np.array([(seg_dt[1]-t0).seconds*1.0 for seg_dt in segment_datetimes])

# 求dt在交易日中的自然时间

nature_t = (trade_dt - t0).seconds

# 求dt已经走过的交易时间

traded_t = np.sum(nature_t - starts[starts<=nature_t]) - np.sum(nature_t-stops[stops<nature_t])

if traded_t < 0:

# 开盘之前的为无效交易时间

return result

# 求当前所在窗口的宽度、索引、开始交易时间及截止时间

window_width = window * INTERVAL_MAP[interval]

window_idx = np.floor(traded_t/window_width)

window_start = window_idx * window_width

window_stop = window_start + window_width

# 求各个交易时间段的宽度

segment_widths = stops - starts

# print("!!!3",window_start,window_stop,segment_widths)

# 求各个交易时间段累计日内交易时间

sums = [np.sum(segment_widths[:(i+1)]) for i in range(len(segment_widths))]

if window_stop > sums[-1]:

# 不可以跨日处理

window_stop = sums[-1]

# 累计日内交易时间数组

seg_sum = np.array(sums)

# 每段开始累计日内交易时间数组

seg_start_sum = np.array([0] + sums)

# 求窗口开始和截止时间的时间段索引

s1,s2 = seg_sum - window_start,seg_sum - window_stop

start_idx,stop_idx = np.sum(s1 <= 0),np.sum(s2<0)

# 求窗口开始和截止时间的在其时间段中的偏移量

start_offset = (window_start-seg_start_sum)[start_idx]

stop_offset = (window_stop-seg_start_sum)[stop_idx]

# 求窗口包含的时间片段列表

window_segments = []

for idx in range(start_idx,stop_idx+1):

start,stop = segment_datetimes[idx]

t1 = start + timedelta(seconds=start_offset) if idx == start_idx else start

t2 = start + timedelta(seconds=stop_offset) if idx == stop_idx else stop

window_segments.append((t1,t2))

# 窗口所属交易日及包含的时间片段列表

result = (trade_day,window_segments)

return result

def get_week_tradedays(self,trade_dt:datetime) -> List[date]:

""" 得到一个交易时间所在周的交易日 """

trade_dt = to_china_tz(trade_dt)

trade_day,trade_segments = self.get_trade_hours(trade_dt)

if not trade_day:

return []

monday = trade_dt.date() - timedelta(days=trade_dt.weekday())

week_dates = [monday + timedelta(days=i) for i in range(5)]

if trade_day not in week_dates:

next_7days = [(trade_dt + timedelta(days=i+1)) for i in range(7)]

week_dates = [day.date() for day in next_7days if day.weekday() not in [5,6]]

return week_dates

def get_month_tradedays(self,trade_dt:datetime) -> List[date]:

""" 得到一个交易时间所在月的交易日 """

trade_dt = to_china_tz(trade_dt)

trade_day,trade_segments = self.get_trade_hours(trade_dt)

if not trade_day:

return []

first_day = date(year=trade_day.year,month=trade_day.month,day=1)

this_month = trade_day.month

days32 = [first_day + timedelta(days = i) for i in range(32)]

month_dates = [day for day in days32 if day.weekday() not in [5,6] and day.month==this_month]

return month_dates

def get_year_tradedays(self,trade_dt:datetime) -> List[date]:

""" 得到一个交易时间所在年的交易日 """

trade_dt = to_china_tz(trade_dt)

trade_day,trade_segments = self.get_trade_hours(trade_dt)

if not trade_day:

return []

new_years_day = date(year=trade_day.year,month=1,day=1)

this_year = trade_day.year

days366 = [new_years_day + timedelta(days = i) for i in range(366)]

trade_dates = [day for day in days366 if day.weekday() not in [5,6] and day.year==this_year]

return trade_dates

def has_night_tradetime(self) -> bool:

""" 有夜盘交易时间吗? """

for (days,start,stop) in self.time_segments:

if start >= 18*INTERVAL_MAP(Interval.HOUR):

return True

return False

def has_day_tradetime(self) -> bool:

""" 有日盘交易时间吗 ? """

for (days,start,stop) in self.time_segments:

if start < 18*INTERVAL_MAP(Interval.HOUR):

return True

return False先给它取个名称,就叫MyBarGenerator吧,它是对BarGenerator的扩展。

不过在构思MyBarGenerator的时候,我发现它其实不应该叫“日内对齐等交易时长K线生成器”。因为我们不应该只局限于日内的n分钟K线生成器,难道vnpy系统就不应该、不能够或者不使用日线以上的K线了吗?我们只能够使用日内K线进行量化交易吗?难道大家都没有过这方面的需求吗?我想答案是否定的。

那好,所幸就设计一个全功能的K线生成器:MyBarGenerator。

为此我们需要扩展Interval的定义,因为Interval是表示K线周期的常量,可是它的格局不够,最大只能到周一级WEEKLY。也就是说您用目前的Interval是没有办法表达月和年这样的周期的。

class Interval(Enum):

"""

Interval of bar data.

"""

MINUTE = "1m"

HOUR = "1h"

DAILY = "d"

WEEKLY = "w"

TICK = "tick"

MONTHLY = "month" # hxxjava add

YEARLY = "year" # hxxjava add顺便在这里吐槽一下BarGenerator:

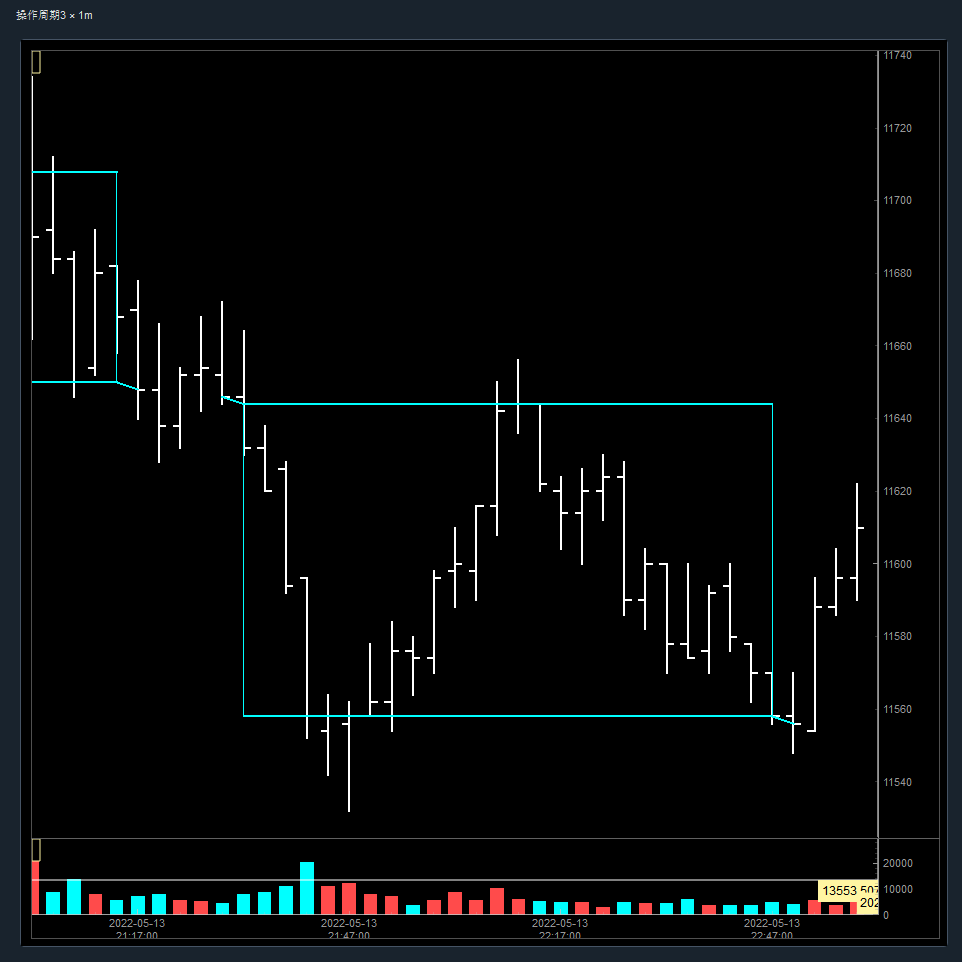

在系统且并详细分析之后,把K线分类为:日内K线、日K线,周K线、月K线及年K线等周期K线五类。

1)日内K线包括1~n分钟K线,如1分钟、n分钟两类,其中n小于正常交易日的最大交易分钟数。日内K线取消对小时周期单位支持,因为可以通过n分钟的方式来实现。如:

2)日K线:每个交易日产生一个,它包含一到多个交易时间段。根据是否包含夜盘交易时间段,又可以分为跨日K线和不跨日K线。

3)周K线:由周一至周五中所有交易日的交易数据合成得到,它其实是一种特殊的n日K线,只是n<=5而已。

4)月K线:由每月1日至月末最后一个交易日的交易数据合成得到,除去所有周末,它最多包含23个交易日,遇到本月有长假日,其所包含的交易日会更少。

5)年K线:由每年1月1日至12月31日中的所有交易日的交易数据合成得到,除去所有周末。它可以理解为由一年中的所有交易日数据合成的,也可以理解为由一年中的12个月的交易日数据合成的。

1)日内K线(包括1~n分钟K线)生成规则:

2)日K线生成规则:

3)周K线生成规则:

4)月K线生成规则:

5)年K线生成规则:

年K线可以由两种方式进行合成:一种是用日K线合成,另一种是用月K线合成。我们这里选择用日K线来合成。

在vnpy\usertools\utility.py中加入如下面的两个部分:

from copy import deepcopy

from typing import List,Dict,Tuple,Optional,Sequence,Callable

from datetime import date,datetime,timedelta

from vnpy.trader.constant import Interval

from vnpy.trader.object import TickData,BarData

from vnpy.trader.utility import extract_vt_symbol

from vnpy.usertools.trading_hours import TradingHours,in_segments

from vnpy.usertools.trade_hours import CHINA_TZ

def generate_temp_bar(small:BarData,big:BarData,interval:Interval):

""" get temp intra day small_bar """

small_bar:BarData = deepcopy(small) # 1 minute small_bar

big_bar:BarData = deepcopy(big)

if big_bar and small_bar:

big_bar.high_price = max(big_bar.high_price,small_bar.high_price)

big_bar.low_price = min(big_bar.low_price,small_bar.low_price)

big_bar.close_price = small_bar.close_price

big_bar.open_interest = small_bar.open_interest

big_bar.volume += small_bar.volume

big_bar.turnover += small_bar.turnover

elif not big_bar and small_bar:

big_bar = BarData(

symbol=small_bar.symbol,

exchange=small_bar.exchange,

interval=interval,

datetime=small_bar.datetime,

gateway_name=small_bar.gateway_name,

open_price=small_bar.open_price,

high_price=small_bar.high_price,

low_price=small_bar.low_price,

close_price = small_bar.close_price,

open_interest = small_bar.open_interest,

volume = small_bar.volume,

turnover = small_bar.turnover

)

return big_barclass MyBarGenerator():

"""

An align bar generator.

Comment's for parameters:

on_bar : callback function on 1 minute bar is generated.

window : window bar's width.

on_window_bar : callback function on x interval bar is generated.

interval : window bar's unit.

trading_hours: trading hours with which the window bar can be generated.

"""

def __init__(

self,

on_bar: Callable,

window: int = 0,

on_window_bar: Callable = None,

interval: Interval = Interval.MINUTE,

trading_hours:str = ""

):

""" Constructor """

self.bar: BarData = None

self.on_bar: Callable = on_bar

self.interval: Interval = interval

self.interval_count: int = 0

self.intra_day_bar: BarData = None

self.day_bar: BarData = None

self.week_bar: BarData = None

self.month_bar: BarData = None

self.year_bar: BarData = None

self.day_bar_cnt:int = 0 # 日K线的1分钟K线计数

self.week_daybar_cnt:int = 0 # 周K线的日K线计数

self.window: int = window

self.on_window_bar: Callable = on_window_bar

self.last_tick: TickData = None

if interval not in [Interval.MINUTE,Interval.DAILY,Interval.WEEKLY,Interval.MONTHLY,Interval.YEARLY]:

raise ValueError(f"MyBarGenerator support MINUTE,DAILY,WEEKLY,MONTHLY and YEARLY bar generation only , please check it !")

if not trading_hours:

raise ValueError(f"MyBarGenerator need trading hours setting , please check it !")

# trading hours object

self.trading_hours = TradingHours(trading_hours)

self.day_total_minutes = int(self.trading_hours.day_trade_time(Interval.MINUTE))

self.tick_windows = (None,[])

# current intraday window bar's contains trading day and time segments list

self.intraday_bar_window = (None,[]) # (trade_day,[])

# current daily bar's window containts trading day and time segment list

self.daily_bar_window = (None,[])

# current weekly bar's window containts all trade days

self.weekly_bar_window = []

# current monthly bar's window containts all trade days

self.monthly_bar_window = []

# current yearly bar's window containts all trade days

self.yearly_bar_window = []

def update_tick(self, tick: TickData) -> None:

"""

Update new tick data into generator.

"""

new_minute = False

# Filter tick data with 0 last price

if not tick.last_price:

return

# Filter tick data with older timestamp

if self.last_tick and tick.datetime < self.last_tick.datetime:

print(f"特别tick【{tick}】!")

return

if self.tick_windows == (None,[]) or not in_segments(self.tick_windows[1],tick.datetime):

# 判断tick是否在连续交易时间段或者集合竞价时间段中

self.tick_windows = self.trading_hours.get_trade_hours(tick.datetime)

if self.tick_windows == (None,[]):

# 不在连续交易时间段

print(f"特别tick【{tick}】")

return

if not self.bar:

new_minute = True

elif (

(self.bar.datetime.minute != tick.datetime.minute)

or (self.bar.datetime.hour != tick.datetime.hour)

):

self.bar.datetime = self.bar.datetime.replace(

second=0, microsecond=0

)

self.on_bar(self.bar)

new_minute = True

if new_minute:

self.bar = BarData(

symbol=tick.symbol,

exchange=tick.exchange,

interval=Interval.MINUTE,

datetime=to_china_tz(tick.datetime),

gateway_name=tick.gateway_name,

open_price=tick.last_price,

high_price=tick.last_price,

low_price=tick.last_price,

close_price=tick.last_price,

open_interest=tick.open_interest

)

else:

self.bar.high_price = max(self.bar.high_price, tick.last_price)

if tick.high_price > self.last_tick.high_price:

self.bar.high_price = max(self.bar.high_price, tick.high_price)

self.bar.low_price = min(self.bar.low_price, tick.last_price)

if tick.low_price < self.last_tick.low_price:

self.bar.low_price = min(self.bar.low_price, tick.low_price)

self.bar.close_price = tick.last_price

self.bar.open_interest = tick.open_interest

self.bar.datetime = to_china_tz(tick.datetime)

if self.last_tick:

volume_change = tick.volume - self.last_tick.volume

self.bar.volume += max(volume_change, 0)

turnover_change = tick.turnover - self.last_tick.turnover

self.bar.turnover += max(turnover_change, 0)

self.last_tick = tick

def update_bar(self, bar: BarData) -> None:

"""

Update 1 minute bar into generator

"""

if self.interval == Interval.MINUTE and self.window > 0:

# update inday bar

self.update_intraday_bar(bar)

elif self.interval in [Interval.DAILY,Interval.WEEKLY,Interval.MONTHLY,Interval.YEARLY]:

# update daily,weekly,monthly or yearly bar

self.update_daily_bar(bar)

def update_intraday_bar(self, bar: BarData) -> None:

""" update intra day x window bar """

if bar:

bar.datetime = to_china_tz(bar.datetime)

if self.interval != Interval.MINUTE or self.window <= 1:

return

if self.intraday_bar_window == (None,[]):

# 首次调用日内K线更新函数

trade_day,time_segments = self.trading_hours.get_intraday_window(bar.datetime,self.window)

if (trade_day,time_segments) == (None,[]):

# 无效的1分钟K线

return

# 更新当前日内K线交易时间

self.intraday_bar_window = (trade_day,time_segments)

# 创建新的日内K线

self.intra_day_bar = BarData(

symbol=bar.symbol,

exchange=bar.exchange,

interval=Interval.MINUTE,

datetime=bar.datetime,

gateway_name=bar.gateway_name,

open_price=bar.open_price,

high_price=bar.high_price,

low_price=bar.low_price,

)

elif not in_segments(self.intraday_bar_window[1],bar.datetime):

# 1分钟K线不属于当前日内K线

str1 = f"bar.datetime={bar.datetime}\nintraday_bar_window:{self.intraday_bar_window}"

trade_day,time_segments = self.trading_hours.get_intraday_window(bar.datetime,self.window)

if (trade_day,time_segments) == (None,[]):

# 无效的1分钟K线

return

# 当前日内K线已经生成,推送当前日内K线

if self.on_window_bar:

self.on_window_bar(self.intra_day_bar)

# 更新当前日内K线交易时间

self.intraday_bar_window = (trade_day,time_segments)

str1 += f"\nintraday_bar_window:{self.intraday_bar_window}"

print(str1)

# 创建新的日内K线

self.intra_day_bar = BarData(

symbol=bar.symbol,

exchange=bar.exchange,

interval=Interval.MINUTE,